From Google to Googles: The Rise of the Baby Googles

Why splitting Google might be the best (and worst) thing to happen to Silicon Valley? And what happens when a $2.4 trillion tech giant is sliced into a few different companies?

If you've been following tech news during the past year or two, you've probably heard about Google having a hard time in court, and losing some important cases. In some of them, the term “remedies” is mentioned, making everyone wonder if it’s possible to force a change in one of the tech giants (an important piece of the Magnificent 7).

Intro – Why Is Everyone Talking About a Google Break-Up?

But what does that actually mean, and why is it suddenly a hot topic? Let's break it down in simple terms.

What Is Antitrust Law, Really?

Think of antitrust law as the business world's referee. When one company becomes so dominant that it can harm competition or consumers, U.S. (and EU) regulators can sue to split it into separate firms. The basic idea is simple: competition is good for everyone – it keeps prices fair, drives innovation, and gives consumers more choices.

Just like sports need referees to prevent one team from breaking the rules and ruining the game (and don’t start talking about the premiere league and LaLiga, I know what you have to say on their referees). But unlike sport referees, cards are peanuts to the really powerful companies. So regulators in the U.S. and EU can sue and—if they win—impose powerful remedies, including splitting the company into separate firms. The goal isn’t to punish success; it’s to keep markets open so prices stay fair, innovation continues, and newcomers have a real shot.

Not sure what a Monopoly is?

Go to the “Business Glossary”

Google's Current Legal Storm

Here's where things get interesting for Google (or Alphabet, its parent company). The tech giant is facing multiple major antitrust battles in both the U.S. and Europe, and the courts are already ruling against them:

In the United States:

Search and Advertising Monopoly: On August 5, 2024, U.S. District Judge Amit Mehta in Washington D.C. delivered a landmark ruling that Google illegally monopolized the search market and search text advertising. The case, originally filed by the DOJ in 2020, found that Google maintained over 90% market share through exclusive deals—including paying Apple $10 billion annually to be the default search engine on iPhones. The remedies trial begins September 22, 2025, where Judge Mehta will decide what punishment Google faces.

Ad Technology Monopoly: On April 17, 2025, U.S. District Judge Leonie Brinkema in Virginia ruled that Google illegally monopolized the advertising technology market. The case, filed in January 2023, went to trial in September 2024 and concluded that Google used acquisitions like DoubleClick to control 87% of the ad-selling industry. This ruling makes Google "once, twice, three times a monopolist," as prosecutors put it.

Google Play Store Monopoly: In December 2023, a federal jury in California found that Google illegally monopolized Android app distribution through the Google Play Store in the Epic Games lawsuit. On July 31, 2025, the Ninth Circuit upheld both the verdict and court-ordered remedies requiring Google to open Android to rival app stores and stop forcing developers to use Google Play Billing.

In Europe:

Under the EU's Digital Markets Act, Google was designated as a "gatekeeper" in 2023. InMarch 2025, the European Commission issued preliminary findings that Google may be violating DMA rules by restricting developers from directing users to alternative payment channels and charging excessive fees on the Play Store

These aren't just slaps on the wrist—these are serious legal challenges that could fundamentally reshape how Google operates.

It’s a pattern, not a single case.

Kara Swisher, the longtime tech reporter and co-host of the “Pivot” podcast, has recounted numerous early‑days vignettes from late‑1990s/early‑2000s Silicon Valley. In one of the Pivot episodes she mentioned she visited Google offices in their early age, and was introduced to a room where Google recorded all the news VHS recorders, but when she asked them if they had the rights to use it, they were not giving any answer.

Remember back then the companies were worried about piracy and public distribution, not about collecting data. So it matched perfectly to the Silicon Valley pattern at the time: aggressive “collect first, ask later” behavior in data collection and content usage, with legal and licensing cleanup later if and when challenged.

If Google recorded TV news without licenses, the main risk is copyright infringement: copying, storing, or reusing broadcasts can violate rights to reproduce, distribute, or publicly perform content unless fair use applies.

Fair use is stronger for transformative, internal indexing; it’s weak for public redistribution or using full clips without change.

Terms of service and licenses matter: using feeds or services in ways they forbid can be a breach of contract, separate from copyright.

In practice, these disputes often get settled with retroactive licenses or business deals, especially when the use was internal and not public. Most chances we will never know what happened there and if there was a lawsuit, but let’s say Google can now buy all the cable news companies for a dime.

Learning from History's Biggest Corporate Breakups

If this sounds dramatic, remember that America has been here before with other corporate giants:

The AT&T Breakup (1984): Ma Bell was split into seven regional "Baby Bells" after dominating telecommunications for decades. The result? Cheaper long-distance calls, rapid innovation in wireless technology, and the birth of today's major telecom companies like Verizon and AT&T (which rebuilt itself). Competition flourished, and consumers won big.

Standard Oil (1911): John D. Rockefeller's oil empire was broken into 34(!) separate companies. Far from destroying value, this breakup created many of today's "Big Oil" majors—companies like Exxon and Chevron that went on to thrive independently and drive massive innovation in the energy sector.

In both cases, what seemed like corporate destruction actually unleashed competition and innovation that benefited consumers for generations.

What's Coming Next

The legal momentum is building fast. With three major monopoly rulings already handed down and remedies trials scheduled through 2025, we're witnessing the most significant antitrust enforcement action against a tech company since Microsoft in the 1990s. We also know that a lot of it is at the hand (and mainly the mood) of Trump and his administration, so the following article is a thought experiment, with some chances to come true.

Whether you're rooting for or against a Google breakup, understanding how it could unfold will help you navigate the biggest potential shakeup in the tech industry since the dawn of the internet age.

