Netflix Games: Entertainment’s Next Frontier

So what is the story behind Netflix Games? What does Kim Kardashian and Emily in Paris have in common? And why should they buy Ubisoft?

TL;DR (Wild speculations for 2025+)

Netflix games' future will be in streaming (aka. Cloud gaming) to your TV and laptop.

Netflix will stop acquiring small boutique mobile studios, but should consider buying companies Ubisoft or Quantic Dreams for its content, great IP, and experience in game development. (similar to Microsoft’s moves of acquiring Bethesda and Activision-Blizzard).

Netflix should also acquire infrastructure companies such as Utomik and Blucknut.

Mobile games strategy will become more focused, using simple game mechanics (narrative based games, social life simulations), will remain free, and their goal will remain as a companion to the existing Netflix tv shows brands.

Introduction

In 2021, Netflix made a surprising leap into the gaming world, transforming from a streaming powerhouse into an aspiring game developer. What began as a bold experiment has become a high-stakes journey to conquer the potential of innovative storytelling, alongside uncertainty.

The link between games and video-content is very old and exists for decades, and it has success stories in both ways (as the recent Fallout, The Last of Us, Super Mario Bros,) as well as failures (Mortal Kombat, the previous Mario Bros. movie, Sonic movies). A good storytelling is the success factor, but it requires different skills for each medium. Being great in one thing doesn’t mean you are going to succeed in another. We’ll soon see if Netflix got what it takes to do it right, and what it learned so far.

One interesting thing about Netflix which does not always come into mind, is that Netflix has actually already pivoted a lot during the years. Not all pivots are dramatic the the same, but major changes The most known was the transition from DVD rental to Streaming (2007 until 2012), but even before it, it shifted from pay-per-rental service to subscription model, started from the Bay Area across California (2008-2010), became a domestic business when it covered major cities around the US (2005), and then became a global company (2010-2016). Changes are part of Netflix DNA.

This article is more than just a corporate strategy story—it's a window into the future of digital entertainment, where the lines between streaming, gaming, and technology continue to blur.

The Background Story:

Netflix Evolution From DVDs to Interactive Entertainment

Netflix's journey is a testament to radical reinvention in the digital entertainment landscape. Founded in 1997 as a DVD-by-mail rental service, the company began by challenging the traditional video rental model pioneered by Blockbuster. What started in a small Los Angeles apartment quickly transformed the way consumers accessed movies, eliminating late fees and offering unprecedented convenience. The real revolution came in 2007 when Netflix launched its streaming service, a move that would ultimately disrupt the entire entertainment industry. As internet speeds improved and smartphone adoption increased, the company rapidly shifted from a logistics-based business to a technology-driven content platform. By 2013, Netflix began producing original content with "House of Cards," marking its transition from a content distributor to a content creator—a strategy that would redefine television production and consumption.

The Leadership

Netflix operates under a unique co-CEO structure with Greg Peters and Ted Sarandos at the helm. Peters oversees the company's newer ventures, including gaming and advertising initiatives, while Sarandos focuses on content strategy and creative development.

In the gaming division, a significant restructuring occurred in 2023-2024, with Alain Tascan appointed as President of Games in July 2023, bringing over three decades of expertise in video game creation and development. The gaming leadership structure was further enhanced when Tascan brought in Jeet Shroff as VP of games tech and portfolio development, focusing on maintaining consistency and quality across Netflix's game library. Mike Verdu, who previously led the gaming division, had recently transitioned to a new role focused on cutting-edge game innovation and development of new technologies. The gaming division also includes Leanne Loombe, who serves as head of external games and oversees the company's cloud gaming initiatives.

The Interactive Movies Sad Story

Netflix's foray into interactive movies represented one of its earliest experiments in gaming-adjacent content. Starting in 2017 with "Puss in Book: Trapped in an Epic Tale," the company produced 24 interactive titles, with "Black Mirror: Bandersnatch" (2018) becoming their most notable success. The initiative included partnerships with established gaming companies, including Telltale Games for Minecraft: Story Mode, and various projects ranging from children's content (Carmen Sandiego, Spirit, Captain Underpants, Barbie Epic Road Trip) to sophisticated narrative experiences like "Choose Love", You vs. Wild, Unbreakable Kimmy Schmidt, and more. However, by late 2024, Netflix dramatically scaled back this initiative. The format of interactive movies was always problematic and never gained commercial success, not from users or producers. The company's spokesperson acknowledged that while the technology served its purpose, their focus has shifted to other technological efforts, marking the end of this ambitious but ultimately short-lived experiment in interactive entertainment.

Note: I wrote my seminar work on the relations between games and narratives. One of the outcomes was that interactive movies are some kind of zombie, not a movie and not a game, activating different areas of your brain, but not empowering the user nor improving the experience. So you can’t suspect me as a fan of the genre, but I do appreciate the experiment.

The Rationale

Why Gaming?

Netflix's leadership increasingly recognized gaming as a significant competitor for audience attention, and it wasn’t wrong. Reed Hastings, the company's co-founder, had long viewed entertainment through a broad lens, famously stating that Netflix competes with (and loses more time to) video games like Fortnite than traditional television. Gaming had emerged as a formidable competitor, consuming approximately 8.45 hours of users' weekly entertainment time and generating $196 billion in 2023—surpassing combined streaming and box-office revenues.

The demographic landscape told a compelling story. While 52% of Netflix's audience is over 35, younger viewers (aged 13-24) split their entertainment time equally between gaming and traditional content. With 80% of people aged 12-18 identifying as gamers, and young people spending nearly 30% of their entertainment time in gaming environments, the strategic imperative was clear.

The potential for cross-media storytelling was particularly exciting. Netflix could transform its popular franchises like "Stranger Things" into interactive experiences, deepening fan engagement and extending the life of its intellectual properties. Building on earlier experiments like "Black Mirror: Bandersnatch," the company saw gaming as a natural evolution of its narrative capabilities.

Also need to mention during this time the world was shocked by Covid-19, lockdowns and isolation were still popular in many places, and the gaming industry just went rocket high and many thought this honeymoon period will never end (teaser warning: it did). Everyone thought they could build the next Fortnite and Roblox (teaser warning: they didn’t). And there was another issue of the cheap money, back then when the rates were around 0, companies raised money like crazy and everyone in the market was looking only for growth.

Netflix's gaming strategy was more than a mere expansion—it was a defensive move. By offering games at no additional cost to subscribers (and we’ll see if it was the right move), the company aimed to retain its audience, counter engagement threats from gaming platforms, and create new value in an increasingly competitive entertainment ecosystem.

