The Nintendo Playbook

Luck didn’t build Nintendo’s legacy. Creativity did. Lessons from the most inventive company in gaming.

TL;DR (wild speculations for 2025+)

Switch2 (switch successor) will still be a hit. But so far it seems it won’t bring a revolution, but a technical improvement of the recipe for the current success.

Next console will be much more challenging, though. Longer term is even more scary…

More investment and exploration of existing IP (movies, theme parks, TV-Shows? maybe something is cooking with Netflix?)

Extra careful with AI, as it might take their IP (most important assets) to unexpected directions.

Nintendo is one of those massive game corporations that we believe has always existed, large and solid.

Personally, I have encountered Nintendo a few times in my life, both as a child and as a father to a child. I was astounded that the magic was preserved, and I wondered how they managed to continue doing it for so long while everything else changed.

This article provides a thorough (two-part) analysis of Nintendo's development from a business and strategic perspective. This can assist you in answering the following questions: What did they accomplish correctly? Will they succeed in the future as well? Is it a good idea to buy their stock?

Nintendo has been one of the major gaming companies for the past 40 years. Its risk taking approach has proven itself time after time, but also learning quickly from its own mistakes and adapting to changes are also should be learned all over the world. Unlike its competitors, it is surprisingly a small company, and due its size and limited resources it reflects a delicate mix between innovation and conservatism.

Note:

As I was writing this (November 2024), Nintendo drastically lowered their sales estimate. The main reason is that they had great years in the past, like the Covid era and the release of the Super Mario animated movie. But now their main product, the Switch, is in its 8th year and consumers are less interested in it. Even the newest Mario and Zelda games didn't help sales, but the numbers suggest a more complex picture. Many investors are waiting for the Switch successor, but Nintendo will announce it until the current fiscal year, which ends in March 2025. This means that we won't be able to buy this item until late summer or maybe just before Christmas 2025. The reason seems to be to ensure enough there will be no shortage of supply. It was followed by a rumor (or leakage?) the price will remain around $400, higher than the current Switch model but still much lower than the rest, and the investors love it.

Another positive news about the next Switch is there will be full support of the previous Switch titles, which gives the new device a great starting point, armed with all titles of the previous device, and also reduce suspicion of existing Switch users who were might afraid to upgrade to the new device.

Historic Journey:

Nintendo's transformation from a humble playing card company to a global gaming powerhouse is one of the most fascinating evolution stories in business history. This journey, spanning over 130 years, demonstrates how innovation, adaptability, and unwavering commitment to quality can revolutionize an entire industry.

The Playing Card Era (1889-1960s)

Nintendo's story begins in 1889 in Kyoto, Japan, when Fusajiro Yamauchi founded "Nintendo Koppai," a company producing handmade Hanafuda playing cards. The company's name, "Nintendo," is often translated as "leave luck to heaven". These traditional Japanese playing cards quickly gained popularity, leading Nintendo to become Japan's largest playing card company. In 1953, Nintendo became the first Japanese company to produce plastic playing cards, which opened doors to mass production and international markets, including a notable deal with Disney to print Disney-themed playing cards, marking its first step into character licensing.

Diversification and Experimentation (1960s-1970s)

The 1960s marked a period of ambitious experimentation for Nintendo. The company ventured into various businesses, including:

A taxi company

A love hotel chain

A TV network

Food production

Toy manufacturing

While most of these ventures proved unsuccessful, the toy manufacturing experience provided valuable insights into electronic entertainment. Under Gunpei Yokoi's leadership, Nintendo began producing electronic toys, including the Ultra Hand, a extending arm toy that became a domestic hit in Japan.

Entry into Electronic Gaming (1970s)

Nintendo's first steps into electronic gaming came in the mid-1970s when it secured the rights to distribute the Magnavox Odyssey video game console in Japan. This experience proved invaluable, as it gave Nintendo first hand exposure to the emerging video game market. The company began developing its own electronic games, leading to the creation of the Laser Clay Shooting System for bowling alleys in 1973.