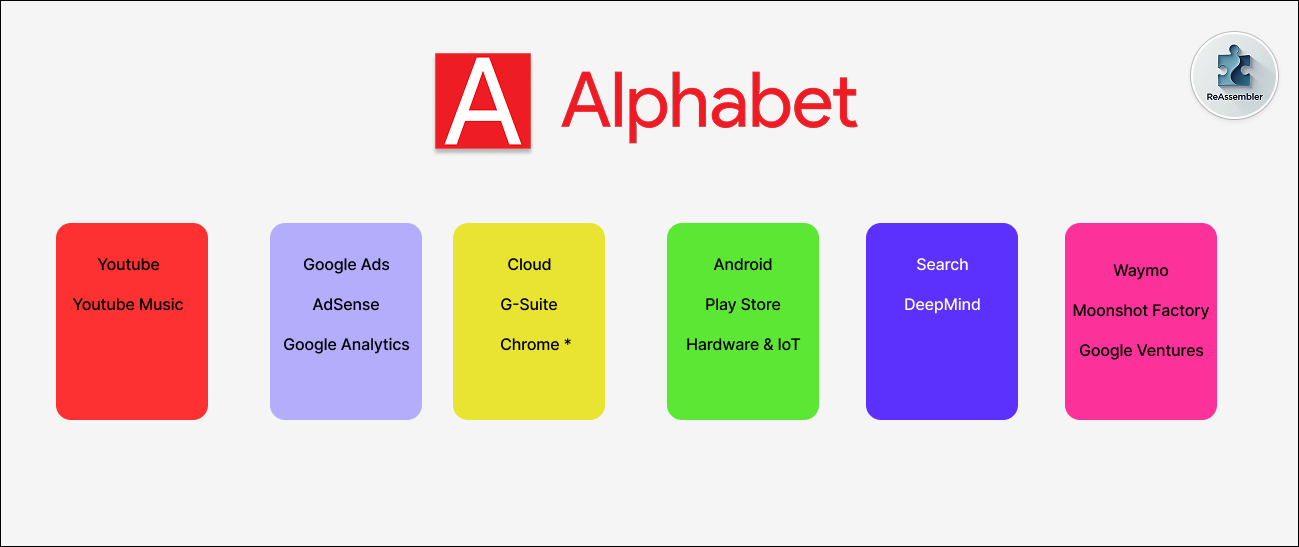

Understanding Google's Current Structure

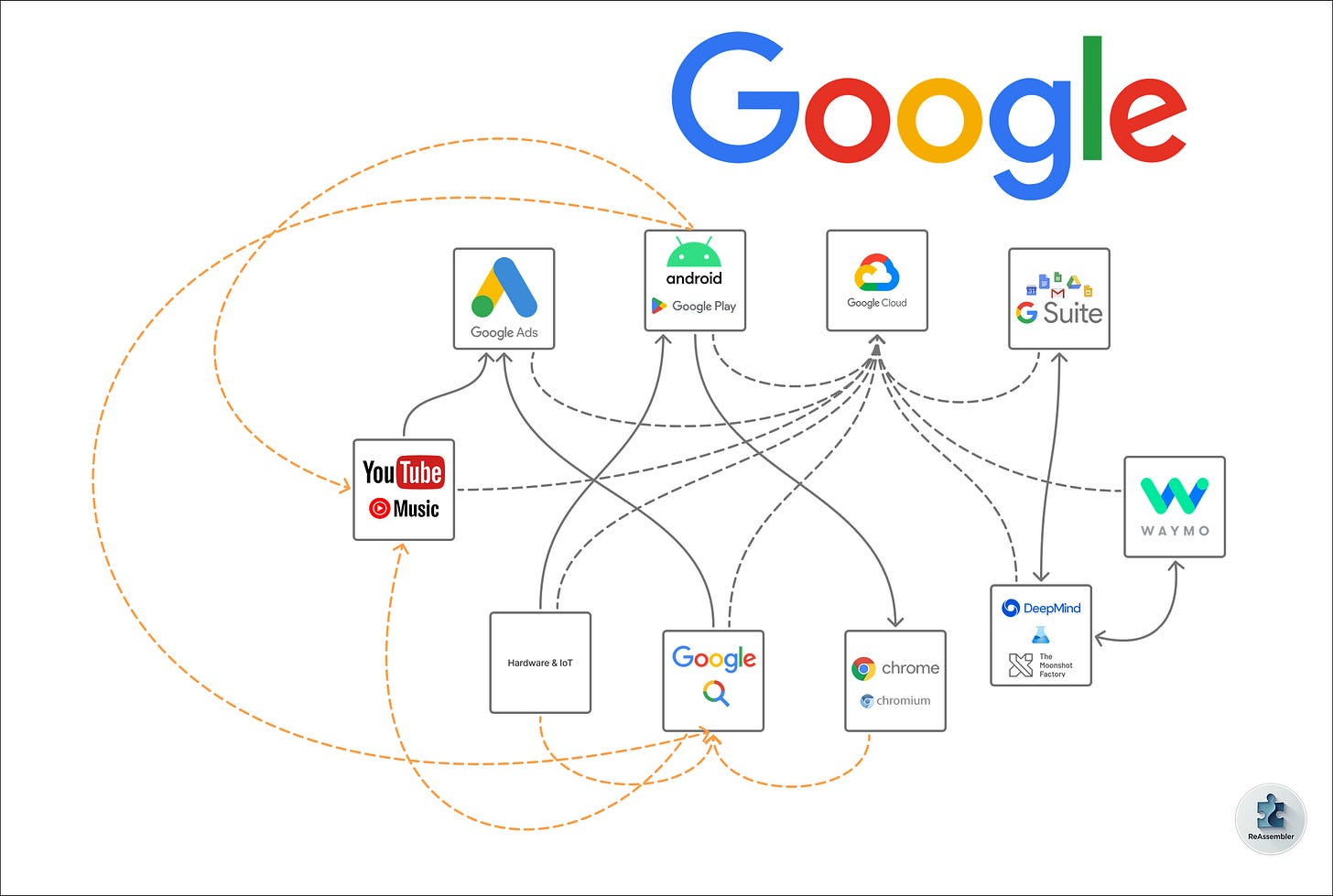

Google isn't just one big company anymore, as it's part of a larger setup under Alphabet Inc., which acts like an umbrella holding company. This structure, established in 2015, lets Google focus on its core internet products while allowing riskier, innovative projects to operate somewhat independently. As of mid-2025, Alphabet uses a "matrix" organization, blending specialized functional teams (like engineering or marketing) with product-focused divisions to encourage creativity and quick decision-making. Sundar Pichai serves as CEO of both Alphabet and Google, overseeing a global workforce of over 180,000 people.

Here's a breakdown of the key divisions and what they do, based on the latest available info:

Google Services: This is the heart of Google's empire and its main money-maker. It includes everyday tools like Google Search (for finding info online), YouTube (video sharing and streaming), Android (the operating system powering most smartphones), Chrome (web browser), Maps (navigation and location services), and Ads (the advertising system that funds it all by showing targeted promotions). These services drive massive user engagement and ad revenue, making them the "core cash engine".

