Inside the Chip War: Who Controls the New Oil?

Did you know a 46-cent chip nearly triggered nuclear war? How AI chips fuel the new US-China cold war? For how long does NVIDIA keep winning AI? and will Intel survive?

TL;DR (wild speculations for 2025+)

Intel will survive! Best chances it will become more Fab focused, and less as pure IDM based on its own original designs. It’s going to be a tough ride.

More companies will release great new AI chips for different use cases, and this market will become more fragmented and healthy (sorry Nvidia, we had a great time, but I'm sure you will do well).

China will keep doing well without western technologies. Too well...

The global supply chain will remain too fragile in the near future, despite the CHIPS act and similar positive steps in the right direction. Let's hope no new pandemic or nuclear war breaks out anytime soon.

Introduction

From your morning coffee maker to your car's navigation system, tiny but powerful chips are silently powering our modern world. These chips – called semiconductors – are the unsung heroes behind every piece of technology we use, forming the foundation of today's global economy.

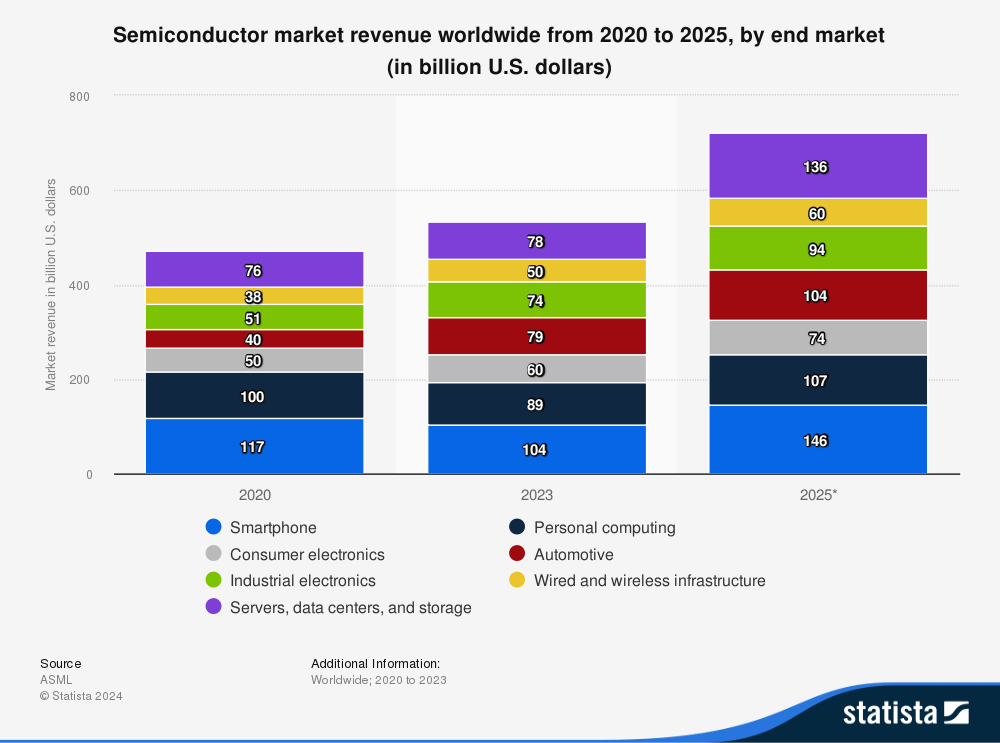

The numbers tell an impressive story: the semiconductor industry was worth $573 billion in 2023 and is expected to reach $1 trillion by 2030. This extraordinary growth reflects how deeply these components have become woven into every aspect of our lives, from healthcare devices to space exploration.

While you might hear more about flashy new phones or AI chatbots, semiconductors are the essential ingredients that make all of these innovations possible. Think of them as the invisible backbone of our digital world – they are maybe unsexy, unglamorous, but without them, none of our modern technology would work.

What makes this industry particularly fascinating is its diversity. Much like comparing apples to oranges, the companies in the semiconductor world are remarkably different from each other. Some design the chips, others manufacture them, while others specialize in specific materials or assembly. It's a global collaboration spanning from Silicon Valley's design labs to Taiwan's manufacturing facilities, from Japan's material suppliers to Southeast Asia's assembly lines.

In this analysis, we'll unpack this remarkable industry, breaking down its complexities into clear, understandable pieces, and examining how these tiny technological marvels shape our present and future.

Breaking Bad: The Chips Nightmares

Before diving into the details, with fun flowcharts and numbers, here are some stories of why we should take it seriously, as “chips” are not just buzzwords for pumping up sales. Some of them have a very crucial part in our life, and sometimes it’s more than just a broken coffee machine or delays in new cars delivery.

1980 NORAD Chip Incidents

In June 1980, a series of alarming incidents at NORAD brought the world perilously close to nuclear conflict due to a faulty 46-cent computer chip. The most serious incident occurred at 3 AM in November, 1979, when National Security Advisor Zbigniew Brzezinski received an urgent call indicating that 220 Soviet missiles were heading toward the US, followed by a second alert claiming 2,200 missiles were incoming. Brzezinski remained remarkably calm, though he chose not to wake his wife, believing everyone would be dead within 30 minutes. Just one minute before he planned to wake President Carter, a third verification revealed it was a false alarm by cross-referencing multiple data sources.

Later on, additional false alarms occurred on May 28, June 3, and June 6, 1980, all caused by the same defective 46-cent. computer chip making typographical errors. Secretary of Defense Harold Brown later warned President Carter that such false alerts were virtually inevitable, emphasizing the importance of human safeguards in preventing catastrophic responses.

Aviation Disasters

Several aviation disasters have been linked to defective chips or critical component failures. In 2023, a V-22 Osprey crash off Japan's coast killed eight Airmen due to metal chips in the gearbox, revealing a known issue since 2011 with 10 previous in-flight failures producing similar metallic chip alerts. The Boeing 737 MAX crashes in 2018-2019 were caused by faulty angle of attack (AOA) sensors triggering the MCAS system inappropriately, leading to two fatal accidents. During the investigation of SilkAir Flight 185, electron microscope examination revealed 'chip-outs' and burrs in the PCU servo valve, potentially interfering with its operation and resulting in an out-of-court settlement

Banking System Failures

Do you remember the Y2K bug? In Germany, in 2010 a chip-related failure caused up to 20 to 30 million bank cards to become unusable, at least 20% of the payment terminals in German stores could read cards. Estimated replacement cost would have been up to $430 million. In the same year in Belgium, Citibank's Digipass (customer identification chips) experienced a complete system failure due to a date encoding issue. Both the German banking crisis and the Belgian Citibank Digipass failures in 2010 were caused by the same underlying technical issue, known as the "Y2K+10" or "Y2.01k" problem, but they had a different scale and impact.

Covid-19 vs. Automotive Industry

The Covid-19 pandemic triggered one of the most severe semiconductor shortages in history. When lockdowns hit in 2020, automakers canceled their chip orders expecting a prolonged slump in car sales. However, the demand for electronics soared as people shifted to remote work and entertainment, causing chipmakers to reallocate their capacity to consumer electronics. When car sales rebounded unexpectedly quickly, automakers found themselves at the back of the line for chips, leading to massive production delays and billions in lost revenue.

Understanding Semiconductors: What Exactly is a Chip?

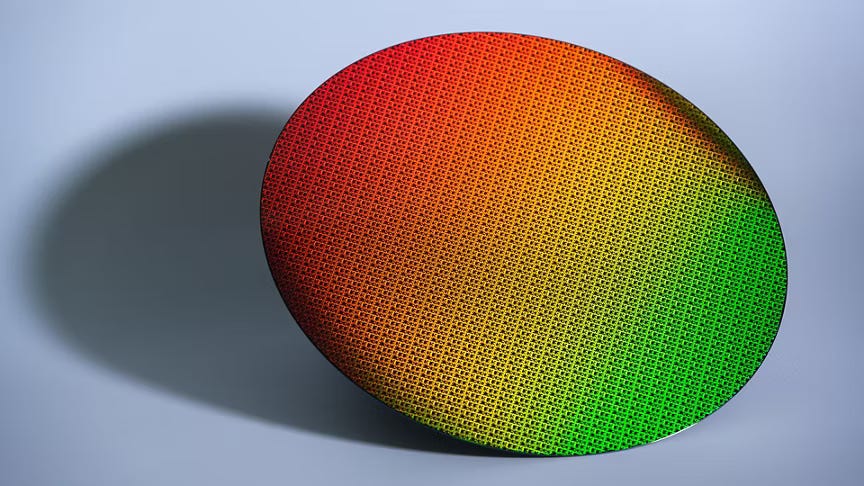

Let’s start with the basics: What is a chip? A chip, also called an integrated circuit (IC), is essentially the brain of modern electronics. It’s a tiny piece of material (usually silicon, a material found in sand) embedded with microscopic transistors, resistors, and other components. These transistors act as on/off switches to process information, store data, or control various electronic functions.

These chips are the fundamental building blocks of all electronic devices. However, not all chips are created equal. They’re just one part of the broader semiconductor ecosystem, which includes materials (like silicon wafers), manufacturing tools, and other components like power regulators or connectors.