The Game & Watch: The Handheld Revolution (1980+)

In 1980, Nintendo engineer Gunpei Yokoi conceived the Game & Watch series after observing a bored businessman playing with a calculator. These handheld electronic games, featuring a single game and a clock display, became Nintendo's first major success in electronic gaming. Since then Nintendo kept a line of handheld products, and it’s part of their vision of the gaming experience (and we will see how the mobile gaming industry challenged this approach).

Notable devices:

1980: Game & Watch series - Created by Gunpei Yokoi, these simple but addictive LCD games became a global phenomenon, selling over 43 million units

1989: Game Boy - A revolutionary handheld console that dominated the market with Tetris and Pokemon games (Note: Look for the movie “Tetris”, it’s a great context about the place and time).

2004: Nintendo DS - The dual-screen innovation that became the best-selling handheld console of all time.

2011: Nintendo 3DS - Brought glasses-free 3D gaming to handheld devices.

Home Gaming Console Evolution (1983-1990)

Back when Atari and Sega were the biggest players in the industry, most people recognize the year of 1983 as the year of the big crash, when retailers were hesitant to stock video games, and the public confidence in video games was at an all-time low (look for the case of the E.T. game). That year Nintendo released its first home console, with a high polished gaming experience that has kept since then in all their products. Notable consoles:

1983: Famicom (Japan)/NES (1985, International) - Revived the crashed gaming market with revolutionary titles like Super Mario Bros. Sold over 60m units worldwide.

1990: Super Nintendo (SNES) - Enhanced graphics and sound capabilities, introducing iconic franchises.

1996: Nintendo 64 - Pioneered 3D gaming with titles like Super Mario 64.

2001: GameCube - Compact but powerful, focusing on innovative gameplay.

2006: Wii - Revolutionary motion controls that attracted non-traditional gamers.

2012: Wii U - Though commercially unsuccessful, it laid groundwork for the Switch.

2017: Switch - Brilliantly merged handheld and home console gaming (sold more than 143m units).

Leadership and Corporate Evolution

Until 2002 Nintendo was still a family business, balancing between its growth into a modern corporate and core values based on family values and cultural traditions.

The Yamauchi Era (1889-2002)

Fusajiro Yamauchi (1889-1929): Founder, established Nintendo as a playing card company.

Sekiryo Yamauchi (1929-1949): Son-in-law of Fusajiro, expanded the playing card business.

Hiroshi Yamauchi (1949-2002): Transformed Nintendo into a global gaming company.

Known for his autocratic leadership style but brilliant business instincts.

Made crucial decisions like hiring Shigeru Miyamoto and backing revolutionary projects.

Modern Corporate Leadership (2002-Present)

Satoru Iwata (2002-2015): First non-Yamauchi president

Former HAL Laboratory programmer

Led Nintendo through the successful Wii and DS era

Known for his "Nintendo Direct" presentations and developer-friendly approach (we will get to that later in this article)

Tatsumi Kimishima (2015-2018): Stewarded the transition from Wii U to Switch

Shuntaro Furukawa (2018-present): Current president focusing on mobile gaming and IP expansion.

Funny Fact - Doug Spencer Bowser is the current president of the American branch of Nintendo since 2019. Some of you might have noticed that Bowser shares his surname with the main antagonist of the Mario franchise, Bowser (the leader of a turtle like monster, which first appeared already in 1985 games). This was the subject of further humorous reactions. The BBC referred to the case as "one of the most charming cases of nominative determinism ever".

Business Model Evolution

Nintendo's business model has undergone significant transformations over the years, adapting to changing market conditions and consumer preferences while maintaining its core focus on creating innovative gaming experiences.

1. Traditional Hardware/Software Model (1980-Present)

Nintendo's original business model followed a razor-and-blades strategy, where gaming hardware (consoles) served as the platform for high-margin software sales (the games). This model proved highly successful during the 80s and 90s:

Hardware pricing strategy: Consoles sold at slight loss or break-even

Software licensing: 20-30% royalty fees from third-party developers

First-party game development: High-margin proprietary games

Quality control: Strict licensing agreements ensuring software quality

This strategy proved highly successful, with Nintendo selling over 5.1 billion video games and 800 million hardware units globally over the past 30 years

2. Shift to Mobile Gaming (2015-Present)

In response to changing market dynamics and to expand its reach, Nintendo entered the mobile gaming market in 2016. This move marked a significant departure from its traditional hardware-centric approach.