The Kim Kardashian Use Case

The "Kim Kardashian: Hollywood" mobile game, launched in June 2014 and running until April 2024, emerged as a groundbreaking example of entertainment IP transformed into an interactive experience. Players started as E-list celebrities, climbing the social ladder through modeling jobs, acting gigs, and club appearances, with the ability to customize characters, buy homes, and even adopt virtual pets.

Financially, the game was a massive success. It generated $1.6 million in its first five days, scaling to $43.4 million in its first quarter. Over its decade-long lifecycle, the game accumulated a lifetime revenue of over $600 million, with Kim Kardashian earning more than $100 million.

What distinguished the game was its innovative live operations approach. By integrating real-world events and Kardashian's actual life into gameplay, it maintained constant player engagement. Users spent a collective 35,000 years playing the game in just two years, reaching 42 million downloads.

The game's success provided a crucial blueprint for entertainment companies like Netflix, validating that non-traditional gaming audiences could be effectively engaged through compelling narratives, regular content updates, and strategic use of entertainment IP.

Market Opportunity: Gaming industry in Numbers

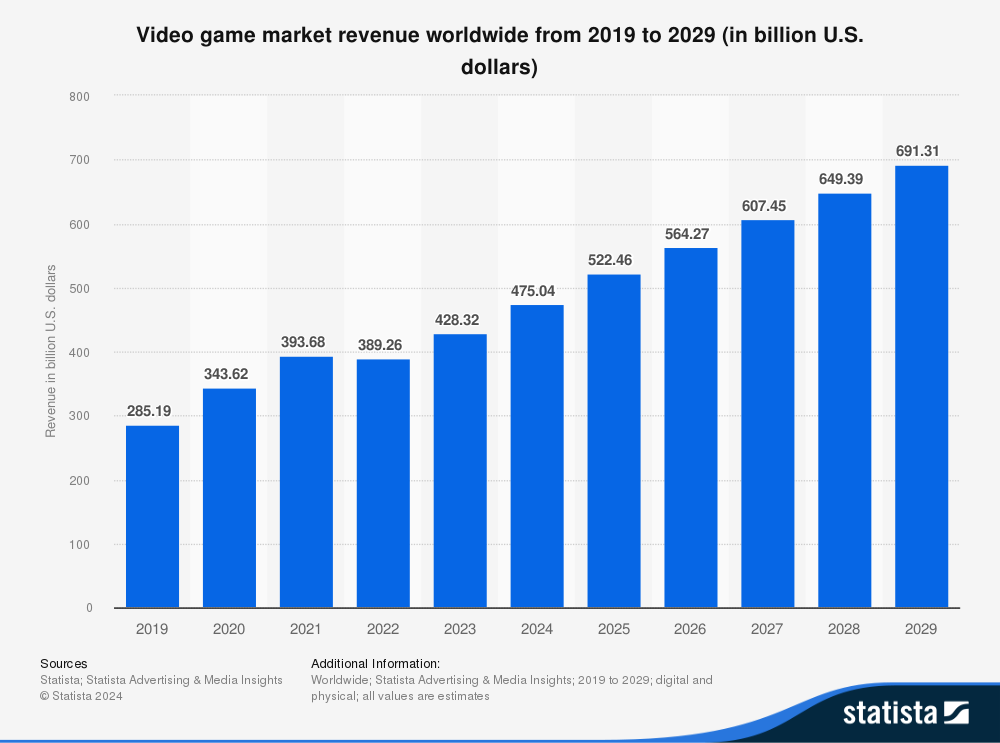

The global gaming industry, valued at $455.27 billion in 2024, is experiencing rapid growth across various platforms, from mobile to cloud gaming, with a diverse player base of 1.31 billion worldwide. As reported by Statista, the industry's revenue is projected to reach $625.64 billion by 2028, driven by technological advancements and increasing consumer engagement across different age groups and demographics.

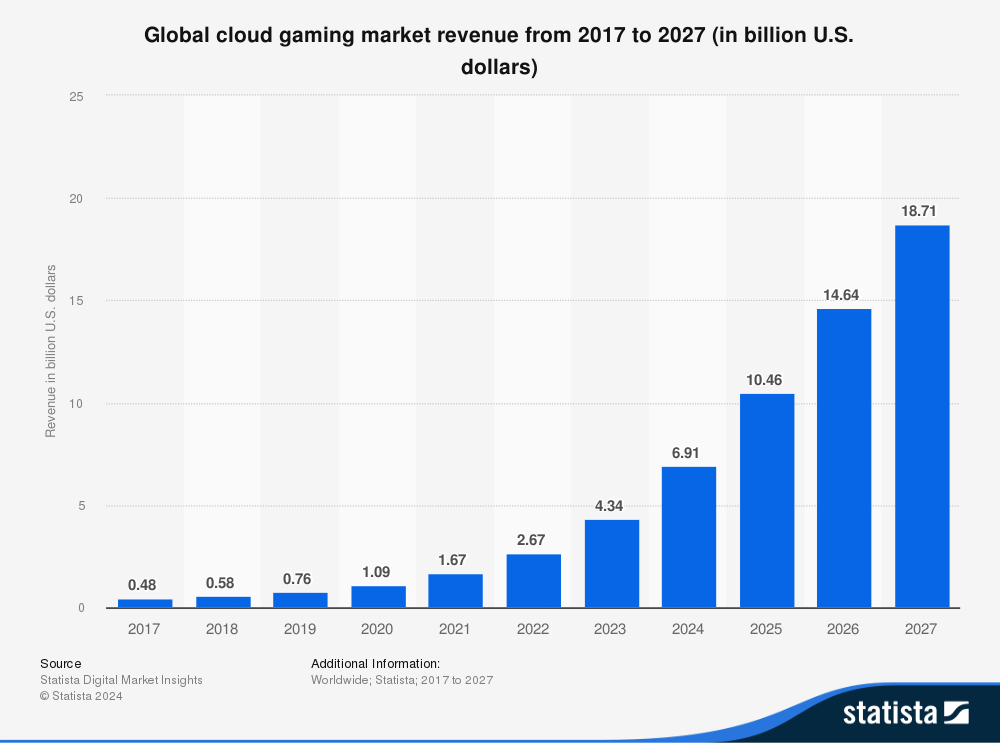

Rapid expansion characterizes the gaming industry's trajectory, with a projected CAGR of 12.9% from 2024 to 2028. This growth is fueled by technological advancements, increased internet penetration, and the rising popularity of esports. By 2033, the market is expected to reach a staggering $664.96 billion, with cloud gaming emerging as a particularly dynamic sector. The cloud gaming segment, valued at $2.27 billion in 2024, is forecast to surge to $96.67 billion by 2034, boasting an impressive CAGR of 45.52%.