As for the financial point of view, the global semiconductor chip market is a complex and dynamic ecosystem, valued at approximately ~$500-$580 billion in 2024, but in terms of growth there are mixed results compared to previous years (2022 which was booming mainly due to AI and Crypto). For comparison, the entertainment industry is estimated at around $2.6 trillion, and the global automotive industry was valued at approximately $4.07 trillion in 2023.

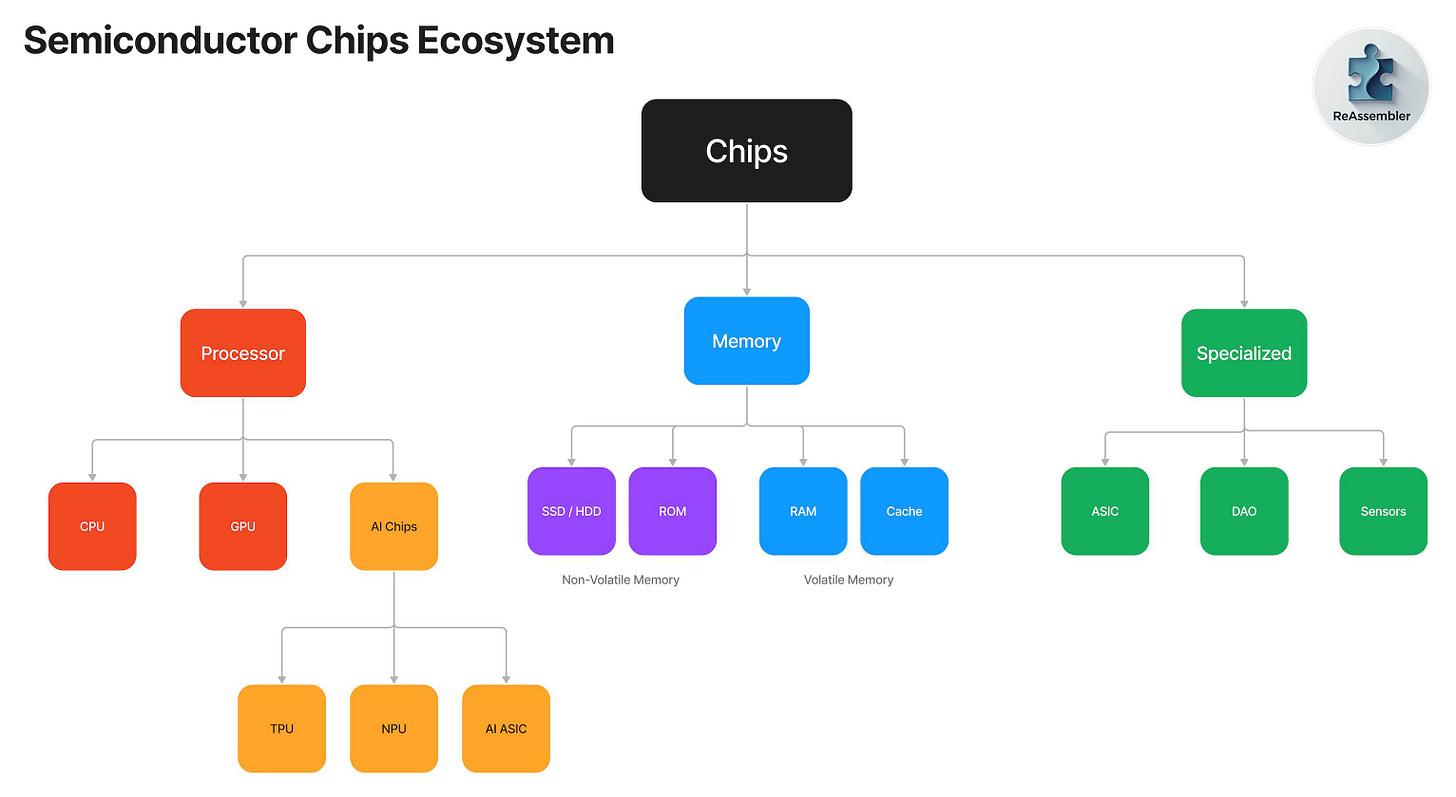

Let’s dive in and understand the main types of chips and their global market value:

1. Processor Chips

Processor chips handle computations and decision-making. They're central to most electronic devices, from your phone to high-end servers. Here’s a breakdown:

CPU (Central Processing Unit):

Often referred to as the "brain" of a computer, the CPU handles general-purpose tasks like running software, managing files, and executing operating system commands. CPUs are designed for versatility, enabling them to perform many different tasks but at lower efficiency for highly specialized workloads.Common Uses: PCs, laptops, smartphones, and servers.

Key Players: Intel, AMD, Apple, and Qualcomm.

Example: A desktop CPU, like Intel's Core i9 or AMD's Ryzen, has multiple cores that divide tasks for faster performance.

Market size: ~$80 billion.

GPU (Graphics Processing Unit):

GPUs are designed for parallel processing, meaning they can handle thousands of operations simultaneously. While originally built for rendering graphics in games and visual applications, GPUs have become essential for tasks like cryptocurrency mining, scientific simulations, and AI model training.Common Uses: Gaming PCs, data centers, and AI-driven applications.

Key Players: NVIDIA, AMD, and Intel.

Example: NVIDIA's RTX GPUs power not only games but also AI advancements like ChatGPT and self-driving cars.

Market size: ~$49-$61 billion. (data centers market alone estimated at $13.18 in 2023)

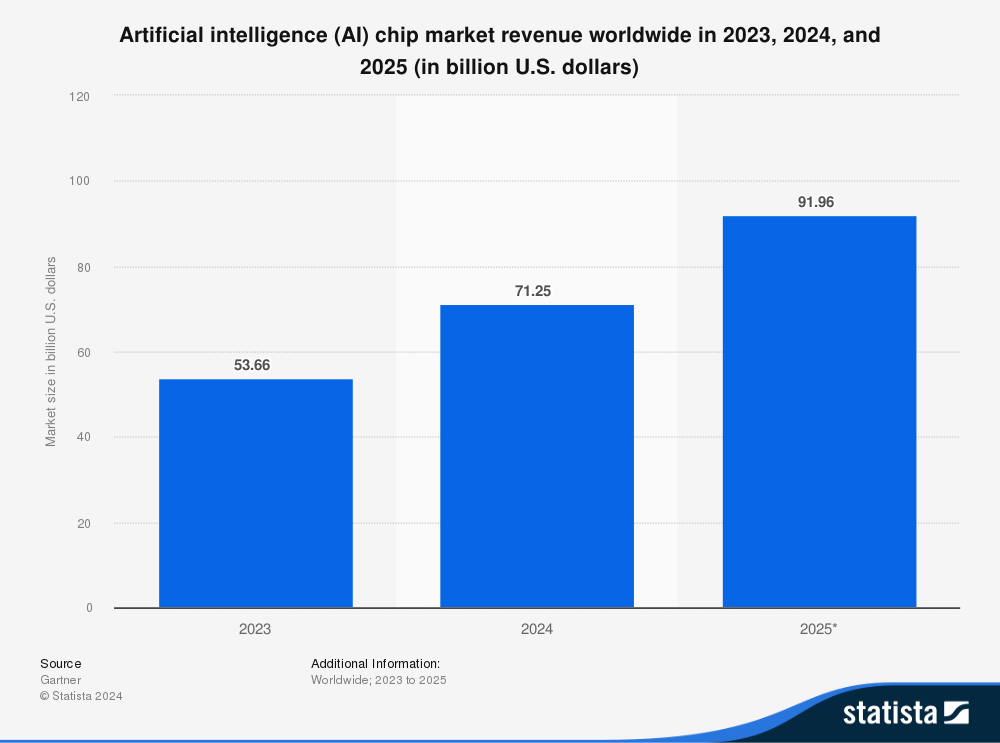

AI Chips (e.g., TPU, NPU, AI ASIC):

These chips are designed to accelerate artificial intelligence tasks like image recognition, language processing, and recommendation systems. Unlike CPUs and GPUs, AI chips are optimized for neural network computations.TPU (Tensor Processing Unit): Developed by Google for deep learning.

NPU (Neural Processing Unit): Found in smartphones to enhance features like voice recognition and photo optimization.

AI ASICs: Custom chips built for specific AI tasks, such as for training and running AI models more efficiently than GPUs.

Key Players: Google (TPU), Apple (NPU), Amazon (ASIC), Meta (ASIC), Tesla (ASIC).

Market size: ~$30-40 billion. (note: although this is a fast growing market, this number is problematic, as many of the new custom AI chips are developed and used within the same companies, so their real value cannot be measured as a standalone product)

More details about AI chips available later in this article.

2. Memory Chips

Memory chips store and retrieve data, enabling devices to function efficiently. They’re categorized based on how data is accessed and stored.

RAM (Random Access Memory):

RAM is a temporary memory that provides fast access to data needed for running applications. When you open multiple apps on your phone or computer, the data is stored in RAM. Once the device is turned off, the data is lost.Common Uses: Computers, smartphones, and gaming consoles.

Key Players: Samsung, SK Hynix, Micron.

Market size: ~$40-$60 billion.

Storage (SSD and HDD):

SSDs (Solid State Drives) are faster, durable and power-efficient storage technology, a modern alternative to traditional HDDs (Hard Disk Drives) which are significantly cheaper and popular for large scale data storage.Common Uses: Computers, cloud storage, and backup systems.