Key developments in Nintendo's mobile strategy:

Partnership with DeNA in 2015 to develop mobile titles ($181 million investment)

Focus on using mobile games as a marketing tool to introduce Nintendo IPs to new players

Launch of Super Mario Run in 2016 ($170m revenue), followed by other titles like Fire Emblem Heroes ($1+ billion in lifetime revenue), Animal Crossing: Pocket Camp, and Pokémon GO ($6+ billion in lifetime revenue, partnership with Niantic)

While mobile gaming initially showed promise, with Fire Emblem Heroes generating over $1 billion in revenue, Nintendo has since scaled back its mobile ambitions, focusing on it more as a marketing channel rather than a primary revenue driver.

3. Digital Distribution Strategy (2011-Present)

Nintendo has embraced digital distribution as a key component of its evolving business model. This shift allows the company to reduce physical production costs and provide more convenient access to games for consumers. Nintendo's digital transformation accelerated with the 3DS and Wii U, but truly matured with the Switch.

Key elements of Nintendo's digital strategy include:

Establishment of the Nintendo eShop for digital game sales (D2C).

Offering digital versions of physical releases

Developing and selling downloadable content (DLC) for existing games

Launch of the Nintendo Switch Online subscription service, providing access to classic games and online multiplayer functionality.

4. IP Licensing and Merchandising

Nintendo has increasingly leveraged its valuable intellectual property (IP) through licensing and merchandising agreements, but it carefully selects its partners. This strategy allows the company to generate additional revenue streams, but more importantly it helps to maintain brand awareness while Nintendo can keep doing what it does best, which is games software and hardware.

Notable IP licensing and merchandising initiatives:

Nintendo has established partnerships with leading brands including:

Apparel: Levi's and Puma

Toys: Lego, Hasbro and Mattel

Cosmetics: ColourPop2

Collaboration with Illumination Entertainment for the Super Mario Bros. animated film, released in 2023 and became the most profitable film of 2023. It generated $1.36 billion in global box office revenue, and achieved $559 million in net profit. (it outperformed the disappointing 1993 live-action adaptation, which only generated $38.9 million against a $48 million budget)

5. Theme Parks and Entertainment Ventures (2021-Present)

In a significant expansion of its brand, Nintendo has entered the theme park industry through a partnership with Universal Studios (which also was the publisher of the Super Mario Bros 2023 movie). This move represents a major strategic shift for the company, aiming to create immersive real-world experiences based on its popular franchises.

Key developments in Nintendo's theme park strategy:

Opening of Super Nintendo World at Universal Studios Japan in 2021, and in Universal parks in California in 2023.

Plans for additional Super Nintendo World areas in Florida and Singapore.

Integration of Nintendo's characters and gameplay elements into physical attractions.

The theme park venture is expected to generate significant revenue, with projections of $288 million in its first year for the Japan location alone.

Financial Impact:

Expected annual revenue from theme park licensing: $250-350 million

Merchandise sales at parks: Estimated $100+ million annually [Source: Industry Analyst Reports]

6. The Benefits of Business Model Evolution

This evolution represents Nintendo's transformation from a pure gaming company to an integrated entertainment company, while maintaining its core strengths in gaming hardware and software.

Risk Diversification: Reduced dependency on console cycle, Multiple revenue streams across entertainment sectors.

Higher Margins: Digital distribution eliminates physical production costs, IP licensing provides high-margin revenue with minimal financial risks.

Broader Market Reach: Mobile gaming reaches non-traditional gamers, Theme parks create physical touchpoints, Movie ventures expand brand awareness.

Stable Revenue Streams: Subscription services provide recurring revenue, Licensing deals offer steady income regardless of gaming performance.