China leads the global gaming market with a projected revenue of $94.49 billion in 2024, followed closely by the United States at $78.01 billion. The Asia Pacific region dominates the industry, commanding a 54.14% market share. Other significant markets include Japan ($28 billion), South Korea ($9.65 billion), and the United Kingdom ($8.88 billion). This regional distribution highlights the global nature of the gaming industry, with strong representation across multiple continents and economies.

The gaming population spans diverse age groups, with the average player age being 31 years old. Gen Z and Millennials dominate the market, comprising 70% and 65% of users respectively, while Gen X (54%) and Boomers (39%) also represent significant segments. Gender distribution in gaming is relatively balanced, with males making up 55% of players and females 45%. Weekly gaming time varies by country, with China leading at 12.39 hours per week, followed by Vietnam at 10.16 hours, while South Korea reports 5.88 hours. The industry's growth is further fueled by increasing smartphone adoption and internet penetration, particularly in emerging markets.

Dominating the gaming landscape, mobile gaming stands as the largest segment in the industry, generating a substantial revenue of $98.74 billion in 2024. Its popularity is unmatched, with 34% of players preferring mobile platforms over other gaming options. The sector's growth is primarily driven by the increasing global smartphone adoption and improved internet connectivity, particularly in emerging markets. As mobile technology continues to advance, the segment is expected to maintain its leading position in the gaming industry, offering accessible and diverse gaming experiences to a wide range of users.

Is it a market fit?

With 282.7 million paid subscribers worldwide, Netflix captures the most valuable audience segments: 70% of Gen Z and 65% of Millennials. The platform maintains a balanced gender distribution (52% female, 48% male) and attracts diverse ethnic backgrounds, with higher daily viewership among Hispanic and African American audiences.

While mature markets like the US show 70% penetration, the Asia Pacific region demonstrates remarkable potential with 65% subscriber growth. The EMEA region leads with 96 million subscribers, indicating strong international market presence

Netflix's recent ad-supported tier has proven successful, with one-third of new sign-ups choosing this option. This hybrid approach allows Netflix to:

Capture price-sensitive consumers

Maintain premium subscribers

Generate additional advertising revenue

Makes room for experimenting with premium features

This combination of strong demographic alignment, geographic expansion opportunities, and flexible revenue models positions Netflix ideally for continued market leadership.

Financial Breakdown: Show me the Money

Financial Performance Overview

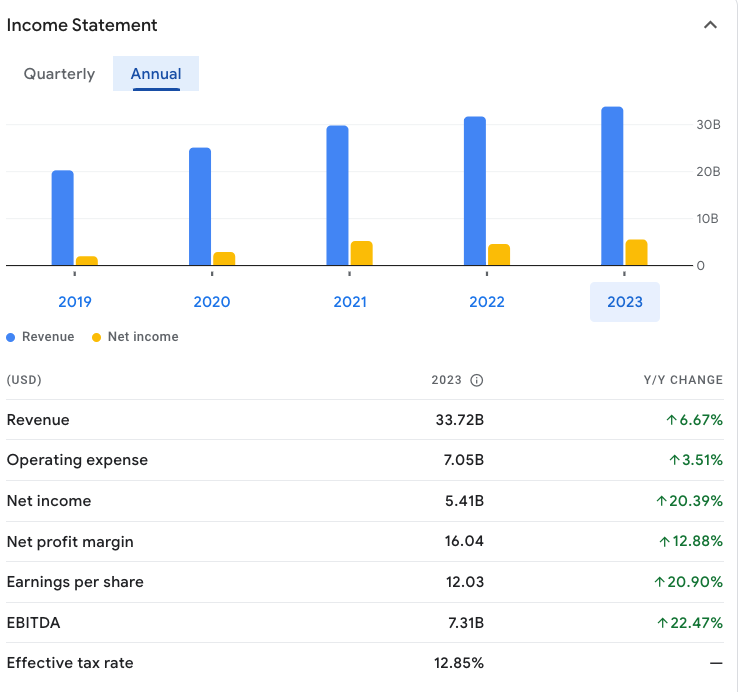

Netflix demonstrated robust financial performance in Q3 2024, with revenue reaching $9.82 billion, representing a significant 15% year-over-year increase. The company's operational efficiency improved markedly, with operating margin expanding to 30%, up from 22% in the same period last year. Net income showed impressive growth, reaching $2.36 billion, while diluted earnings per share climbed to $5.40, marking a 45% increase compared to Q3 2023.

Regional Growth Analysis

Geographic expansion continues to be a key driver of Netflix's success. The Asia-Pacific (APAC) region emerged as the strongest performer, delivering 19% year-over-year revenue growth. Both the UCAN (United States and Canada) and EMEA (Europe, Middle East, and Africa) regions maintained strong momentum with 16% revenue growth each. The company's global reach expanded further, adding 5.07 million paid memberships in Q3 2024, bringing the total subscriber base to an impressive 282.72 million. User engagement remains strong, with average viewing time holding steady at approximately two hours per member daily.

Stock Market Performance

Netflix's stock has shown exceptional performance in 2024, reaching an all-time high of $891 in November 2024. With a market capitalization of $379.26 billion, the company has delivered an impressive year-to-date return of 81.53%. The stock has traded between $445.73 and $848.45 over the past 52 weeks. Major financial institutions have expressed confidence in Netflix's trajectory, with Bank of America setting a $1,000 price target and maintaining a "buy" rating, while JPMorgan Chase raised its target to $850.

Financial Health Assessment

The company maintains a healthy financial position with well-managed debt levels. The current ratio of 1.13 and debt-to-equity ratio of 0.62 indicate strong financial stability. Cash flow generation remains robust, with Q3 2024 operating cash flow of $2.321 billion and free cash flow of $2.194 billion, demonstrating the company's ability to fund operations and investments internally.

Forward-Looking Projections

Looking ahead, Netflix projects Q4 2024 revenue of $10.13 billion, representing a 15% year-over-year growth, with an expected operating margin of 21.6%. For 2025, the company has set ambitious targets of $43-44 billion in revenue, indicating 11-13% growth, and aims to achieve an operating margin of 28%. While specific gaming division financials are not separately disclosed, this segment continues to be viewed as a strategic growth area alongside advertising and core streaming services.

The Games Rabbit Hole

Netflix has made a substantial investment in its gaming division, committing approximately $1 billion since the division's inception through 2023. For 2024, the company plans to invest an additional $1 billion specifically in gaming content (including acquiring games developed by external companies, acquiring small mobile game studios, and establishing their own in-house studio). This investment represents a relatively small portion of Netflix's overall content budget, which stands at $17 billion annually.