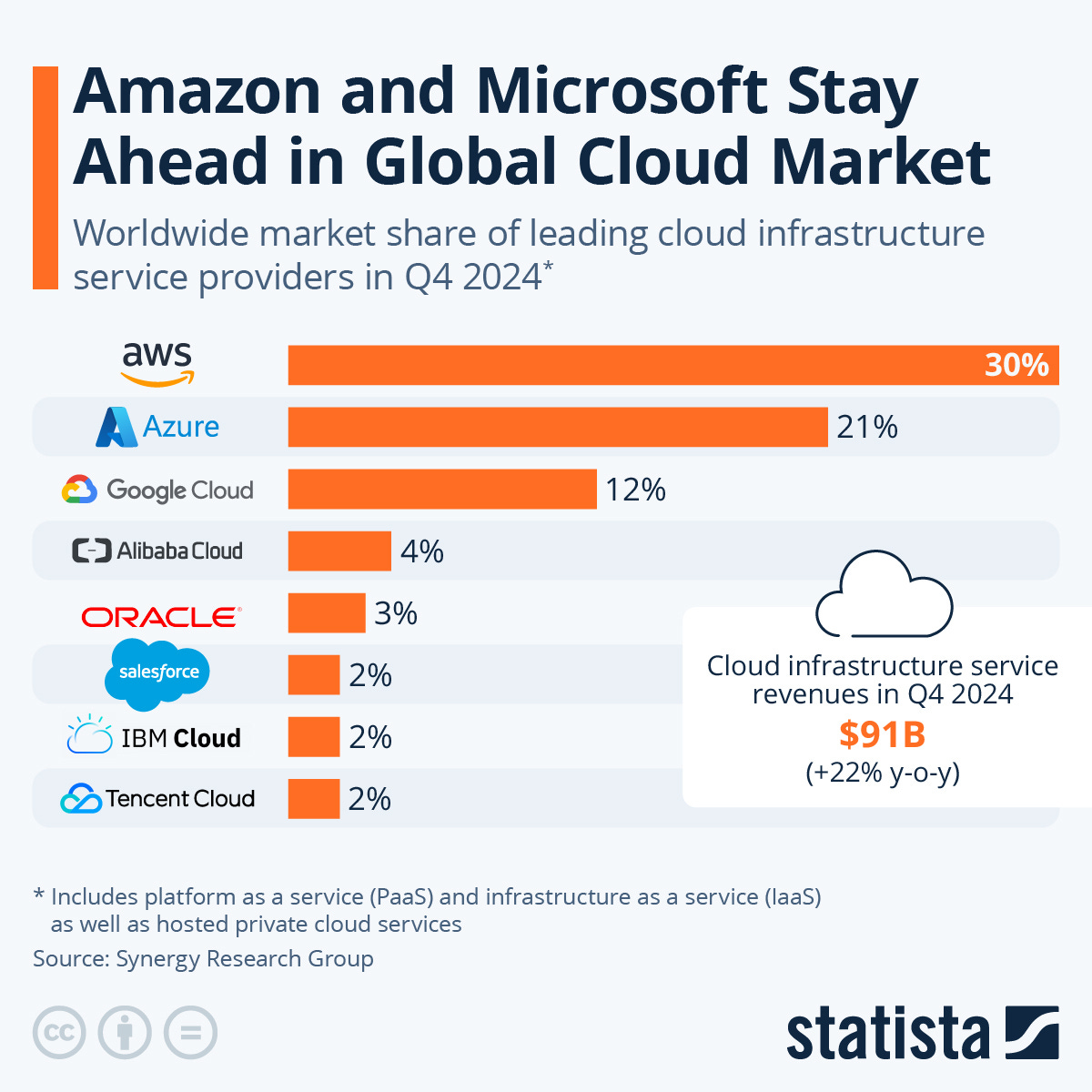

Google Cloud: A fast-growing arm focused on business tech solutions. It offers cloud infrastructure (servers and storage in the "cloud"), data analytics (tools to crunch big data), and Workspace (productivity apps like Gmail and Docs for teams). While it reported losses until around 2023, it's now booming with 32% revenue growth in Q2 2025, though still investing heavily to catch up to competitors.

Platforms and Devices: This division handles Google's hardware and ecosystem integration. It includes products like Pixel phones, Nest smart home devices, and the broader Android platform, aiming to create seamless experiences across devices and software.

Other Bets: These are Alphabet's experimental "moonshot" projects (aka. Google X), often operating as semi-independent subsidiaries. They focus on futuristic tech, involved with robotics, biotech and AI, and aren't always profitable yet—in Q2 2025, they generated $373 million in revenue but posted $1.25 billion in losses. Key ones include:

Waymo - the self-driving cars and autonomous ride-hailing, now offering 250,000 rides weekly in select U.S. cities. Unlike Tesla which keep promise and doesn’t deliver, Waymo is already doing it, hooking up with Uber, and keeps expanding.

DeepMind - AI research and development, powering advanced tools like the Gemini and other AI models (like VEO and weather forecast models), and where the idea for GPT was initially born. It was under the hood, mainly for research, but now it’s a crucial key for the future.

Veril - Focuses on human health and life sciences.

Isomorphic Labs - Uses artificial intelligence for drug discovery.

There is so much more cool stuff over there, you should take a look yourself.

Also, Google itself makes changes in their structure from time to time, so moving the pieces is flexible when they wish to speed up innovation or to optimize performance, but the regulation is focusing at the beating heart of Google revenues, splitting off parts like Android, Ads or YouTube to reduce Google's dominance. But for now, it keeps the company innovative and interconnected, and paying the bills for what might be the future of the company (aka. Other bets).