Key Players: Western Digital, Seagate, Samsung.

Market size: ~$50-$90 billion. (different reports suggest different numbers)

Cache & ROM:

Cache is an ultra-fast memory that is integrated into the CPU and stores frequently accessed data to speed up processing. ROM is permanent memory used to store firmware, like the software that starts up your computer, phone, router or even the washing machine.Combined market size: ~$20-$25 billion.

3. Specialized Chips

These chips are designed for specific applications:

DAO (Digital-to-Analog/Analog-to-Digital Converters):

These chips translate signals between the physical (analog) and digital worlds. For example, microphones convert sound into digital data using ADCs, while speakers reverse the process with DACs.Common Uses: Audio systems, cameras, IoT devices.

Key Players: Texas Instruments, Analog Devices.

Market size: ~$5 billion. (some reports suggest it is already around ~$20 billion)

Sensors:

Sensors are chips that detect changes in the environment and convert that data into electronic signals. For examples: accelerometers (detect motion), gyroscopes (detect orientation), proximity sensors (detect objects).Common Uses: Smartphones, cars, fitness trackers, and industrial machinery.

Key Players: Bosch, STMicroelectronics.

Market size: ~$30 billion. (many reports are inconsistent with their results, but can reach up to $88.1b, depends on the segments it includes)

ASIC (Application-Specific Integrated Circuit):

ASICs are custom-designed chips for a single application, such as cryptocurrency mining or 5G communication. Because they are optimized for specific tasks, they are faster and more efficient than general-purpose chips like CPUs.Common Uses: Bitcoin mining rigs, telecommunications, and IoT.

Key Players: Bitmain, Qualcomm, and Broadcom.

Market size: ~$20 billion.

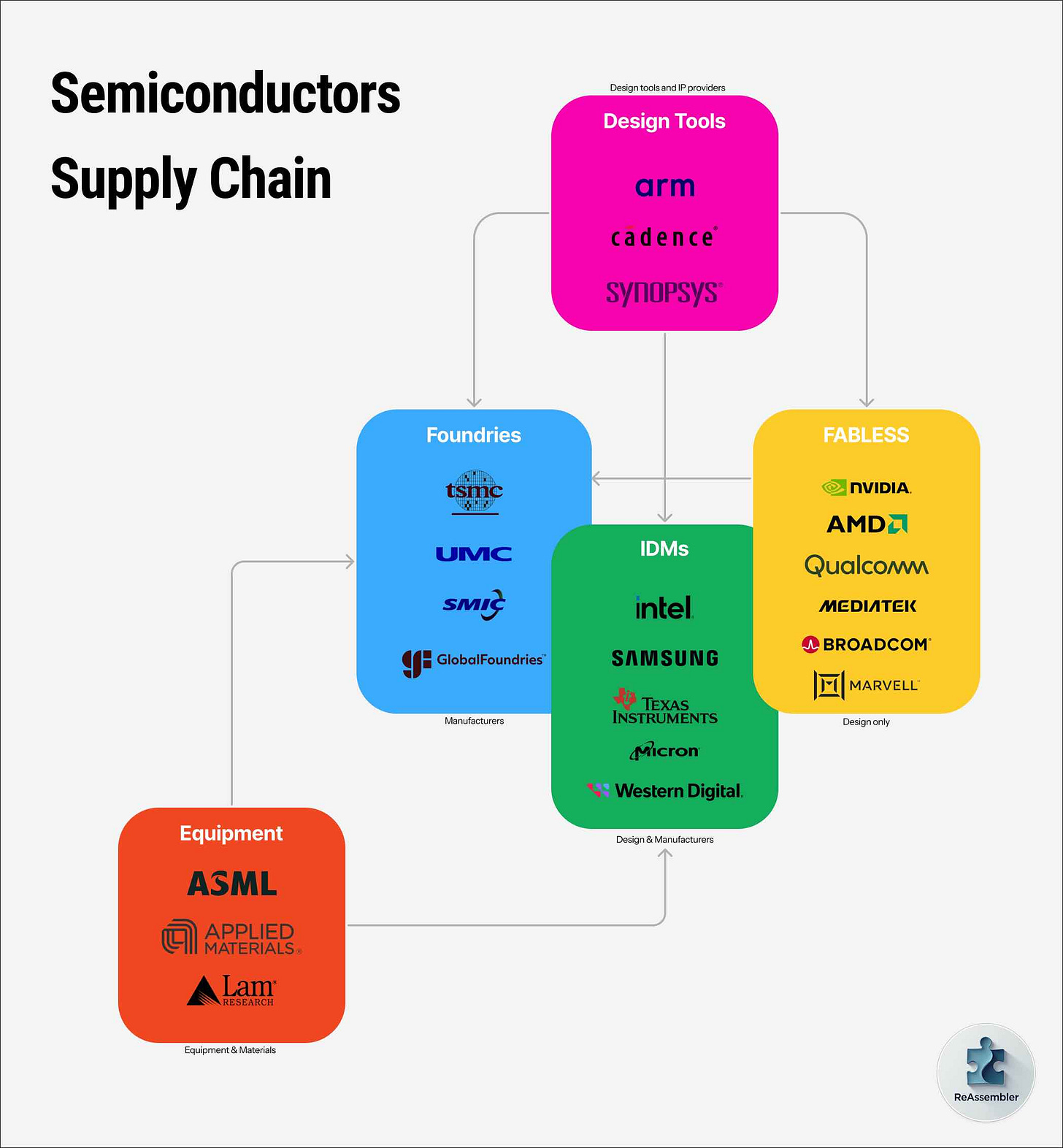

Mapping the Players

The semiconductor industry is a vast and intricate network of specialized companies, each playing a unique role in the creation of the chips that power our modern world. From designing and manufacturing to testing and enabling advanced technologies, these companies form a tightly interwoven ecosystem. In this section, we’ll break down the major types of semiconductor companies—foundries, fabless designers, IDMs, design tool providers, and equipment suppliers—and explore their roles, products, clients, and challenges. By understanding these players, we can better appreciate how semiconductors are made and the collaborative effort behind every breakthrough in technology.

Foundries

Foundries are specialized manufacturers that produce semiconductor chips for other companies. They fabricate chips by processing silicon wafers with advanced technologies, often in cleanrooms to ensure precision. These chips are then sent to packaging firms or directly to clients (not consumers).

Their main services and products:

Chip Manufacturing: Fabrication of chips at varying levels of complexity, from basic to cutting-edge (e.g., 3nm).

Technology Development: Innovating new manufacturing processes to enable faster, smaller, and more efficient chips.

Packaging and Testing: Ensuring chips meet quality standards before shipment.

Key Players in the Foundry Landscape:

TSMC (Taiwan Semiconductor Manufacturing Company):

Global market leader with approximately 53% market share in advanced chips.

Leader in advanced chips (3nm, 5nm).

Key clients: Apple, AMD, NVIDIA and Qualcomm.

Challenges: High costs and Taiwan-China geopolitical risks.

GlobalFoundries:

Specializes in mature nodes (12nm+), serving IoT and automotive markets.

Challenges: Competing without advanced-node capabilities.

Significant manufacturing facilities in the United States

SMIC (Semiconductor Manufacturing International Corporation):

China’s largest foundry, focusing on domestic demand.

Challenges: U.S. sanctions restricting access to cutting-edge tools.

UMC (United Microelectronics Corporation):

Specializes in mature manufacturing processes (aka. Legacy nodes)