The game division's performance metrics show mixed results. While download numbers have grown impressively from 5.2 million in 2021 to 81 million in 2023 (a 180% year-over-year increase), this represents only 0.15% of total mobile gaming downloads across App Store and Play Store. Individual game performance varies significantly, with titles like GTA III reaching revenue spikes of $106,000 in mid-April 2024, while other games show minimal or no revenue. The total catalog has achieved 326 million installations across all titles, averaging 2.7 million downloads per game when excluding the GTA titles. The most disappointing data point is that Less than 1% of Netflix's 247 million subscribers play games daily.

Notes

At this point, after heavy investment, it’s still hard to see the ROI anytime soon.

Despite having over 100 games available, user interest remains low.

Should a game department support growth? Retention? Diversity? Netflix is still in growth, but growth doesn’t last forever. Retention is good, but most of the titles are not related to Netflix IP (only a few), and diversity of revenue could be a good idea, but most of them don’t have any monetization.

If it seems to you like a lot of money, and non-sustainable, you're probably right.

Netflix's Gaming Strategy

So we have a vision, but do we have a strategy?

Current Approach - Money Can Buy Everything

The Business Model

Netflix games are currently offered completely free to subscribers with no ads or in-app purchase. This strategy allows developers to focus purely on player enjoyment without worrying about monetization mechanics, and for the users to enjoy a premium game experience for free (well, they are still paying for their Netflix account, but you where i’m going).

Mobile-First Approach

Before spending any money, they did look at the numbers. And the problem with numbers, they can tell many different stories. This time, the numbers lead Netflix to adopt the mobile-first approach, as it has the greatest potential reach since smartphones are the most popular gaming devices globally. This approach allows Netflix to meet users where they are most active and engaged (and where they lose their focus on Netflix toward other activities).

Other benefits from this approach is the rapid iteration, as developing, testing and adjusting is much easier on mobile devices, and overall mobile games development is significantly cheaper and faster than on other platforms. This lowers the risk of making expensive mistakes, and there are many examples of such mistakes in the game industry.

Overall, it’s hard to say it was the wrong approach, as it allows Netflix to gain experience in this field and succeeds in releasing a steady stream of content.

The big questions remaining are how to do it right, and how Netflix users can get it.

Investments

Netflix has made a substantial investment in its gaming division, committing approximately $1 billion since the division's inception through 2023, including acquiring games developed by external companies, acquiring small mobile game studios, and establishing their own in-house studio. For 2024, the company plans to invest an additional $1 billion specifically in gaming content (including acquiring games developed by external companies, acquiring small mobile game studios, and establishing their own in-house studio). This investment represents a relatively small portion of Netflix's overall content budget, which stands at $17 billion annually.

Game studio acquisitions - There were 4 major studio acquisitions done between late 2021 to 2022, which includes Night School Studio, Next Games, Boss Fight Entertainment, and Spry Fox.

Partnerships - around 80 of the 100 games released by Netflix were developed by 3rd parties. The deep pockets of Netflix allowed them to release premium games for free for Netflix users, and the list is very impressive: GTA series, Monument Valley 1, 2 & 3 , Valiant Hearts: Coming Home, Twelve Minutes, Reigns: Three Kingdoms, Football Manager 2024, Tomb Raider Reloaded, TMNT: Shredder Revenge, Exploding Kittens, Farming Simulator 2023, Into the Dead 2, and many more… Only games with great ratings and positive reviews.

Hiring top talents - Netflix obviously didn’t stop with acquiring studios and game titles, they also brought people who actually have great experience in the game industry. Some name-drops are Chacko Sonny (Overwatch and Call of Duty), Joseph Stated (Halo franchise), Rafael Grassety (God of War). Above all, Netflix made sure they have someone who knows how to create a studio from scratch, and the conductor in charge of this orchestra (titled as Games President) is Alain Tascan (VP at Epic Games and founded the Montreal studios for Ubisoft and EA).

Establishing AAA studio (aka team “Blue”) - Founded in late 2022 and shut down in October 2024. Aimed to develop a AAA multiplatform game with original IP, but it was closed before releasing any game or even announcing their projects publicly.

Original IP Titles - Netflix achieved its goal of creating several games titles around their original IP, such as Stranger Things: Puzzle Tales, Netflix Stories, Too Hot to Handle 3, Perfect Match. The common ground to all of them is their simplicity, from using basic match-3 mechanics to narrative driven games (which is basically text and images with simple selection between 2-3 actions) with some character customization. Simple yet effective, but not groundbreaking. Did someone say interactive movies on steroids?

And then reality hit hard

Money can be a funny thing sometimes. It definitely raises your chances of success, but it doesn’t guarantee it (ask Chelsea F.C. , they know it too well).

So far, it does look as Netflix tried to make all the right decisions. Although they have a gigantic budget to spend, they diversified and placed their eggs in several baskets. Any casual gamer (and above) can tell you their portfolio is a great offer (as Netflix did with video content in its early days), but did it move any needle?

The game division's performance metrics show mixed results. While download numbers have grown impressively from 5.2 million in 2021 to 81 million in 2023 (a 180% year-over-year increase), this represents only 0.15% of total mobile gaming downloads across App Store and Play Store. Individual game performance varies significantly, with titles like GTA III reaching revenue spikes of $106,000 in mid-April 2024, while other games show minimal or no revenue. The total catalog has achieved 326 million installations across all titles, averaging 2.7 million downloads per game when excluding the GTA titles.

The most disappointing data point is that Less than 1% of Netflix's 247 million subscribers play games daily. This low adoption also is troubling, because it hint on other potential problems:

Discovery - Maybe the problem is that some viewers are using Smart TV and are not aware of the games offered on Android and iOS?

Attention War with Yourself - Netflix basically started a war on the attention of the user between their main app and their games apps on mobile. Users might have a cognitive challenge from making the context switching between different apps on the same device? (if they start with Netflix, they don’t necessarily want to leave it just yet)

Non-engaging content - Is it the old content the players already know? Maybe the new original games are not interesting enough?

On top of the poor, the lack of monetization in most of their apps makes the business model unsustainable in the long run. There are great freemium games, as there are great premium games. And the opposite goes as well. And yet, for choosing the right business model, we need to understand the business goals.

So what do we know so far?

Netflix yet failed to define what is a success (KPI in the industry jargon), and how it affects the business. The strategy so far was making only smart small decisions at large scale, but the experiment failed. It’s hard to believe Netflix wished to become a mobile game publisher when they went on this journey, and keeping the current strategy will get their focus on what they are doing best, which is creating content.

Although Netflix revenue is now set on a record high, once the machine starts to squeak it won’t be as forgiving for this rally of cash spending without getting results.

And There Are Other Challenges

Monetization (lack of)

Overall, the statement of releasing high-quality games for no additional cost is nobel. At the end of the day, games are content, and the formula that worked for videos theoretically should work on games, doesn’t it?