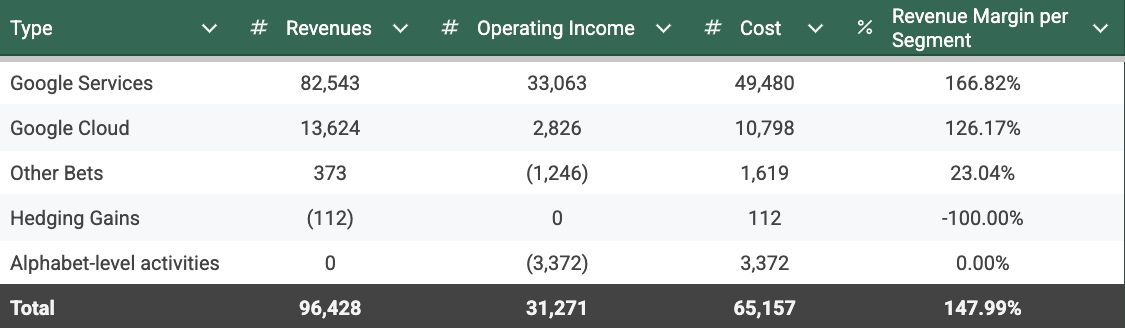

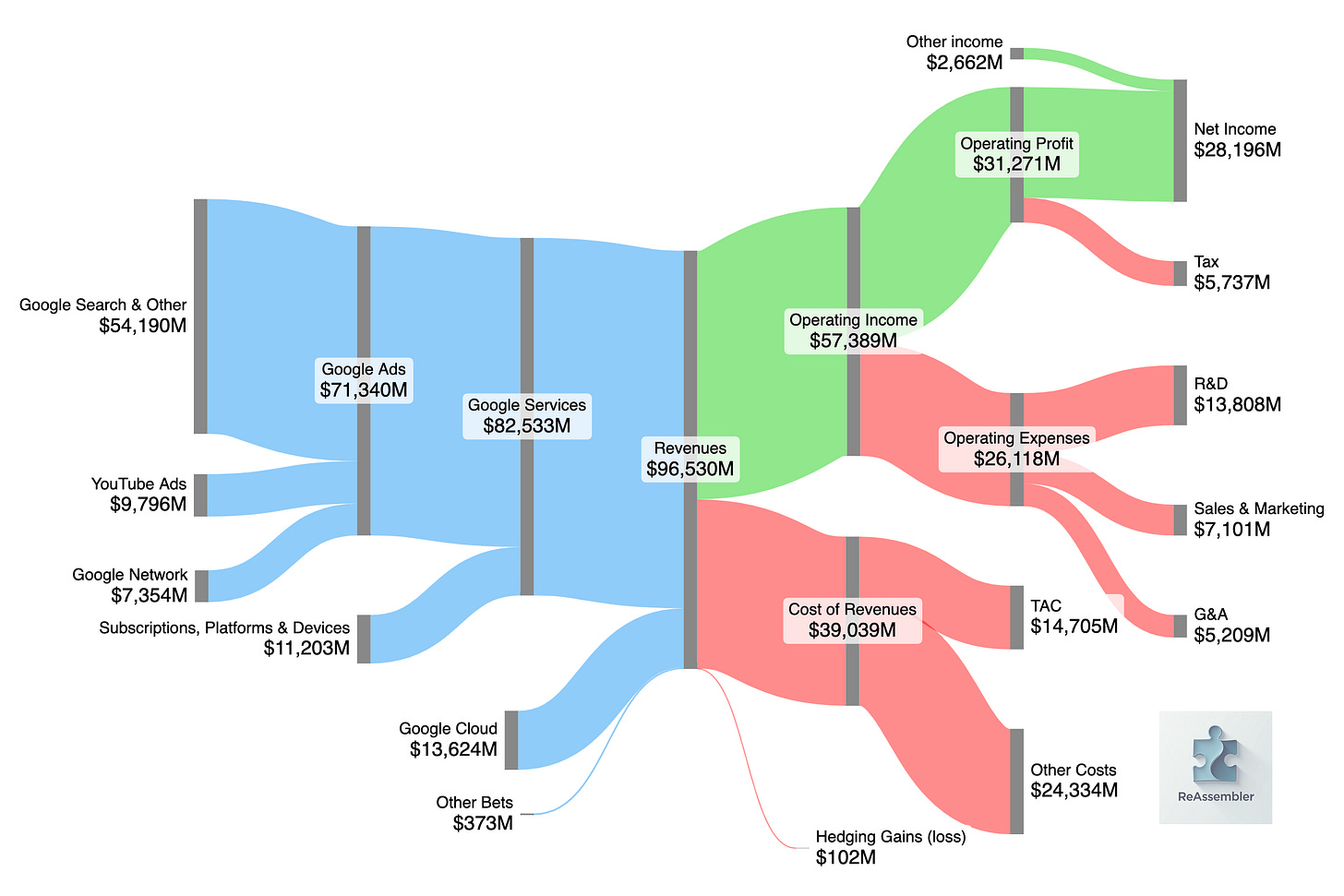

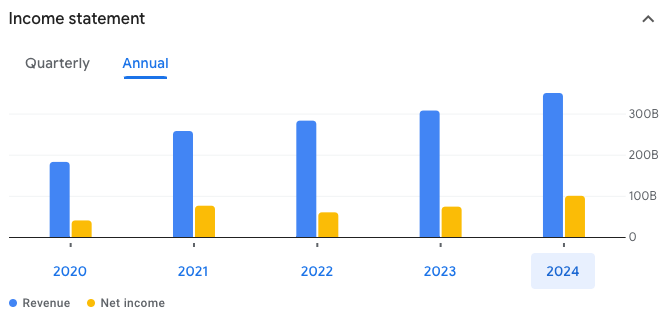

Financial Analysis: Growth and Rising Costs

Google delivered another strong quarter in Q2 2025, posting $96.4B in total revenues (+14% YoY) and maintaining its 32.4% operating margin. The results showcase continued momentum across core business segments while highlighting significant capital investments in AI infrastructure.

Revenue Performance by Segment

Search Advertising: The Steady Cash Engine

Google Search & Other revenues reached $54.2B (+12% YoY), demonstrating the resilience of the search advertising business despite increasing AI competition. The 12% growth rate represents a slight acceleration from recent quarters, suggesting that AI Overviews and AI Mode features are enhancing rather than cannibalizing traditional search revenue. This $54.2B quarterly run-rate translates to over $216B annually, maintaining Google's dominant position in the search market.