Serves automotive, IoT, and industrial markets

Provides cost-effective chip manufacturing solutions

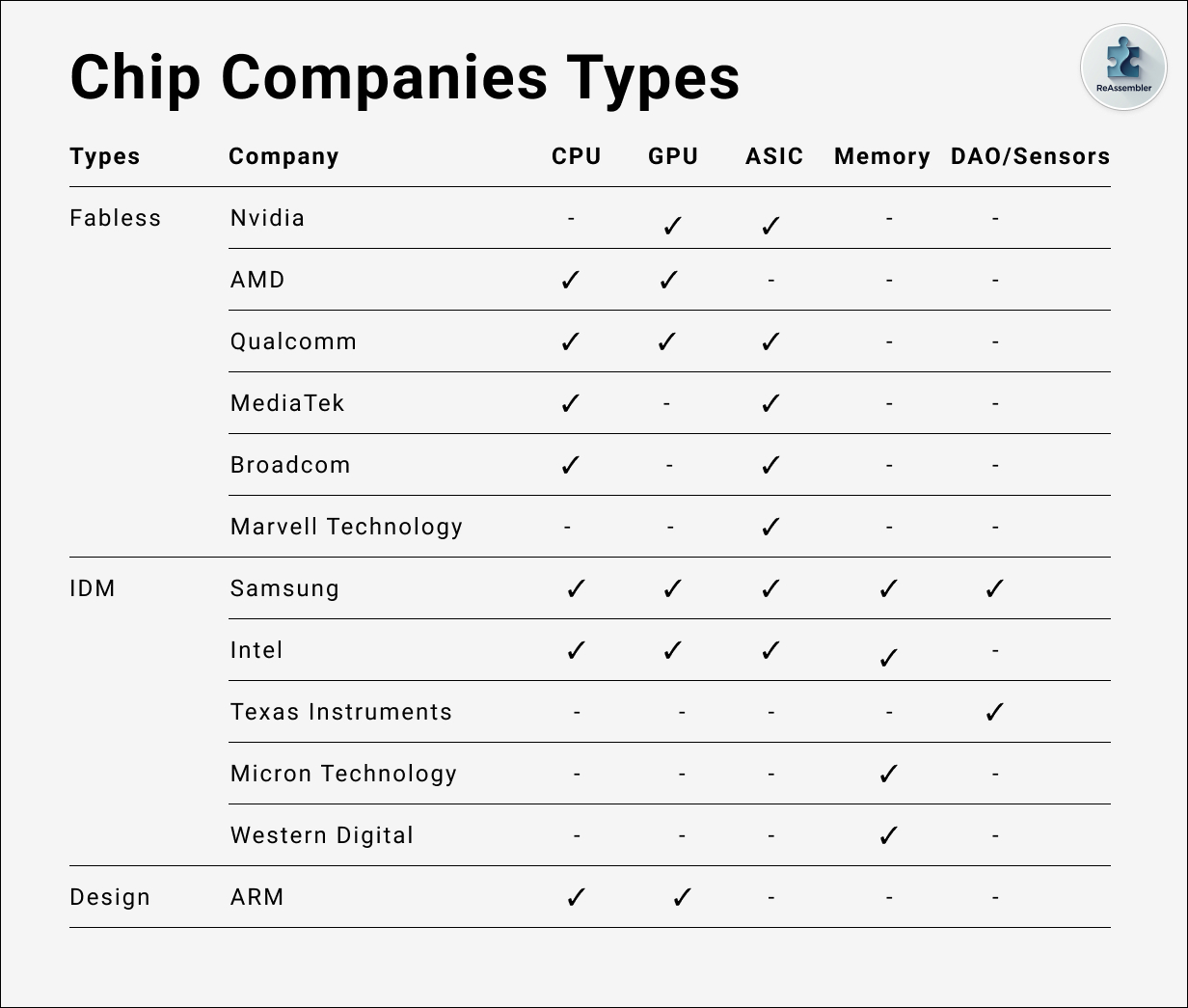

Fabless

Fabless companies design semiconductor chips but outsource their manufacturing to specialized foundries like TSMC or GlobalFoundries. This model allows them to focus on innovation and cutting-edge chip design without the massive capital investment required for chip fabrication.

What Do Fabless Companies Do?

Chip Design: Fabless companies create chip architectures tailored to specific applications, such as graphics processing, wireless communication, or AI.

Testing and Optimization: They rigorously simulate and test their designs to ensure they perform efficiently and reliably before sending them to a foundry for production.

Collaboration with Foundries: They partner with foundries to manufacture their designs, leveraging the foundry’s expertise in advanced fabrication technologies.

Key Fabless Companies:

NVIDIA:

Focus: GPUs for gaming, AI, and data centers.

Products: GeForce GPUs, AI chips (H100).

Challenge: Heavy reliance on TSMC and competition in AI.

AMD:

Focus: CPUs and GPUs for PCs, gaming, and servers.

Products: Ryzen CPUs, Radeon GPUs, gaming consoles chips.

Challenge: Competes with Intel (CPUs) and NVIDIA (GPUs), behind with AI.

Qualcomm:

Focus: Mobile processors and wireless communication.

Products: Snapdragon processors, 5G modems, IoT.

Challenge: Smartphone market dependency.

Broadcom:

Focus: Networking and storage chips.

Products: Wi-Fi modules, Ethernet chips.

Challenge: Managing diverse product lines.

Integrated Device Manufacturers (IDMs)

IDMs are semiconductor companies that handle both the design and manufacturing of their chips. Unlike fabless companies, IDMs own fabrication facilities (fabs) and produce chips in-house, giving them greater control over the entire production process.

What IDMs Do?

Chip Design and Development: IDMs design chips for a variety of markets, from consumer electronics to industrial applications.

Manufacturing: They own and operate fabs, where they produce their chips, often leveraging advanced manufacturing nodes.

Packaging and Testing: IDMs test and package their chips before delivering them to clients or integrating them into their own products.

Key IDM Companies:

Samsung:

Focus: Memory chips, processors, and foundry services for other companies.

Clients: Sells memory chips to global tech companies (e.g., Apple, Sony) and uses processors in its own smartphones.

Challenges: Balancing leadership in memory with competing in advanced-node foundry services (against TSMC).

Notable Strengths: Massive manufacturing capacity, technological diversity.

Intel:

Focus: CPUs, GPUs, and data center solutions, and a new addition is AI and machine learning processors.

Clients: Computer manufacturers, data centers, enterprise computing.

Challenges: Falling behind TSMC and Samsung in advanced-node manufacturing; catching up with its IDM 2.0 strategy, including foundry services; Increasing competition from AMD, rising manufacturing costs.

Texas Instruments (TI):

Focus: Analog and embedded chips for industrial, automotive, and consumer applications.

Clients: Automotive industry, industrial manufacturers, electronic and IoT companies.

Challenges: Maintaining market leadership in analog chips while managing mature-node fabs cost-efficiently.

Notable Strengths: Precision in niche semiconductor technologies

Equipment Suppliers

Equipment suppliers provide the cutting-edge machinery and tools essential for fabricating semiconductor chips. These companies enable foundries and IDMs to produce chips at ever-smaller nodes (e.g., 3nm), powering technological advancements in AI, mobile devices, and beyond.

What Are Semiconductor Equipment Suppliers?

Semiconductor equipment suppliers design and manufacture the highly specialized machinery used in chip production. These companies create:

Photolithography machines

Deposition equipment

Etching systems

Cleaning and inspection tools

Advanced manufacturing technologies

Key Equipment Suppliers:

ASML:

Focus: Lithography machines, particularly EUV (extreme ultraviolet) lithography, critical for advanced nodes (e.g., 5nm, 3nm), and Deep Ultraviolet (DUV) lithography machines.

Clients: TSMC, Samsung, Intel.

Challenges: High production costs and geopolitical constraints (e.g., export controls to China).

Unique Advantage: Monopoly on advanced EUV lithography technology

Applied Materials:

Focus: Tools for deposition, etching, and chemical mechanical planarization (CMP) processes.

Clients: Foundries, IDMs, and memory chipmakers like Micron and SK Hynix.

Challenges: Meeting demand for diverse tools across nodes while managing supply chain risks.

Lam Research:

Focus: Specializes in plasma etching and thin-film deposition technologies critical for multi-layer chip design, Wafer fabrication equipment.

Clients: Samsung, TSMC, and other leading manufacturers.

Challenges: Innovating for emerging technologies like 3D NAND memory while keeping costs manageable.

Design Tools & IP

In the semiconductor industry, design tools and IP providers enable chipmakers to create complex and efficient designs. These companies supply the essential software and intellectual property (IP) that fabless, IDM, and foundry companies rely on to bring their chips to life. You can think of it as their variation of Photoshop for designing their products, as these tools and their features are the building blocks for making a chip design to work.

What Do Design Tools and IP Providers Do?

Design Tools: Software that helps engineers design, simulate, and verify semiconductor chips. It is also referred to as EDA (Electronic Design Automation).

IP Providers: Companies that create pre-designed circuit blocks and technologies that can be licensed and integrated into chip designs

The Key Players:

ARM:

Focus: Provides CPU and GPU IP cores, especially for energy-efficient and high-performance processors.

Clients: Major fabless companies like Qualcomm, NVIDIA, and Apple use ARM’s IP to design their chips.

Challenges: Maintaining dominance as RISC-V, an open-source alternative, gains traction.

Unique Advantage: Dominant in mobile and embedded processor technology

Cadence:

Focus: EDA tools and design IP for system-on-chip (SoC) development.

Clients: Fabless companies, IDMs, and system designers developing chips for automotive, AI, and IoT.

Challenges: Balancing innovation with the complexity of supporting diverse clients and chip technologies.

Synopsys:

Focus: Industry-leading EDA tools and IP solutions for digital and analog chip design.

Clients: Semiconductor firms across all segments, including NVIDIA, Intel, and Samsung.

Challenges: Keeping pace with the growing complexity of advanced nodes (e.g., 3nm, 2nm).

Notable Strengths: Advanced AI-driven design tools, comprehensive IP libraries.