I won’t repeat everything that was written so far, but if the goal is only retention, then this model is right. If it’s another revenue stream, then the model is wrong. But what about gamers who are not Netflix users? And what if in the future a big game will be available not through Apple or Google?

Another concern that can be raised is what if your (expensive) talents are focused only on creativity, without having to deal with the business impact of their product, how can you measure the ROI?

Another issue that is mentioned from time to time is use ads in the games as well. As Netflix started their ads subscription tier with reduced price, it is not a far fetch to take the knowledge in ads and convert it to mobile ads in games (or other format of in-game apps). But there’s a big gap between what Netflix is doing on the big screen and on mobile, while this market is dominated by giants with much more experience and reach (Google, Meta, Unity, AppLovin etc.). Trying to compete with them has a high potential, but it’s also a big risk of trying to do too many things at once, none of them are part of Netflix core activities.

Game Design

Games content and video content are not the same species.

Now we can leave aside the business part of games, and talk about more fun aspects.

The declared goal of building Netflix Games was retention, and especially to let users to play with your IP during the break between different seasons.

The IP and storytelling is the best advantage that Netflix can offer (OK, and publicity), but games eventually are more about mechanics. There are games which are focused only on narrative, they have their market (mainly focused on women), and there is an audience for games that have both good story and good mechanics (remember Point & Click?). And yet, creating a match-3 game with the brand of Stranger Things doesn’t really add any value to the show brand, more chances it does the opposite.

Also, there is a change in behavior of gamers while using a dedicated console (as PC, Switch, PS5, Xbox) and mobile, and it’s with the duration of each game session, the popular genres, the meta-gaming, and what eventually leads to engagement.

While writing this analysis I was watching the trailer of the upcoming “Squid Game: Unleashed” which is basically a deadly version of “Fall Guy” game with “Squid Game” tv-show settings, and it seems brilliant, maybe the best fit for this IP. And yet, if we don’t measure a game by its revenues, what does it take for such a game to focus only on retention? For how long could you do it?

For now, and without having access to the data, I can only assume the most successful ROI belongs to “Netflix Stories”, which is a hub for many text game adventures with the characters of tv-shows as “Emily in Paris”, “Love is Blind”, “Virgin River”, and you get the idea. A dedicated app for each title might have some traffic and will be easier for tracking purposes, but if the same audience is moving between different shows at the same platform, depending on their appearance on screen, it makes more sense their interactive stories will appear also on the same hub as well.

And after all the above, it seems that most of us expect more of Netflix. After spending more than $1b, you expect more than a text adventure of Emily in Paris. And most of the talented people who joined Netflix also came to do much more.

Context Switching

We had a small glimpse into this issue in the previous section, but now we should address this issue with the right respect - users should not switch between apps. They should not leave Netflix at all!

If earlier I was talking about having “Netflix Stories” as a super-hub of interactive text stories, it’s not the case with all other games (and we have around 100 by now).

The fact the user should be aware of so many different apps, deal with them separately to the Netflix ecosystem, and especially if they don’t relate to any Netflix IP, it’s a lose-lose situation. The cognitive overhead that users have by this structure leads to low discoverability, and low install rate. This overhead becomes even harder when you are watching your content on the SmartTV or laptop, get to know a cool game of Netflix, but have no motivation to switch to mobile.

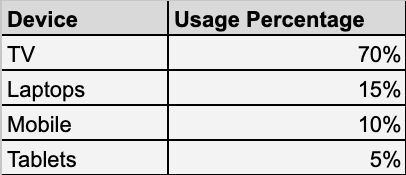

According to Stream TV Insider, half of all users watch video on phones, but only 10% of total viewing is mobile. Finance Online had stats showing around 70% of the streaming consumption was made via TV, (although the sign-ups process stats suggest a different story, but it’s not related for this context). Also their watching timing, duration, and other behavioral characteristics are different.

Marketing and Promotions

For now Netflix was able to avoid this issue, as its main focus was on known mobile titles that were republished under their brand, and titles which related to their IP (successful TV shows). Neither of them needed any significant marketing.

Users on mobile (Android or iOS) noticed in their Netflix app there’s a section with the games, but until very recently it was the only version of Netflix that contributed to discovery of games. It’s also the most user-friendly scenario of context switching (from netflix to the external app).

Lately users on TV (as Samsung) also started to see a new games section, with a product page and trailers for different games, but there is no option to play it on non-mobile devices, and no direct install. The process required a QR code, preventing users from quick install, so the experience does not fulfill its full potential.

It will be interesting to see if Netflix will eventually decide to promote their games through other ads agencies, or anywhere outside the Netflix ecosystem?

As long as the main motivation for making games remains retention, I suspect the chances are low.

Cloud Gaming: To Jump or not to Jump

Games streaming is a technology that was “just behind the corner” for about 10-15 years. Its main promise is to provide the user access to games without installing, without a need for expensive hardware, and without waiting. In other words - get more for less.

There were some flops, some companies failed to monetize their technology, and even the almighty Google closed its Stadia projects which was the hope that many had been waiting for, but the idea is still here. Maybe not always at the front, but companies with experience in content such as Nvidia, Microsoft and Sony offer game streaming services (on some locations), and there are few smaller actors in the field as well.

The infrastructure Needs

It might be tempting to think that because Netflix already has its own Streaming service, it should be easy to convert it to gaming.

Without going too deep into the technical architecture design, Netflix has a hybrid approach for its content delivery process. They use AWS to handle user authentications, recommendations, billing, and their own proprietary infrastructure called “Open Connect” for the actual video streaming, content caching, the local content delivery (aka. CDN).

But the name of the game is latency. Latency for games must be low to ensure responsive gameplay, while video streaming standards are much more loose. It also requires much more servers armed with GPUs near the clients, and not just CDN points (which are good for static media, such as images and videos).

Proprietary vs. 3rd Party

If it’s not clear, this is an expensive adventure to enter, which will require Netflix to invest in more servers armed with powerful GPUs (not the AI kind). From what we can learn from the current architecture, Netflix doesn’t want to be dependent on a 3rd-party for its core features, and it’s understood.

On the other hand, companies as AWS, Sony, Microsoft and Nvidia have already gone a long way in this road and gained the experience and infrastructure optimizations for games streaming. Netflix knows it cannot offer a 720p resolution for game streaming while the competitors offer up to 4K, and also offer supporting more controller types.

The Beta Experiment

Netflix launched its game streaming beta initially in Canada and the UK in August 2023, followed by a US rollout in October 2023, and several European countries in January 2024. The beta test was not widely available to all subscribers but only for a closed group in each country, and it included two games: Oxenfree and Molehew's Mining Adventure.

The service was tested across multiple devices including Smart TVs, Nvidia Shield, Amazon FireTV and more. The players need to use their mobile phones as controllers through a dedicated Netflix Game Controller app available for both Android and iOS platforms.