YouTube: Advertising Growth Continues

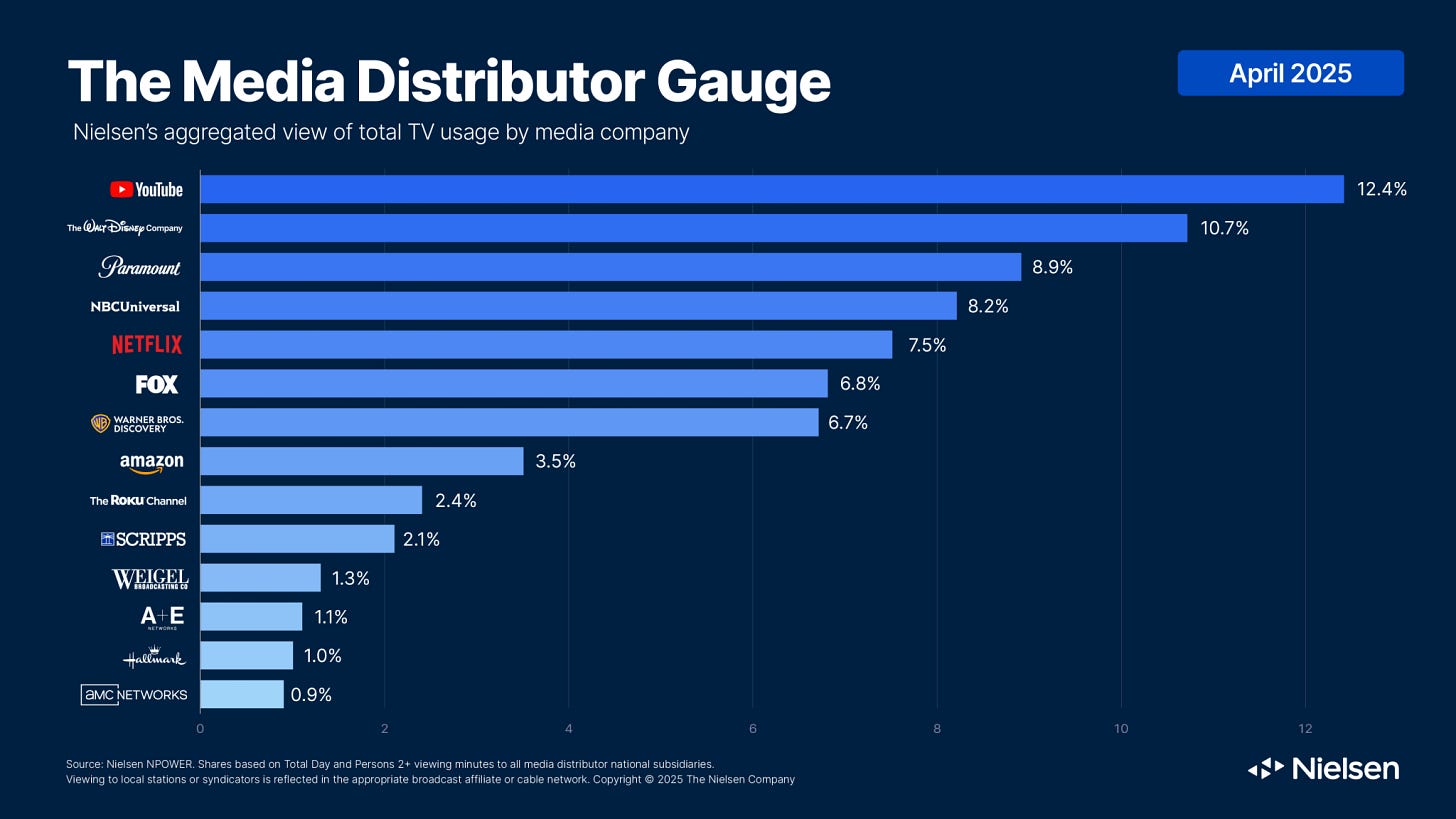

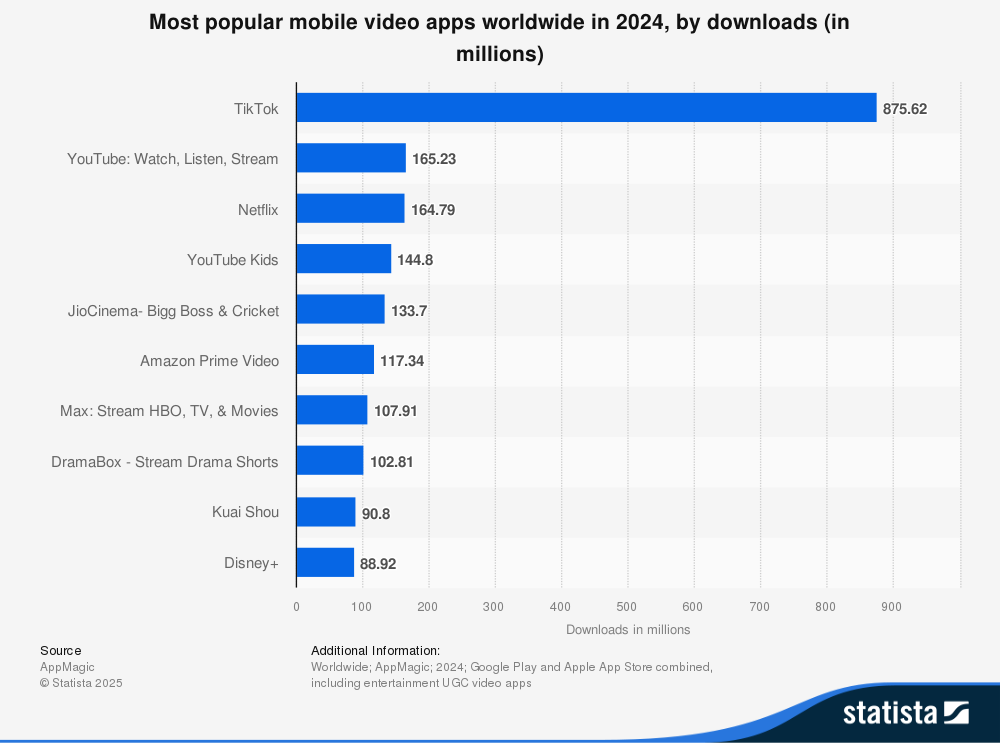

YouTube advertising revenues grew 13% YoY to $9.8B, outpacing Google's overall advertising growth. This performance is particularly noteworthy given the competitive pressure from TikTok and other short-form video platforms. YouTube's ability to maintain double-digit growth while scaling from an already massive base demonstrates the platform's continued relevance and monetization improvements.

Google Cloud: The Growth Engine

Google Cloud delivered exceptional performance with $13.6B in revenues (+32% YoY), significantly outpacing competitors. More importantly, Cloud operating income surged to $2.8B from $1.2B in Q2 2024, achieving a 20.7% operating margin - a dramatic improvement from 11.3% the previous year. CEO Sundar Pichai noted that Cloud's annual revenue run-rate now exceeds $54B, positioning Google as a formidable competitor to AWS and Microsoft Azure in the enterprise cloud market.

Other Bets: Waymo's Modest Contribution

Other Bets revenues remained relatively flat at $373M (+2% YoY), with operating losses of $1.2B. While Waymo continues to expand its robotaxi services and has achieved significant technological milestones, the segment has yet to reach meaningful scale. The modest revenue growth suggests that commercial deployment of autonomous vehicles remains in early stages, though this represents a massive long-term opportunity.

Profitability and Margin Analysis

Google maintained its impressive 32.4% operating margin despite significant investment increases. However, the company's cost structure shows interesting shifts:

Cost of revenues increased 10% YoY to $39.0B, primarily driven by higher traffic acquisition costs (TAC) of $14.7B.

R&D expenses surged 16% to $13.8B, reflecting heavy AI investments

General & administrative costs jumped 65% to $5.2B, partly due to legal settlement charges

The ability to maintain margins while substantially increasing R&D spend demonstrates Google's operational leverage and pricing power in core advertising markets.

Capital Expenditure (CAPEX) Surge

Perhaps the most striking aspect of Q2 2025 results was the $22.4B in capital expenditures (+70% YoY), primarily for AI infrastructure and data center expansion (that’s the trend now). Management indicated capex will reach approximately $85B for full-year 2025. This massive investment reflects Google's commitment to maintaining AI leadership but significantly impacted free cash flow, which dropped to $5.3B from $13.5B in Q2 2024.