Financial Models

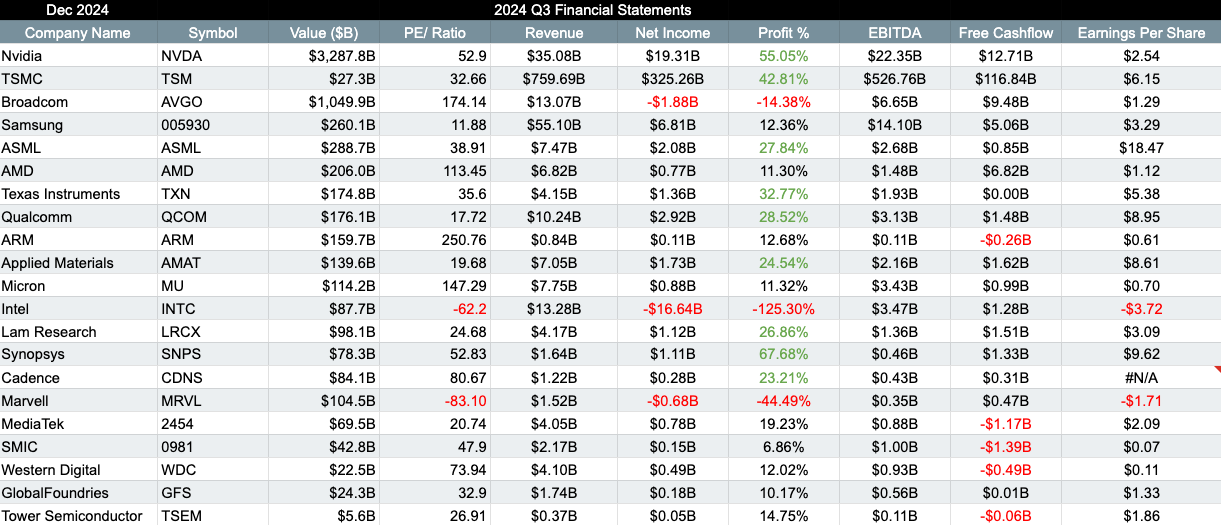

Industry Overview

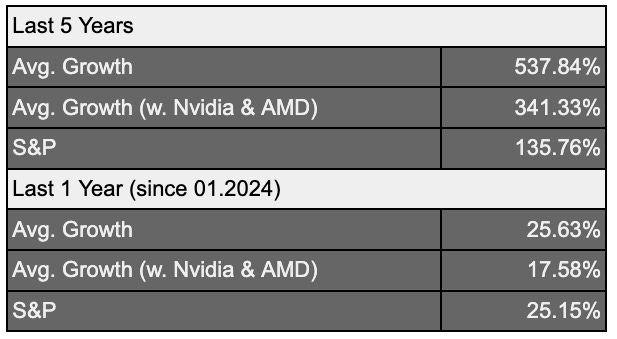

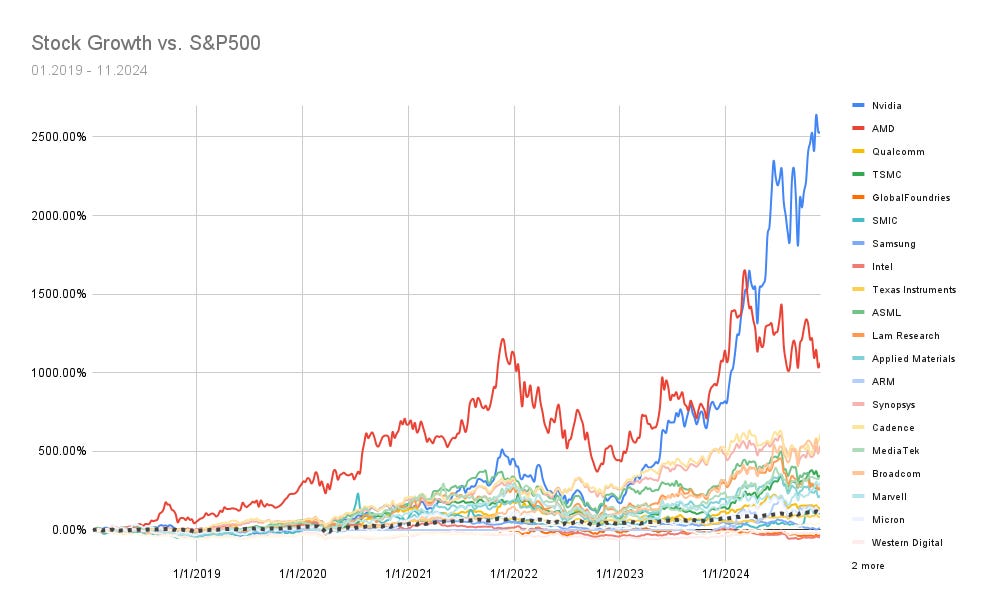

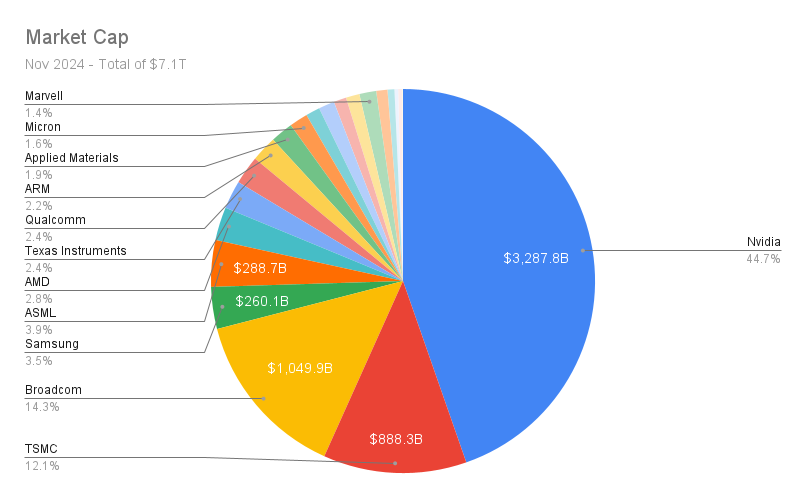

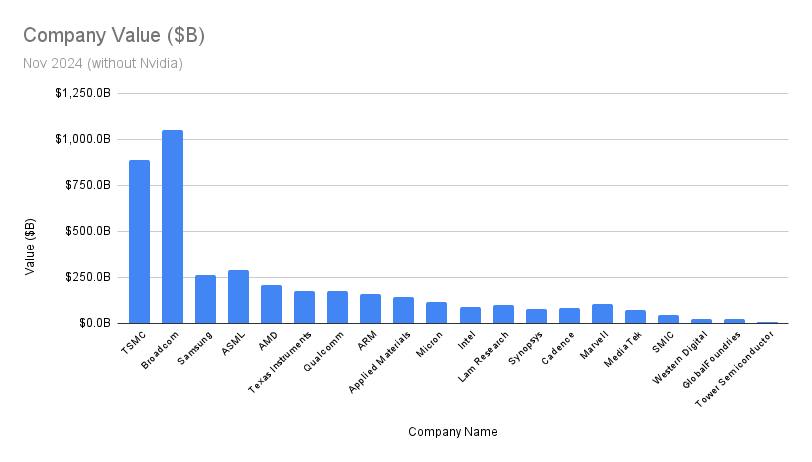

During the last 5 years, the industry grew significantly, overpassing the S&P by x4 times (537.84% vs. 135.75%). But when we’re looking only at the last year, things have changed. The increase is the same, and without Nvidia and AMD we’re getting lower results than the S&P (17.58% vs. 25.15%).

We can also see the value of Nvidia in this industry is not proportional. Without a doubt they have more than perfect business performance, but their weight in the index funds expose the whole industry to volatility. Everything is good as they keep beating the expectations, but one day the music will stop playing, and after AI and Crypto Nvidia will have (too) high expectations to meet.

In my examples, for the averages I chose not to use weights, in order to keep it simple and balanced. In index funds you will find weights for optimizing the market values.

The semiconductor industry operates across a spectrum of business models, each with unique financial dynamics. From fabless designers to capital-heavy foundries, understanding the financial frameworks of these segments is crucial to grasping the industry's structure and challenges.

Fabless Model

Fabless companies focus on designing chips while outsourcing manufacturing to foundries. This model allows them to minimize capital expenditures (CapEx) but requires substantial investments in research and development (R&D).

High R&D Costs: Fabless firms invest heavily in design and development to create competitive chips, often exceeding 20% of sales.

Low CapEx: By avoiding the need for costly fabs, they can allocate resources to innovation and marketing.

Profitability: Fabless companies can achieve high profit margins due to their asset-light model, but they are vulnerable to pricing pressures from foundries.

Case Study: NVIDIA

Nvidia exemplifies the fabless model's success, leveraging its focus on innovation to dominate GPU markets. Over three years, Nvidia invested $14.6 billion in R&D and CapEx combined, far outpacing competitors like AMD. Its proprietary technologies, such as CUDA (framework for using GPUs for new needs), and economies of scale have enabled it to maintain strong profitability despite high R&D costs.