As far as we know, the TV-based gaming test wasn't marketed as a success, with user experience being notably problematic. On the other hand, UX can be improved over time. Choosing low-paced games (as adventure and text-based genres) are more likely to tackle the latency issue quite well.

Competitors

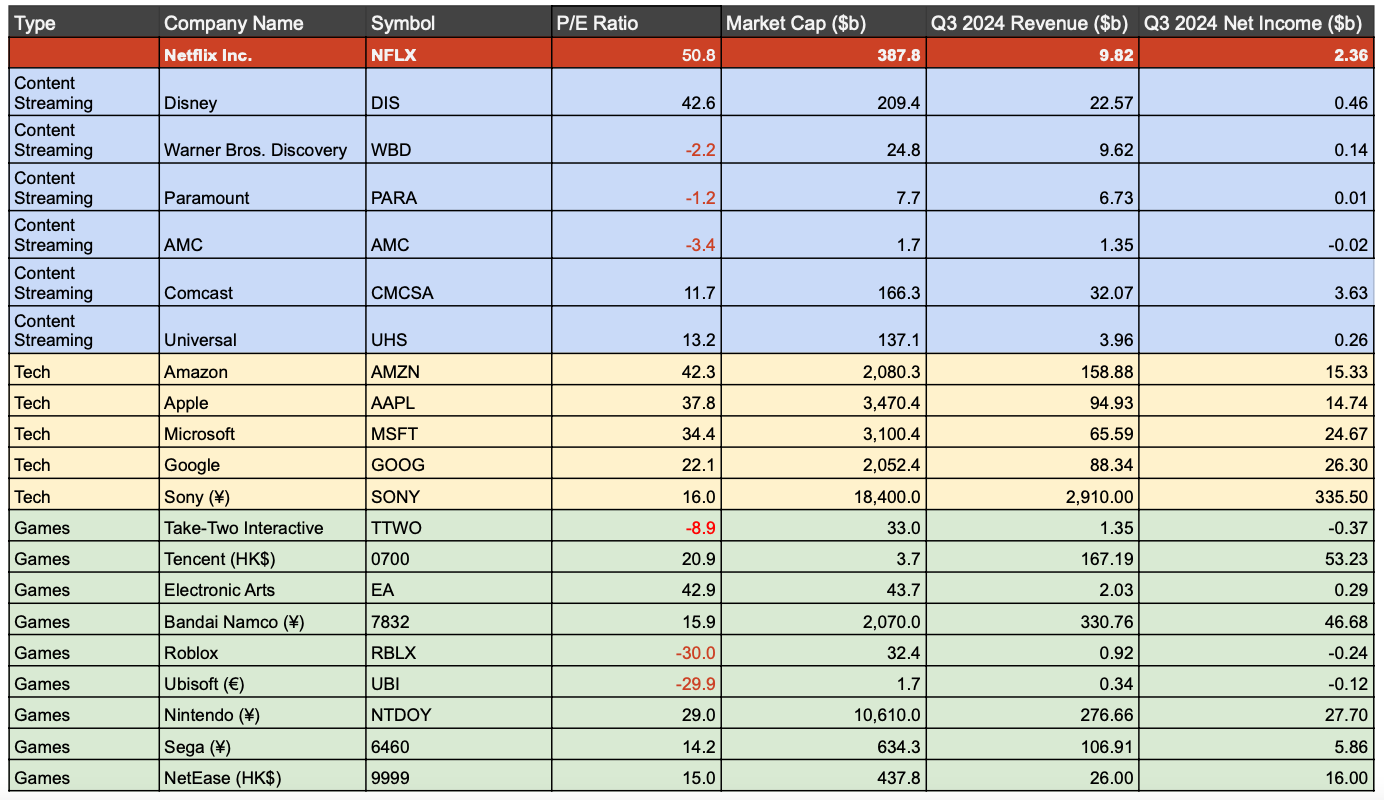

Before diving into the numbers and other data, it was a deliberate choice to look at the competitors only at a late stage. Netflix is a unique company, and now has 3 types of competitors (content streaming, tech and gaming). Each sector has different P/E ratios (aka. Multiples for trading), different market cap, and different revenues streams.

From a very high-level financial overlook, Netflix has the highest multiple (50.8x) compared to its direct competitors, especially Disney (42.6x). It is also surprising to see its multiple is also higher than the tech giants like Google (22.1x), Amazon (42.3x), Microsoft (33.4x) and Apple (37.8), which are known to be highest in the market. It’s also much higher than most gaming companies, although EA (42.9x) and Nintendo (29x) are also doing fine, while many others are significantly behind in this aspect.

But as you probably understand by now, the big picture is more complex than showing a few numbers. The first thing that comes to mind is that the stock can only fall down, the multiple is so high, and everyone is just looking for you to make mistakes. Pressure is good for business, but remember Netflix was the most creative and disruptive before it became a Nasdaq monster.

Table data is updated to Nov 2024, using $ as default currency, and coin values are in billions. The stock value is not interesting, as the P/E ratio is the most relevant in this case as they reflect the trust of the market in each company. The other values just give a better understanding of the big picture.

Traditional gaming companies

It’s a tough time for the game industry. During Covid-19, between lockdowns and “the end of the world as we know it” atmosphere, video games became again highly popular. Everyone bought new computers, new mobile phones, new TVs. And after that, they wanted to consume content. But after 1-2 years, there was a slowdown. For some of the companies it was surprising, but it wasn’t. It happened in many other industries as well (ask ecommerce). Many games became larger and more expensive to develop, games were delayed, and during the past 12 months we can see major layoffs in the game industry. Some game companies remained strong and successful (EA, Take2, Nintendo, Tencent), but there are others that are in deep trouble (Ubisoft, Roblox).

As games are launched only after many months (or years) of development, after release the sales need to last for long, big games such as GTA V or EA FC 25 are making their companies stock very volatile.

Mobile Gaming Studios / Publishers

Mobile games are different species. Usually the game studios can remain smaller and independent, and it’s their choice to have an external publisher or not. Usually very successful games make their studio into a bigger publisher, if it’s not acquired by one of the bigger companies (Glu mobile purchased by EA, King by Activision-Blizzard, Zynga by Take-Two, etc.). But there are still good games that got good reviews, but their earnings are just enough for the company to be able to work on the next project, so it’s an ongoing balance between creative and finance. (This is exactly what Netflix is looking for)

Content Streaming

Although this article is now about the streaming wars ,we should take a quick look at it, and here’s a spoiler, Netflix is (still) the winner by far.