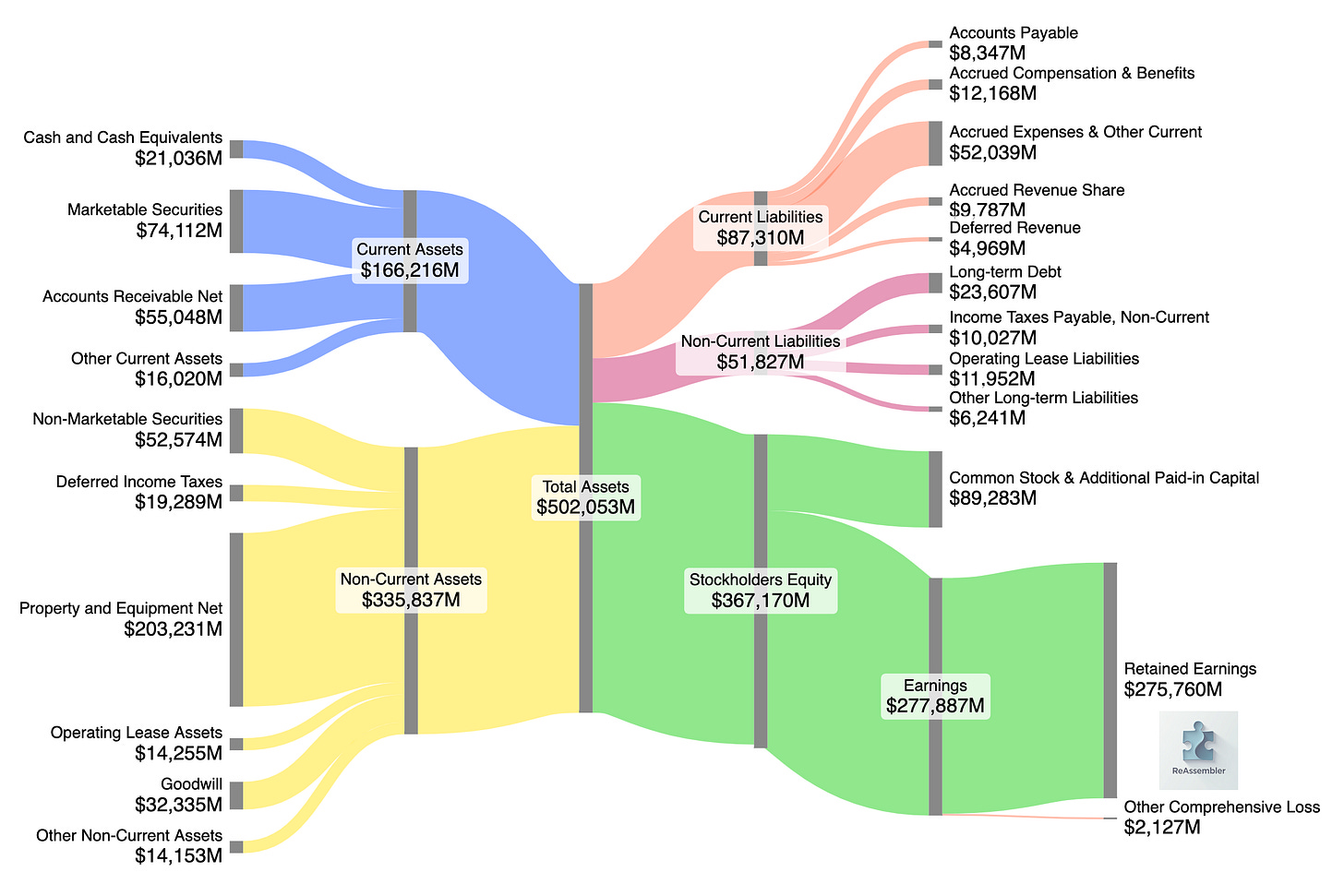

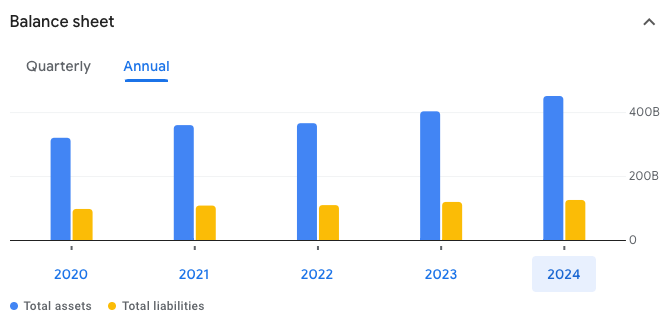

Balance Sheet Strength

Google's financial position remains robust with $95.1B in cash and marketable securities. The company issued $12.5B in senior unsecured notes during Q2, providing additional liquidity for its AI investments while taking advantage of favorable interest rates.

The Multiplier Paradox

And despite another perfect quarter, Google trades at a PE ratio of approximately 21.71 as of August 2025. With diluted EPS of $2.31 for Q2 2025, Google's trailing twelve-month earnings per share is around $9.38, making it one of the most attractively valued mega-cap tech stocks.

Quick comparison with the other Mag7:

Google (Alphabet): 21.71

Amazon: 34.53

Apple: 31.90

Microsoft: 37.97

Meta (Facebook): 28.43

Netflix: 51.62

Tesla: 174.9 (for comparison purposes only, it's supposed to be an automotive company, but it’s also about robots, AI, and rumors about integration with xAI)

In other words, 43% lower than Microsoft, 24% lower than Apple, 38% lower than Amazon, 23% lower than Meta.

More companies that face competition with Google:

Oracle: 55.67

Spotify: 144.42

Reddit: 34

The private AI companies (as OpenAI and Anthropic) still operate in significant losses, so they have no meaningful PE ratio, despite their high valuations and growing revenues.

The market worries about Google due to several reasons, from AI disruption to losing the ads business, but it might have been over-punished. Remember there are trends in the market, and the price of the stock is also demonstrating the potential the investor thinks it has, and not just about its past. So does it mean the market believes Google belongs to the past and won’t be part of the future?

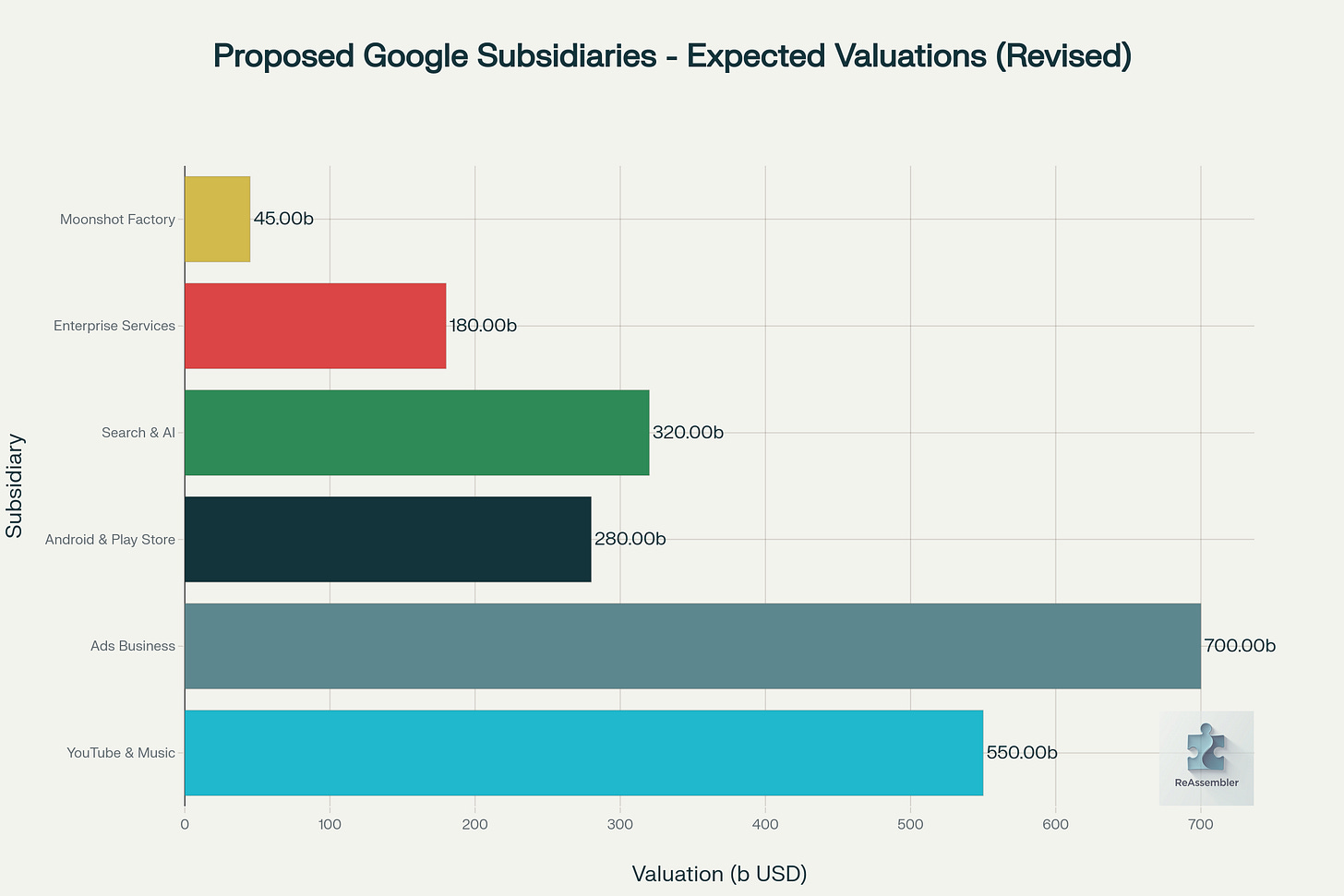

4. Proposed Google Remedies: A Strategic Breakup Analysis

The breakup of Google's monopolistic structure presents both significant opportunities and complex challenges for regulators, competitors, and consumers alike. Based on current market data and regulatory pressures, here is a comprehensive analysis of six proposed subsidiaries that could emerge from Google's restructuring.