Foundries Model

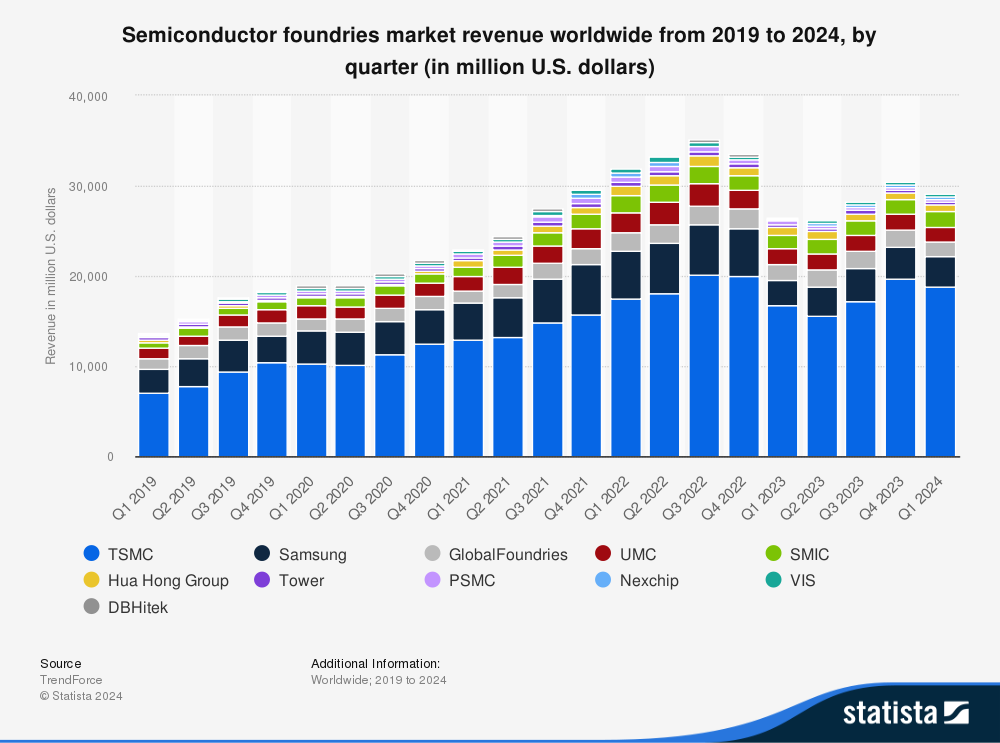

Foundries handle chip manufacturing for fabless companies and other clients. This business model is highly capital-intensive, requiring massive upfront investments in cutting-edge facilities.

Capital-Intensive: Foundries require massive investments in fabs, often exceeding $10 billion for advanced-node facilities. Foundries like TSMC invest billions annually (e.g., $30 billion in 2024) to maintain technological leadership and expand capacity.

Economy of scale: Foundries benefit from pooling demand across multiple clients, reducing per-unit costs and enabling reinvestment in advanced technologies.

Profitability: Despite high fixed costs, leading foundries achieve strong margins due to their scale and technological edge.

Case Study: TSMC

TSMC dominates the global foundry market with over 60% market share and produces more than 90% of the most advanced chips. Its ability to reinvest profits into cutting-edge technologies like EUV lithography has solidified its leadership position, though geopolitical tensions (Taiwan and China) and supply chain risks remain challenges.

IDM Model

Integrated Device Manufacturers (IDMs) combine design and manufacturing under one roof. This vertical integration provides control over the supply chain but comes with both advantages and challenges.

High Fixed Costs: IDMs must invest heavily in both R&D and CapEx spending to remain competitive.

Flexibility: Vertical integration allows IDMs to mitigate supply chain disruptions and maintain tighter control over production timelines.

Profitability: While IDMs face higher fixed costs, their ability to leverage internal capacity can offset these expenses during periods of high demand.

Case Study #1: Intel

Intel's IDM model allows it to manufacture its CPUs, but its delayed transition to advanced nodes has eroded its market share. The company’s IDM 2.0 strategy aims to compete with foundries by offering manufacturing services, requiring significant CapEx. While this diversification may stabilize revenue, it introduces additional operational complexity. The mess with the CEO leaving created new hopes for investors, as during his time they lost more than 50% (though he didn’t have a great starting point).Case Study #2: Samsung

Samsung combines IDM and foundry models, excelling in memory production while competing in advanced-node logic chips. Its dual focus diversifies revenue but increases financial risk in balancing memory market cycles with foundry investments.

Equipment Providers

Equipment providers supply critical tools for semiconductor manufacturing, such as lithography systems. Their business depends on long-term demand from foundries and IDMs.

Dependence on Demand: Equipment sales align with manufacturers’ investment cycles, leading to revenue fluctuations (volatility).

High R&D and Innovation Costs: Maintaining a technological edge requires continuous investment. (e.g., ASML’s EUV systems).

Service revenue: Providers generate recurring income through system upgrades and maintenance contracts.

Case Study: ASML

ASML leads the lithography market with its EUV technology, essential for advanced chip production. Despite high R&D expenses, its strong customer relationships and recurring service revenues ensure robust profitability.

Design Tools and IP Providers

Companies in this segment develop electronic design automation (EDA) tools or license intellectual property (IP) for chip design.

Low CapEx requirements: These firms operate asset-light models focused on software development.

High-margin licensing revenue: Licensing IP generates steady and predictable income streams with minimal incremental costs.

Long R&D timelines: Developing new tools or IP can take years, requiring sustained investment before generating returns.

Case Study: ARM

ARM licenses its IP to over 1,000 partners worldwide (such as Qualcomm, Apple, etc.), earning royalties on every chip sold containing its designs (mostly of mobile CPU and GPU). This scalable model enables ARM to maintain high profitability without incurring manufacturing costs. Its lightweight financial model minimizes CapEx but faces rising competition from open-source alternatives like RISC-V.

General Notes and Insights

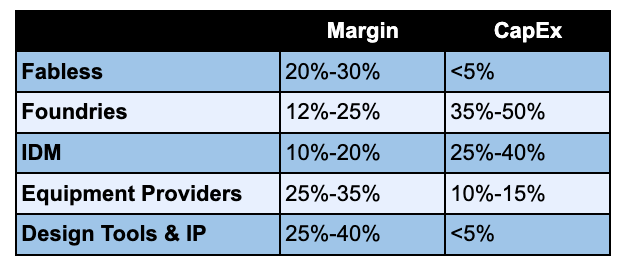

Profit Margins Across Segments:

Fabless: 20-30% (Fabless firms like NVIDIA enjoy high margins due to low CapEx).

Foundries: 15-25% (Foundries operate on lower margins but make up for it in volume; TSMC is exceptional).

IDMs: 10-20% (IDMs balance margins through diversification but face operational inefficiencies).

Equipment Providers: 25-35% (Equipment and EDA providers sustain stable margins due to recurring revenue models).

Design Tools/IP: ~25%-40%

Capital Expenditure Landscape

Foundries and IDMs incur substantial upfront costs, often requiring external funding. Equipment providers, in contrast, see high-margin returns on initial investments.

Fabless : Minimal to no CapEx

Foundries: Highest CapEx (~35%-50% of revenue)

IDMs: ~25%-40% of revenue

Equipment Providers: ~10%-15% of revenue

Design Tools & IP: Minimal to no CapEx

Cyclical Nature:

Demand for semiconductors fluctuates based on end-market trends (e.g., smartphones, PCs, AI, crypto), making revenue streams unpredictable for all segments. History shows us that there is always periodic oversupply and shortage cycles.

Trends & Opportunities

The semiconductor industry stands at the crossroads of rapid technological advancement, shifting geopolitical landscapes, and increasing global demand for chips in various sectors. Below, we break down key trends and opportunities reshaping this critical industry:

Growth Drivers:

Semiconductors power transformative technologies, and their demand is propelled by exponential growth in:

Artificial Intelligence (AI): The AI revolution is driving unprecedented demand for high-performance GPUs, TPUs, and custom AI accelerators. These chips are crucial for training and deploying machine learning models.

5G Networks: 5G rollouts require advanced semiconductors for base stations, modems, and network infrastructure, promising faster connections and greater reliability.

Internet of Things (IoT): Low-power and energy-efficient processors are essential for the billions of connected devices in smart homes, factories, and cities.

Autonomous Vehicles: Chips enabling real-time processing for autonomous systems, including ADAS (Advanced Driver Assistance Systems), LiDAR, and radar, are vital for the automotive sector.

Cloud Computing: Data centers continue to scale, requiring high-performance CPUs, GPUs, and memory technologies to handle massive workloads and enable cloud services.

Geopolitical Dynamics and Government Incentives

Semiconductors have become a focal point in global economic competition. Governments worldwide are implementing policies to bolster domestic chip production:

CHIPS and Science Act (USA): The U.S. has committed over $50 billion to subsidize chip manufacturing and R&D, aiming to reduce dependency on foreign supply chains. Intel got $7.86 billion thanks to this act, and also you can find names like Micron, TSMC, Samsung and more.

European Chips Act: The EU initiative, aimed to mobilize €43 billion, will aim to double its global chip production share by 2030, emphasizing local innovation and manufacturing.

China’s “Made in China 2025” Initiative: With rising sanctions, China has accelerated efforts to develop indigenous semiconductor capabilities, investing heavily in companies like SMIC and establishing subsidies for advanced manufacturing.

AI-Chips

This topic could easily be a standalone article, but we’ll try to simplify it.

Dedicated AI chips represent one of the fastest-growing semiconductor markets. These processors are optimized for specific AI tasks like deep learning and neural network inference.

It is obvious that NVIDIA had the best starting point and all companies purchased their H100-GPU (and its successors), but it also raised a serious question: can a top company rely on one specific vendor for a long time? Remember those companies are not familiar with the status of not controlling the situation and calling the shots, and Nvidia did her profit from this by being ready with the perfect product at the right time. But for how long will Nvidia control the AI chip sales?

The common approach when developing a new technology is that you need first to go after performance for getting the best results, and only later on talking about optimizations. That time has come. Since some of the top AI-chips clients are the top tech companies, we’re talking about companies with (very) deep pockets, only they can develop their own solution to achieve further optimization and eventually reduce costs. Few examples:

Google (TPU v5e): Google has unveiled its sixth-generation tensor processing unit (TPU), named Trillium. This chip is designed to significantly enhance AI workloads by providing a fourfold (x4) increase in training performance and a threefold improvement in inference throughput compared to its predecessor, TPU v5e.