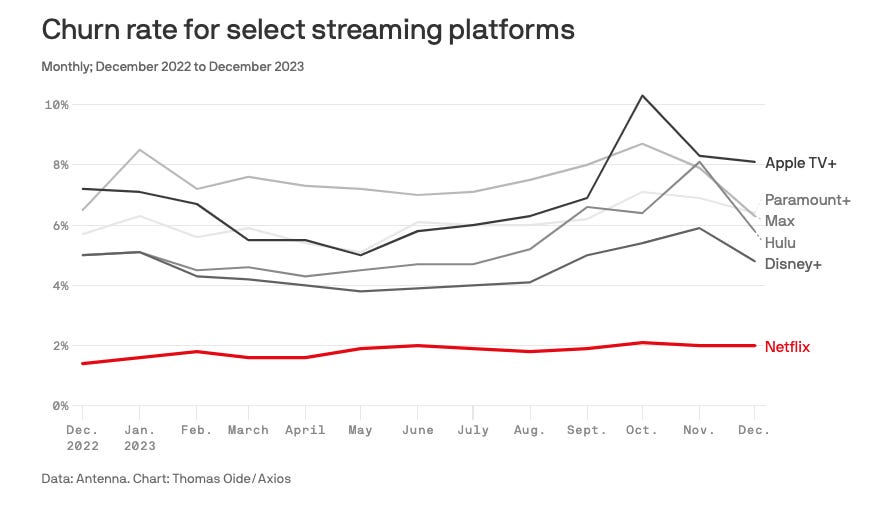

Although there was a point in time (2021-2022) that Disney+ will become the Netflix killer, the danger is gone. The more interesting thing we learned from different reports during the past 12 months is that people just love Netflix as their main streaming service, and won’t cancel it, unlike the others (including Disney+). The most outstanding in the list is Apple, who get the highest churn, as they have great TV-shows, but just not enough in order to justify keep paying for it regularly on a monthly basis.

Big Tech's gaming initiatives (Amazon, Google, Apple)

A subscription for a library of games is not a new idea. I remember having it as a child in local stores, but back then it just wasn’t digital (yeah, i’m ancient, but those were exciting days).

The internet clearly moved fast and broke things, and new offers came along. Before any name dropping, let’s take a minute to talk about owner-rights. When you purchase a game as a hard copy, it’s yours. No one can take it from you, and you are allowed to do whatever you want with it. When you buy a digital copy, it starts to be more complicated, as you are “coupled” with the platform (Steam, Epic or other digital store). If for some reason the game is removed from the store, it is not always clear if you can still play it, and you cannot re-install it. And subscription, and like the previous case, but on steroids.

Top example of successful game libraries:

Apple Arcade & Google Play Pass - Both by the biggest mobile app stores. Both services offer a big number (200-1000) games with no ads and no in-app purchases for monthly $4.99 to $6.99 payment. Pure premium game experience, with high growth rate and deep integration with their other products. Reports suggested Apple arcade gained more than $1b, but there are also ongoing reports on declining payouts and more games leaving the service.

Microsoft Xbox Game Pass - This is the real “Netflix for Games” for PC games. Originally started on Xbox consoles and expanded to Windows users, it offers around 450 games in their catalog. They have a rotation methodology that promises that unpopular games will leave the service, and new games will replace it. Also they promise 1st day release (as with Flight Simulator 2024), and the latest purchase of Bethesda and Activision-Blizzard will help them to keep offering an impressive catalog. They reached 34m users in 2024, and revenue grew by 43% year-on-year to $5.62b in Q1 2024.

EA Play - Pretty similar to Xbox Game Pass, but limited to EA games portfolio. Offer more integration with EA original games (premium edition, in-game members reward, etc), and playing games before their official launch. After a few years of trying to do it solo, they started to cooperate with other platforms, including Microsoft and Steam. The financial statement shows the live services (and other revenues) make up more than 73% ($5.5b) of total revenues of EA.

Game Streaming Services

Now we have the chance to talk about the elite competitors. If cloud gaming is a realistic option for the future, here are services that can proudly say they have already done it for years.

Microsoft xCloud is part of Microsoft’s Game Pass service for Xbox and Windows users, as Sony’s Playstation Plus (formerly known as Playstation Now) started as a standalone service and now merged into Plus, offering playing PS2/PS3/PS4 games on PS5 and Windows, as well as new titles.

Geforce Now Is a key player in game streaming, as it’s a demonstration of force by Nvidia for their abilities in both GPUs and servers (what they are now doing outstanding with AI GPUs for servers). Reports suggest they hold 21% share of the game streaming market. The downside here is that the service offers only the platform to play (a virtual PC), but the user must already own the game.

Amazon Luna is another interesting player, which utilizes AWS for cloud gaming, and you know that Amazon knows everything there is to know about servers. They could work on PCs, Mac, Amazon Fire, mobile and smart TV. Like with Geforce Now, most games are needed to buy separately, as they only offer the platform to play it.

Other - Less familiar brands, but might be relevant for the future

Shadow - Remote PC experience. It differentiates itself by offering a full Windows PC experience rather than just game streaming.

Utomik - Utomik focuses on smart download technology and has one of the larger libraries with over 1,400 games.

Blacknut - Emphasizes family-friendly features with multiple user profiles and parental controls, armed with a library of over 600 games.

Boosteroid - Uniquely allows integration with existing game libraries from Steam and Epic Games Store, with plans that can reach 4K gaming at up to 120FPS. (platform only, no games included in subscription)

Antstream - Specializes specifically in retro gaming with over 1,300 classic titles

Future Outlook

Short-term Expectations (1-2 years)

Mobile Strategy

The “Mobile First” approach is here to stay, at least in the near future.

There is a good reason to believe Netflix might finally understand it needs to adapt the quality over quantity approach. Now, we all know quality is not the first thing that comes to mind when we think of most Netflix’s tv-shows, but we can agree they know how to make good entertainment. So making a better experience, and this time emphasizing it on Netflix IP integration, slowly moving away from third-party premium titles (but it’s good to have a bank of titles in your portfolio).

The last issue that might get some experiments is with the freemium model in order to reach non-netflix subscribers, but without having to develop a standalone ads agency and compete with the big players.

Financial Adjustments

After 2 years of wild spending, there will be stricter observations of how the money is spent. Less likely to keep purchasing old titles, at least not at the speed and scale we saw until now. More likely to keep investing in current teams and studios instead of new acquisitions.

Layoffs are also Less likely to hear about a deep cut as happened in other game companies, but if some employees (with a generous salary) choose to leave, Netflix won’t shed a tear. The gaming industry has now its own version of "Year of Efficiency”, caused by several moving parts (AI integration, drop in sales after COVID, and unsuccessful LiveOps projects). This kind of move will not get too much traction from the media.