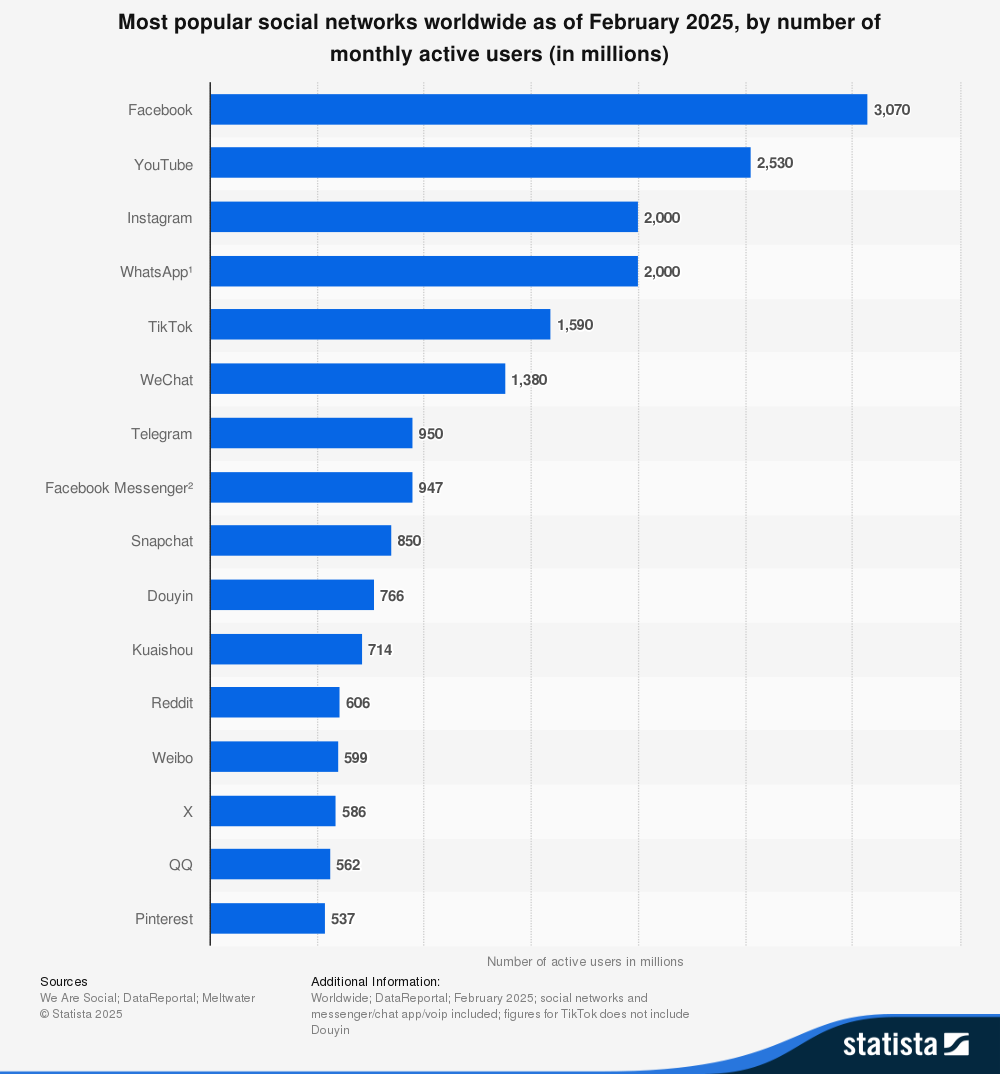

1. YouTube & YouTube Music

Potential: This division represents the crown jewel of the proposed breakup, with an estimated standalone valuation of $475-550 billion. YouTube generated $54.2 billion in revenue in 2024 and is projected to surpass Disney as the largest media company by revenue in 2025. The platform's operating margin of 16% with $8.9 billion in quarterly ad revenue demonstrates strong profitability.

Expected PE Ratio: 45x, reflecting its premium position as a streaming and media platform. This aligns with Netflix's current PE of 44x while accounting for YouTube's superior market position and growth prospects compared to Disney's 17x PE.

Main Competitors: TikTok (mobile engagement), Netflix and streaming services (video content), Spotify and Apple Music (music streaming), traditional media companies like Disney and Warner Bros Discovery.

Regulatory Fix: Breaking YouTube away from Google's search and advertising ecosystem would prevent cross-platform data sharing advantages and reduce Google's ability to leverage search dominance to boost YouTube's market position.

Risks:

Is YouTube a streaming service? a social network?

Loss of integration with Google's ecosystem may reduce user convenience

Higher content licensing costs without Google's financial backing

Potential reduction in creator revenue sharing programs

Security and content moderation challenges without Google's infrastructure

2. Ads Business (Google Ads, AdSense, Analytics)

Potential: The advertising business remains Google's most profitable segment, generating $264.6 billion in revenue in 2024 with a commanding 39% share of global digital advertising. Despite AI threats, this business maintains high margins around 32%.

Expected PE Ratio: 20-25x, which is conservative compared to Meta's 27x PE but reflects the mature nature of the advertising market and potential regulatory constraints. This is close to Google's current overall PE of 21x.

Main Competitors: Meta (18% digital ad share), Amazon (7% share), Microsoft Bing Ads, TikTok, emerging AI-powered advertising platforms.

Regulatory Fix: Separating ads from search would prevent Google from using search monopoly to dominate advertising markets, addressing concerns about discriminatory ad placement and pricing.

Risks:

Reduced advertising effectiveness without search data integration

Higher advertising costs for small businesses

Potential market fragmentation reducing advertiser reach

Loss of sophisticated targeting capabilities in the long run

AI disruption

3. Android, Play Store, Hardware & IoT

Potential: The Android ecosystem generated ₹4 trillion ($48 billion) in India alone in 2024, with global Play Store revenue projected at $55.5 billion. This represents one of the most valuable mobile ecosystems globally.

Expected PE Ratio: 30x, reflecting the premium valuation of mobile ecosystems similar to Apple's ecosystem, though at a discount due to Android's open nature and potential regulatory constraints on app store policies.

Main Competitors: Apple iOS ecosystem, Samsung's ecosystem initiatives, emerging mobile platforms (mainly from China), alternative app stores (as Epic Games Shop for mobile).

Regulatory Fix: Separating Android from Google's other services would prevent the mandatory bundling of Google apps and services, allowing true competition in mobile operating systems.

Risks:

Fragmentation of the Android ecosystem remains the main obstacle for compatibility, and it will become even more challenging once the giant Google is not the one who’s making the deals with all other manufacturers.

Higher device costs for Pixel devices without Google's subsidization model.

Reduced security updates and support for older devices.

Loss of seamless integration between Android and other Google services

4. Search & DeepMind

Potential: While Google's search market share has declined below 90% for the first time since 2015, it still dominates with massive revenue streams. DeepMind, valued at over $500 million when acquired, now represents significant AI capabilities. The AI models could be offered to various cloud providers (and not rely only on Google Cloud), and could offer new products which are based on them (for example: new AI image and video generation tools).

Expected PE Ratio: 15x-20x in the near term, lower than Google's current 21x PE, reflecting the declining growth prospects and AI disruption threats in traditional search. This conservative multiple accounts for the transition challenges and competitive pressures. In the long run it’s a different story, and it mainly depends on the AI models, their performance, and their use cases (image and video generative AI, code assistance, etc.)

Main Competitors: Microsoft Bing armed with ChatGPT integration (who knows for how long), OpenAI's SearchGPT, Perplexity AI (my favorite so far), Apple's potential search initiatives, social media platforms for information discovery.

Regulatory Fix: Consolidating search with AI research addresses the integration of traditional search with next-generation AI technologies, preventing Google from leveraging search monopoly to dominate AI markets.

Consumer Benefits:

More innovation in search algorithms and AI-powered answers, after years of stagnation.