Amazon (Inferentia & Trainium): AWS had recently announced the Trainium2 chips. Trainium is designed for training deep learning models, offering significant cost reductions and efficiency improvements for generative AI tasks. It accelerates training times, making it ideal for developing new AI applications. In contrast, Inferentia is optimized for inference tasks, focusing on deploying trained models for real-time predictions with high throughput and low latency.

Tesla (Dojo): Tesla’s custom AI chips enhance in-car computing for its self-driving technology (FSD), optimized for machine learning tasks. The Dojo chips are used in Tesla's supercomputing clusters.

Meta (MTIA): Meta is designing chips for large-scale AI models like those used in the Metaverse, focusing on efficiency and scalability. Their chips focus on the training part.

AMD (MI300): The usual suspect, and traditionally Nvidia’s direct competitor, AMD, has released its MI350 series as a successor to the MI300 series, aiming to compete with Nvidia's H200 chips.

Intel (Gaudi 3): Intel's Gaudi 3 accelerator focuses on providing a cost-effective alternative for AI workloads in data centers. Intel is positioning itself as a competitor by enhancing its software ecosystem to support these chips.

Qualcomm: Qualcomm's AI chips have demonstrated superior power efficiency compared to Nvidia's in certain metrics, achieving higher server queries per watt. This focus on reducing power usage makes Qualcomm's chips attractive for applications where energy efficiency is crucial.

Microsoft (Azure Maia & Cobalt): Maia serves as an AI accelerator, optimizing AI workloads such as training and inference of large language models, thereby improving application performance. It is currently being tested with applications like GPT-3.5 Turbo. Cobalt is a 128-core CPU designed for general-purpose computing, offering improved performance and efficiency while reducing power consumption by 40% compared to previous ARM-based chips.

Chinese Companies: Companies like Huawei, Alibaba, and Baidu are developing their own AI chips as alternatives to Nvidia's offerings. Alibaba's Hanguang 800 chip and Baidu's Kunlun chip are examples of these efforts

So, as you might understand, Nvidia is now living the dream. Nvidia always creates new markets for its product (remember just a few years ago they were popular for crypto mining?), but their leverage in AI chips will slowly decrease, if not during 2025, it will surely happen during 2026.

Vertical Integration Strategies

Tech giants like Apple are revolutionizing the industry with custom silicon strategies. Apple’s M-series chips are the latest success story, started from iPhones (2010) and expanded to their Mac computers (2020), demonstrating the efficiency and power of tailored designs, setting a high standard of performance gains and ecosystem optimization. With this move they “killed” their dependency on companies such as Intel (CPU/GPU), Nvidia(GPU), AMD (GPU), Samsung (SoCs), Qualcomm (communication), Broadcom (communication, expected by 2025).

The reality, as always, is more complicated. This move didn’t go smoothly at all fronts, and Apple struggled with some of their development, including a purchase of Intel’s modem division, legal disputes and patent avoidance, and underestimating the technical complexities, especially in the modem development aspects.

Intel Horizontal Expansion

Intel faced significant financial losses, technology delays, and competitive pressures from industry leaders like TSMC (fab) and Nvidia (fabless). Intel's IDM 2.0 strategy marks a significant evolution in its business model as IDM, aiming to regain leadership in semiconductor manufacturing by combining internal production with external foundry partnerships. Through Intel Foundry Services, the company seeks to expand its customer base, offering manufacturing capabilities alongside its own product development. This dual approach is designed to enhance operational efficiency and cost-effectiveness, crucial for achieving margin expansion by 2030. A key focus is on advancing process nodes like 20A and 18A, incorporating innovations such as RibbonFET and PowerVia, which are essential for competing in high-performance sectors like AI and data centers. However, with substantial restructuring costs, delayed profitability, and a multi-year technology gap to close, IDM 2.0 is not just a strategic pivot—it may indeed be Intel's last opportunity to secure its future in an increasingly competitive market.

Scientific Innovations

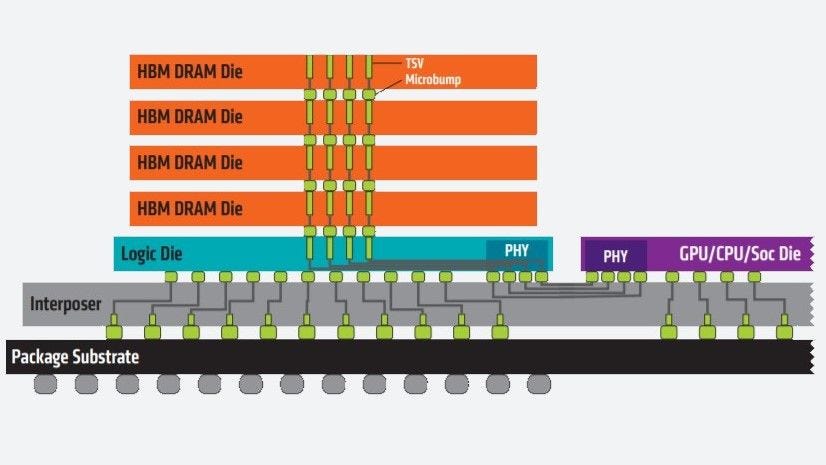

HBM (High Bandwidth Memory) and 3D Stacking: Advanced memory technologies like HBM3 are enabling faster data transfer and reducing latency for high-performance applications, particularly in AI and HPC (High-Performance Computing).

Extreme Ultraviolet (EUV) Lithography: ASML’s EUV machines are revolutionizing chip fabrication, enabling smaller node sizes (e.g., 3nm and 2nm), which boost performance while reducing power consumption.

Chiplets and Modular Design: Chiplet technology involves breaking down a processor into smaller functional units (chiplets) that can be combined within a single package. This modular approach improves manufacturing yields, reduces costs, and allows for greater customization of chips for specific applications. Chiplets are particularly beneficial for high-performance computing and AI workloads, enabling companies to innovate faster while maintaining scalability.

Gallium Nitride (GaN) and Silicon Carbide (SiC) Materials: GaN and SiC are advanced materials that outperform traditional silicon in high-power and high-frequency applications. These wide-bandgap semiconductors operate at higher voltages and temperatures, making them ideal for electric vehicles (EVs), renewable energy systems, and 5G infrastructure. Their adoption is driven by the need for energy-efficient solutions in power electronics, where they enable smaller, lighter, and more efficient devices

Rising Competition from Chinese Players

Chinese companies like SMIC are becoming key players in the semiconductor industry despite U.S.-led sanctions that restrict access to advanced manufacturing tools, such as EUV lithography. These limitations confine SMIC to producing older-generation chips (e.g., 14nm and above), which are in demand for consumer electronics and industrial applications. While SMIC can export these chips to many global markets, its ability to supply advanced semiconductors for AI or 5G is constrained by export controls and security concerns in the West. (For example: companies like Huawei have stockpiled critical components and adapted by designing less advanced chips that comply with U.S. regulations)

To adapt, SMIC is focusing on serving China’s growing domestic market and expanding into less restrictive regions, such as Southeast Asia. The company is also investing in domestic alternatives to Western technologies, signaling its ambition to compete globally, particularly in legacy chips and emerging markets.

Risks & Challenges

Technological Barriers

Moore's Law and Miniaturization: Moore’s Law has driven the semiconductor industry by doubling transistor density approximately every two years, enabling exponential performance and efficiency gains. Physical limits, like heat dissipation and quantum tunneling, make further scaling increasingly difficult. Technologies like quantum computing and neuromorphic chips are being explored as post-Moore’s Law solutions.

Innovation Bottlenecks:

Diminishing Returns: Smaller transistors no longer yield significant performance gains due to power and design complexities.

High Costs: R&D and advanced manufacturing, especially for sub-5nm nodes, are prohibitively expensive.

Material Challenges: Integrating new materials like graphene into existing manufacturing processes remains a hurdle.

Supply Chain Fragility

Over-Reliance on Key Players : The semiconductor supply chain is heavily dependent on a few dominant players, such as TSMC and Samsung, which produce the majority of the world’s advanced chips. This concentration creates significant risks, as these manufacturers are located in regions prone to geopolitical tensions or natural disasters, such as Taiwan and South Korea. The COVID-19 pandemic underscored the fragility of this model, as disruptions to production and logistics caused widespread shortages across industries.

Raw Material Shortages: The production of semiconductors also depends on critical raw materials, such as rare earth elements, high-purity silicon, and specialized gases like neon, which are essential for lithography. The supply of these materials is concentrated in a few countries, with China dominating the rare earth market. This dependence on a limited number of suppliers makes the semiconductor industry highly vulnerable to geopolitical disruptions, trade restrictions, and resource scarcity.

RISC-V: A Potential Architectural Disruptor

The RISC-V architecture represents a significant potential disruptor in the semiconductor industry (or in other words - “democratize chip design”, what a slogan). Unlike proprietary architectures such as ARM or x86, RISC-V is an open standard instruction set architecture (ISA), allowing companies to design custom processors without incurring expensive licensing fees. This approach reduces dependency on traditional players like Intel and ARM, fostering greater innovation and competition, particularly among smaller companies and startups that can now enter the processor market with lower barriers to entry (great for markets like IoT, automotive systems, AI, etc.). RISC-V also enables research institutions, and even nations to develop custom semiconductor solutions tailored to specific technological needs.