The closure of the “Blue Team”, the AAA game studio, is another clue for Netflix to take this direction.

Other

A challenge we expect Netflix to tackle is the discovery of the mobile games from another platforms, as start happening these days from the SmartTV apps, and maybe see an optimized and smoother user-flow from the stage the user actually sees the game trailer on his TV or laptop, until the point it is installed on his mobile device, and can start playing it.

Cloud-gaming will be continued in a careful expansion beta, focusing on casual and narrative-driven games that are less latency-sensitive. The focus of this beta will probably be on a smooth integration directly into smart TVs (Samsung, LG, Sony) and streaming devices (Roku, Amazon Fire, AppleTV).

Long-term Possibilities (3-5 years)

Cloud Gaming Evolution

I think it is pretty clear there will be a big investment in gaming cloud streaming infrastructure.

Although the approach is to be able to achieve most of the work in-house, there’s a big potential of partnership with other major cloud gaming providers (like Microsoft or Amazon) for the infrastructure part, but it’s worth mentioning the less obvious candidates which might be Oracle and Tencent.

Content Integration Strategy

A big key factor for success will be solving the integration issue with the Netflix main app. “One app for all”, this is the real goal here, and there’s no way around it. Another thing we might see happening more and more is the mixture between elements from the games appearing in the TV shows, and the opposite as well. Some of the current standalone mobile games might have their own TV show. We will see some kind of transmedia storytelling across different formats.

Business Model Evolution

Since Netflix has deep pockets, it won’t likely to change their pricing tiers all of a sudden.

A good form of successful games giving Netflix the option to include them as part of their offering, and this where it become interesting:

Full integration - available free for every netflix subscriber.

Hybrid integration - available for only “premium tier” subscribers. Maybe the low tiers will get ads, based on the “ads tier”.

Netflix Gaming Pass - a standalone service for the gaming service, offered cheap compared to the other cloud-gaming services. (Less likely due to Netflix historical mindset, but it is an option that make sense from business point of view since Netflix already reach hundred of million of users)

Strategic Acquisitions & Partnerships

Less likely for Netflix to partner with another big company for a long time, as it’s not part of their DNA, and the experience with companies as Telltale (which was shutdown during development of “Stranger Things” game title) taught them an important lesson about the need to stay independent.

We can split potential acquisitions into 2 segments:

Content - Game companies with a focus on storytelling but in a bad financial phase. I won’t be surprised if Ubisoft might be talking with Netflix, since it has a very interesting IP (Assassin's Creed, Rayman, Prince of Persia, Watch Dogs). Other potential studios might be Telltale alumni, although this might be more difficult due to IP rights, but the game techniques and technology might be very useful for Netflix. But we must stay realistic, and a few more acquisitions won’t be enough in the long run, not if the vision is to offer a games tier on every Netflix platform, with a bank of content as the users have for TV shows and movies. In order to achieve that, Netflix should offer high-quality AAA games on the big screen, and probably will use a hybrid approach that will include small-medium studios with deep focus on narrative games (Focus Entertainment, Outright Games, 4A Games, Microids, Quantic Dream) as well as high profile companies (EA, 2K Games, Team17, CD Projekt Red, Konami, Square Enix) who are willing to license their games to as many platforms as possible. (Disney and Nintendo will be watching carefully)

Infrastructure - Now there’s the technical part of building the infrastructure and its operation. Regardless of the steps Netflix will choose to do within the company, it will require knowledge from the outside, and the best way to do it is to get people who already did it. It might be very specific key roles, an acqui-hiring, or a full acquisition of a cloud gaming service (my guess will be a hybrid of the last 2 options). My suggestion is to keep your eyes on Utomik and Blucknut, both of them are a perfect fit to turn Netflix cloud gaming aspirations into an operational success.

Reassemble

Reinventing the Game, Again

Netflix’s story has always been about reinvention. From disrupting DVD rentals to pioneering the streaming era and redefining content creation, it has been a masterclass in staying ahead of the curve. But now, as it embarks on its gaming journey, we must ask: can the Netflix that revolutionized entertainment still be the Netflix of bold, disruptive innovation under the weight of shareholder expectations?

The Disruption Dilemma - Radical reinvention demands freedom—freedom to experiment, fail, and pivot. For Netflix, that freedom is now tethered to a soaring market cap and high shareholder demands. Yet history tells us this: disruption thrives in focus, not in sprawling ambitions. To succeed in gaming, Netflix will need to embrace leaner operations and sharper strategic clarity. A redefined approach is already underway—one that signals a more focused, thinner game portfolio. It’s not about doing everything; it’s about doing the right things.

Vision Meets Strategy Meets Tactics - Vision is inspiring, but strategy gets results, and tactics is what actually gets the job done. While Netflix has shown it can dream big, the lack of clear KPIs for its gaming ventures has muddied its path forward. Retention may be a worthy goal, but it’s too vague to drive precise execution. Success in gaming, as in streaming, demands metrics that measure impact—engagement, conversion, and yes, even monetization. It’s probably more complex than measuring a standalone game, they must take into account each game is part of a larger ecosystem and how a game impacts it, but it’s possible, and it’s a must. Without having these in mind, even the grandest vision risks getting lost in translation.

Lessons from the Past, Glimpses into the Future - Netflix’s gaming foray is more than a strategic experiment; it’s a statement. Just as Spotify redefined music through royalties and forced artists to diversify their income streams, Netflix’s potential dominance in gaming could reshape how the industry operates. Will traditional developers and platforms pivot to hybrid subscription models? Will games increasingly blend with storytelling, as Netflix's IP integration suggests? The ripples are already forming.

Expect partnerships, acquisitions, and cross-platform storytelling to define the next phase. A move into cloud gaming seems inevitable, especially with Netflix’s tech pedigree, but it’s an expensive, high-stakes path. Partnerships with infrastructure-savvy players or acquisitions of niche cloud services like Utomik or Blacknut could accelerate progress while balancing cost and innovation.

One Platform to Rule Them All - Ultimately, Netflix’s gaming success will depend on solving its own internal conflict: its fragmented app ecosystem. Games need to become an integrated part of Netflix’s core experience—seamlessly discoverable, effortlessly accessible. Imagine a world where viewers watch Stranger Things on their TV, then instantly jump into a game within the same app. That’s the kind of user journey that wins loyalty.

A Game-Changing Conclusion - Netflix's gaming pivot is more than a new revenue stream; it’s a bold attempt to redefine entertainment once again. The odds are daunting, and the stakes are high. But if Netflix has proven anything, it’s that the path to disruption isn’t linear—it’s iterative, adaptive, and relentlessly visionary. Whether it succeeds or stumbles, one thing is certain: the game is only just beginning.

Interesting reading:

Written by Lior Rosenspitz, Nov 2024