Better privacy protections in search without cross-platform tracking

Increased competition leading to higher quality search results

Greater transparency in search ranking algorithms

More access to models without the need to use other Google services

Risks:

Reduced search quality without access to broader Google data ecosystem

Higher costs for AI development without advertising revenue subsidization

Potential brain drain from DeepMind without Google's resources

Loss of integration between search and other productivity tools

5. Enterprise (Cloud, G-Suite/Workspace, Chrome)

Potential: Google Cloud revenue reached $13.6 billion in Q2 2025, growing 32% year-over-year. Google Workspace generated approximately $16 billion in revenue in 2022, while Chrome holds 67% of global browser market share.

Expected PE Ratio: 35x, reflecting the premium valuation commanded by enterprise cloud services, comparable to Microsoft's 34x PE but with a slight premium for Google Cloud's superior growth trajectory of 35% year-over-year. A focus will give them extra points in many organizations.

Main Competitors: Microsoft Azure and Office 365, Amazon Web Services, Apple's business services, Zoom, Slack, alternative browsers like Edge and Safari.

Regulatory Fix: Separating enterprise services prevents Google from leveraging consumer market dominance to gain unfair advantages in business markets.

Risks:

Google cloud is only at 3rd place, so it might be dangerous to go out for price war against the other cloud giants

6. Alphabet / Moonshot Factory

Potential: This division includes Waymo (valued at $45 billion), Verily, Google Ventures, and various R&D initiatives. While currently unprofitable, these represent significant long-term value creation opportunities.

Expected PE Ratio: 40x-60x, reflecting the high-risk, high-reward nature of moonshot ventures (but still below Tesla). Given that many of these ventures are pre-profitability or loss-making, this represents a premium venture capital-style (optimistic) multiple for the profitable portions like Waymo.

Main Competitors: Tesla, traditional automotive companies, other venture capital firms, pharmaceutical companies (for Verily), various technology startups.

Regulatory Fix: Separating moonshot projects prevents Google from using monopoly profits to unfairly subsidize competitive threats in emerging markets.

Risks:

Potential failure of promising long-term technologies without Google's deep pockets

Loss of synergies between different research initiatives

Increased investor uncertainty in high-risk ventures

So breaking up is good for business?

Short answer: It depends.

Long answer: It depends on the analysis approach.

Key Valuations

Google's current market cap is $2.466 trillion as of August 17, 2025.

Our Analysis: $2.075 trillion (-15.9% lower) due to integration synergies, conservative PE ratios, and transition risks.

DA Davidson Analysis: $3.7 trillion (+50% higher) assuming premium sector multiples and elimination of conglomerate discount.

Why the Difference?

Lower Value Case: Market prices in ecosystem benefits; breakup could destroy synergies and add costs.

Higher Value Case: Independent units trade at better multiples (e.g., YouTube like Netflix, Cloud like pure-plays); reduces complexity penalty.

The Reality Check: Big Breakups Take Time

While Google's legal challenges are undeniably serious—with three major monopoly rulings already on the books—history teaches us that corporate dismemberment is both rare and glacially slow. Alphabet is massive, with $2.466 trillion in market cap and tentacles reaching into every corner of the digital economy. Regulators are serious, armed with landmark court victories and remedies trials scheduled through 2025. But transforming legal wins into actual structural changes? That's where things get complicated.

Consider the timeline precedent: AT&T's breakup took eight years from the initial 1974 antitrust filing to the 1982 consent decree, with the actual split not occurring until 1984. Google's current legal saga began with DOJ filings in 2020-2023, which means we're likely looking at resolution no earlier than 2027-2028, and that's assuming no appeals drag the process into the 2030s.

What's Actually Likely to Happen

Rather than the dramatic six-way split outlined in our analysis, the most probable outcome involves targeted structural remedies—think surgical strikes rather than nuclear options. The ad technology stack represents the lowest-hanging fruit: it's already been ruled an illegal monopoly, has clear competitive harm, and can be separated without destroying core product functionality.

Spinning off the ads tech business (encompassing Google's ad exchange, publisher tools, and advertiser platforms) would address regulatory concerns while allowing Google to retain its search advertising revenue through arms-length transactions. This approach mirrors how AT&T kept its long-distance business while divesting local Bell operating companies.

YouTube, despite its massive standalone value, faces higher separation hurdles. The platform's deep integration with Google's infrastructure, from content delivery networks to AI recommendation systems, makes clean separation technically complex and potentially value-destructive. Regulators typically prefer remedies that enhance competition without breaking functional systems.

The Bottom Line (predictions)

Near-term (next 1-2 years): Expect subtle shifts rather than dramatic overhauls in your everyday Google experience. While remedies trials kick off in late 2025, Google's robust $95.1B cash reserves and ongoing $85B annual capex in AI infrastructure will likely keep services like Search, YouTube, and Android humming smoothly. You might notice minor changes, such as easier access to rival app stores on Android devices or tweaked ad targeting in Gmail, but core functionalities— from Maps navigation to Chrome browsing—will remain seamless. For businesses, advertising costs could edge up slightly if ad tech remedies force more competitive bidding, but consumers won't feel major disruptions amid Google's 32.4% operating margins buffering any immediate hits.

Long-term (2028 and beyond): The real transformation could unfold as Google's integrated empire fragments into specialized entities, sparking a wave of innovation similar to how the AT&T split birthed wireless tech giants. Imagine a standalone Android company partnering with hardware makers like Samsung for customized OS variants, or an independent DeepMind offering AI tools (like advanced generative models) to competitors, accelerating breakthroughs in fields from biotech to autonomous driving. Users might benefit from enhanced privacy in search without bundled tracking, fiercer competition driving down cloud service prices via Google Cloud spinoffs, and "Other Bets" like Waymo evolving into dominant players in self-driving tech—potentially creating new job ecosystems while challenging incumbents like Tesla. However, this could come with trade-offs, such as ecosystem incompatibilities echoing Android's current fragmentation risks.

The Trump Wild Card

Predictions are speculative, but the Trump administration could reshape Google's antitrust path in unpredictable ways. A pro-business tilt might favor light-touch "behavioral remedies" like data-sharing mandates, prioritizing U.S. tech dominance against China. Alternatively, an "America First" crackdown on Big Tech biases could accelerate structural changes, such as fast-tracking ad tech spinoffs to empower smaller innovators. With cases spanning Trump and Biden eras, this wildcard could prolong proceedings into 2028 or beyond, potentially using monopoly issues as leverage for broader policies like AI export controls—ultimately redefining the high-tech sector.

In the end, whether Google's breakup materializes as a full dismemberment or targeted reforms, history from AT&T to Standard Oil suggests it's often good for business—unleashing innovation, fairer competition, and long-term value creation. As Alphabet navigates this storm with its AI investments and moonshot ambitions, the real question isn't if change is coming, but how it will redefine the digital economy for generations.

Bonus: Ending Songs

There are so many (great) breaking up songs, so I chose few that I found the most relevant to this story. Feel free to add more ideas in the comments.

Enjoy, and stay curious!

Gloria Gaynor - I Will Survive

P!nk - So What

Fleetwood Mac - Go Your Own Way

Hemi Rudner - Let’s Breakup

Britney Spears - Stronger

Google needs 'big bang breakup' that would value its businesses at $3.7 trillion as AI threatens Search: Analyst (by Laura Bratton, May 13, 2025, Yahoo Finance)

YouTube - Statistics & Facts (Statista)

Streaming Reaches Historic TV Milestone, Eclipses Combined Broadcast and Cable Viewing For First Time (June 2025, Nielsen)

by Lior Rosenspitz, August 2025.