For incumbents, RISC-V presents both a challenge and an opportunity. Companies like Intel and ARM risk losing market share if RISC-V continues to gain traction across industries. But the leading companies also read the map and they are increasingly engaging with RISC-V. Intel has made significant investments in the RISC-V ecosystem through its Intel Foundry Services (IFS), which supports RISC-V IP development and offers optimized solutions for its process technologies. In 2022, Intel joined RISC-V International as a premier member, signaling its commitment to open collaboration. Similarly, Qualcomm is leveraging RISC-V for its Snapdragon wearable platforms and collaborating with Google on the RISC-V Software Ecosystem (RISE) initiative. Nvidia and Google have also invested in advancing RISC-V software for datacenters and consumer electronics. While ARM remains dominant in many sectors due to its mature ecosystem, the rise of RISC-V is prompting incumbents to reimagine their business models and strategies.

Geopolitical Risks

The semiconductor industry is at the center of escalating geopolitical tensions, particularly between the United States and China. The ongoing US-China tech war has led to significant disruptions, with the United States imposing stringent export controls to curb China's technological advancements. In December 2024, the Biden administration launched its third major crackdown in three years, targeting 140 Chinese entities, including prominent firms like Semiconductor Manufacturing International Corporation (SMIC) and Naura Technology Group. These measures restrict exports of advanced chipmaking tools, high-bandwidth memory chips critical for AI development, and other technologies deemed vital for military applications. The restrictions aim to stymie China's ambitions in semiconductor self-sufficiency and advanced chip production. In response, China has retaliated by banning exports of key raw materials such as gallium and germanium—essential components for semiconductor manufacturing—further straining global supply chains. These actions highlight the growing fragility of the semiconductor industry's supply network and its vulnerability to geopolitical shocks.

In addition to export controls, both nations have intensified antitrust investigations against companies from the opposing side, adding regulatory hurdles to an already volatile environment. These geopolitical tensions not only threaten the stability of the supply chain but also drive up costs and foster protectionism within the technology sector. As China accelerates efforts to achieve self-reliance in semiconductors while still lagging behind industry leaders like Nvidia and ASML, the US continues to leverage its alliances with nations such as Japan and the Netherlands to enforce export restrictions. This rivalry underscores a broader struggle for technological supremacy, with far-reaching implications for innovation, economic growth, and international relations.

Environmental and Sustainability Challenges

The Carbon Footprint of Semiconductor Production: Semiconductor manufacturing is among the most energy-intensive industries globally, with processes like wafer fabrication, lithography, and cleanroom cooling systems consuming vast amounts of electricity. A single advanced semiconductor fabrication facility can use as much energy as a small city, with estimates suggesting that cutting-edge fabs consume up to 20 kilowatt-hours (kWh) of energy per chip. In 2021, the global semiconductor industry emitted approximately 76.5 million tons of CO2 equivalent, with Scope 1 (direct emissions) and Scope 2 (energy-related emissions) accounting for the majority. Taiwan Semiconductor Manufacturing Company (TSMC), for instance, consumed about 6% of Taiwan's total electricity in 2020, a figure projected to rise to 12.5% by 2025. The reliance on fossil fuels in regions like Taiwan and South Korea exacerbates the industry's environmental impact. Efforts to mitigate this include TSMC's goal of achieving net-zero emissions by 2050 and Intel's commitment to using 100% renewable energy for its new facilities. However, transitioning to carbon neutrality remains a long-term challenge due to the complexity of semiconductor production and the globalized supply chain.

Resource Constraints and Waste Management: The semiconductor industry is heavily dependent on finite resources such as water and rare earth elements, posing significant sustainability challenges. Producing a single 12-inch wafer requires between 2,000 and 3,200 gallons of ultrapure water (UPW), and major fabs can use up to 10 million gallons of UPW daily—equivalent to the daily water usage of 33,000 U.S. households. This demand places immense pressure on water resources in regions like Taiwan, Arizona, and South Korea, which are already facing water scarcity issues. Companies like Intel and TSMC are investing in water recycling technologies; for example, TSMC’s Arizona plant aims to reclaim about 65% of its water use.

Rare earth elements used in chip production also pose environmental challenges due to their intensive extraction processes, which cause land degradation and pollution. Additionally, electronic waste (e-waste) is a growing concern. In 2019 alone, around 53.6 million metric tons of e-waste were generated globally, with only 17.4% properly recycled. Recycling semiconductors is particularly challenging due to their complex composition but offers significant potential for recovering valuable materials like gold and palladium worth an estimated $57 billion annually from unrecycled e-waste. Companies like Samsung are adopting circular economy approaches by reusing materials such as semiconductor trays.

Cybersecurity Threats

IP Theft and Espionage: Intellectual property (IP) theft remains one of the most significant cybersecurity threats to the semiconductor industry. Semiconductor designs and manufacturing techniques are among the most valuable technological assets globally, representing billions of dollars in R&D investment. Stolen IP can be used to create counterfeit chips or competing products without incurring development costs, severely impacting the profitability and competitive edge of companies. For example, high-profile incidents like the 2020 TSMC breach and the 2022 Broadcom design theft highlight the scale of this threat, with attackers targeting proprietary designs for Wi-Fi and networking chips. Sophisticated cyberattacks, including ransomware targeting design files and advanced malware infiltrating chip design tools, have become increasingly prevalent. To combat these risks, companies are employing advanced encryption, access controls, and counterintelligence technologies to detect and prevent intrusions. By 2025, the semiconductor industry is expected to spend approximately $36.6 billion on cybersecurity measures, reflecting the urgency of addressing these threats.

Supply Chain and Hardware-Level Security Risks: The semiconductor supply chain's globalized nature creates numerous vulnerabilities, as attackers target design houses, foundries, and suppliers at various stages of production. Supply chain attacks such as the 2021 SolarWinds incident demonstrate how compromised software or tools can infiltrate multiple companies. Additionally, hardware-level security concerns have gained prominence following vulnerabilities like Spectre and Meltdown. These exploits revealed fundamental flaws in chip architectures that allowed attackers to access sensitive data through side-channel attacks. Fixing these vulnerabilities has required significant effort, including redesigning processors and implementing patches that sometimes degrade performance by up to 30% under specific workloads. Experts predict that Spectre-like vulnerabilities will persist for decades due to their widespread impact on fast microprocessors.

To address these risks, the semiconductor industry is increasingly embedding security at the hardware level during design. This includes siloing sensitive cryptographic functions into separate secure cores within chips and adopting a "hardware-first" security strategy. Regulatory bodies like the U.S. Department of Homeland Security (DHS) have also recommended integrating security features at the transistor level to enhance device integrity and resilience against attacks. As cyber threats grow more sophisticated—fueled by advancements in AI—the industry must adopt comprehensive security lifecycles that integrate functional testing with proactive vulnerability detection during development.

Reassemble:

Piecing Together the Silicon Puzzle

The semiconductor industry is like a grand symphony where every instrument must play in perfect harmony. From the delicate dance of electrons through silicon wafers to the geopolitical tensions shaping supply chains, this industry represents one of humanity's most complex technological achievements.

The Perfect Puzzle

Imagine a puzzle where each piece must not only fit perfectly but also evolve constantly. The fabless companies design innovative chips, foundries manufacture them with atomic precision, equipment makers provide the tools that make it all possible, and design houses supply the software that brings these visions to life. This intricate ecosystem has enabled everything from smartphones in our pockets to the AI revolution reshaping our world.

Innovation Through Fragmentation

The industry's fragmented nature is both its greatest strength and most significant vulnerability. When TSMC perfects a manufacturing process, NVIDIA can push GPU designs to new limits, and ASML can develop more precise lithography machines, we witness the power of specialization. Yet this same specialization means that a disruption at any point—whether a natural disaster in Taiwan or a geopolitical dispute affecting equipment supplies—can send shockwaves through the entire system.

Beyond Technology

The stakes transcend mere technological advancement. When we talk about semiconductors, we're really discussing the foundations of modern power. A 46-cent chip failure once brought us to the brink of nuclear conflict, while today's chip shortages can paralyze entire industries. The industry's concentration in specific geographic regions has transformed technical manufacturing capabilities into geopolitical leverage, making semiconductors a crucial battlefield in the struggle for global technological supremacy.

The Path Forward

As we look to the future, the industry faces unprecedented challenges. Moore's Law is reaching physical limits, environmental concerns are mounting, and geopolitical tensions threaten to fragment the global supply chain. Yet these challenges are driving innovation in new directions—from chiplet designs to quantum computing, from RISC-V architecture to new materials like gallium nitride.

The semiconductor industry isn't just about making faster phones or more powerful computers. It's about maintaining the delicate balance between innovation and security, between global cooperation and national interests, between technological progress and environmental sustainability. As we continue to push the boundaries of what's possible, the ability to reassemble these pieces into a coherent whole will determine not just the future of technology, but the future of global power dynamics themselves.

Written by Lior Rosenspitz, Dec 2024

Would you include Oxford Instruments in this article as a player? They build a plethora of products for fabrication, failure analysis and inspection / process control.