Financial Breakdown

Data Summary (from Google Finance, Nov 3, 2024):

Previous close: ¥9,228.00 ($58.37 USD)

Day range: ¥9,165.00 - ¥9,308.00

Year Rance: ¥6,520.00 - ¥9,587.00

Market cap: 11.98T JPY (~$76.25 Billion USD)

Employees: 7,724 (taken from 2024 annual report)

HQ Location: Kyoto, Japan

Nintendo Co., Ltd. is a publicly traded company on the Tokyo Stock Exchange. As you can find in Nintendo investor relation website you can see the top owners as for 2024:

The Master Trust Bank of Japan (16.5%)

JP Morgan Chase Bank (9.9%)

Custody Bank of Japan (5.7%)

The Bank of Kyoto (4.2%)

Notes about ownership structure:

Until 2013, Hiroshi Yamauchi (founder) was the largest individual shareholder, owning approximately 10% of Nintendo. After his death, much of his shares were sold to pay inheritance taxes. This marked a significant shift from family control to institutional ownership.

The majority of Nintendo's shares are now held by institutional investors.

Foreign ownership accounts for approximately 30% of shares.

The company maintains a significant portion of treasury stocks.

Nintendo's financial health continues to demonstrate its conservative yet effective approach to business management, deliberately positioning itself away from the high-stakes console war that characterizes its competitors' strategies.

Total net sales reached ¥1.67 trillion ($10.8 billion), marking a 4.4% increase year-on-year.

It is important to remember there is still a significant dependency on the sales of Switch, both hardware and games, and there is a constant decrease in sales of hardware (but not in the games), remembering this console was launched on 2017 (going to be 8 years soon), with many rumors about the upcoming Switch2 device in 2025.

Revenue Diversification

Digital sales have become increasingly significant, reaching ¥443.3 billion ($3.4 billion) with a 9.4% year-on-year growth. Digital content now represents 50.2% of total software sales, marking a historic first for Nintendo. The mobile and IP-related business segment showed remarkable growth, generating ¥92.7 billion ($600.2 million), an 81.6% increase largely driven by The Super Mario Bros. Movie's success.

Nintendo's global reach remains strong, with international sales accounting for 78.3% of total revenue (¥1,309.2 billion). The regional distribution shows:

Americas: 45% of total sales

Japan: 21.7%

Europe: 21%

Financial Strategy and Investment

Nintendo's conservative financial approach is evident in its strong balance sheet and minimal liabilities. The company maintains substantial cash reserves of $15.544 billion, showing an 11.77% increase from 2023. R&D investment reached a record high of ¥137.7 billion ($911 million), representing 8% of net sales, largely focused on next-generation hardware development, and new games to support it on release.

Future Outlook

While maintaining healthy operating profits of ¥528.9 billion, Nintendo projects a 19.3% decrease in sales for FY2025, anticipating ¥1,350 billion in revenue. This conservative forecast reflects both market maturity of current hardware and strategic investment in future initiatives, including the rumored Switch successor and expansion of theme park ventures.

Product Strategy: Playing Differently

Nintendo has crafted a unique position in the gaming industry by deliberately choosing not to compete directly with Sony and Microsoft in the hardware arms race. Instead, they've created their own "blue ocean" by targeting a broader, more diverse audience and bringing their different offering. Their market proposition rests on three key pillars:

Inclusive Gaming Experience:

Nintendo targets an unusually wide demographic spectrum, from young children to seniors, with a nearly equal gender split (50/50 male/female ratio). This contrasts sharply with their competitors' focus on hardcore gamers. Their approach has proven particularly successful with millennials, who represent their largest customer segment.

Family-Friendly Innovation:

Rather than pursuing cutting-edge graphics or processing power, Nintendo focuses on innovative ways to play games that can bring families together. This philosophy has led to groundbreaking products like the Wii's motion controls and the Switch's hybrid design. Also many of their games offer a local multiplayer, for people to sit and play together in the same room.

Innovation and Risk Taking:

Nintendo's hardware strategy follows a unique principle called "Lateral Thinking with Withered Technology," originally conceived by Game Boy inventor Gunpei Yokoi. This approach involves using proven, cost-effective components rather than cutting-edge technology, focusing on innovative gameplay experiences rather than technical specifications, creating unique value through novel combinations of existing technologies (that one explains their ongoing obsession with 2 screens gameplay and motion controls).

Nintendo's software development strategy is structured yet flexible, employing internal game development studios, prototype development with co-development partners, external production with internal oversight, and licensing IP to trusted partners. The company prioritizes gameplay innovation over graphics.

Nintendo ensures quality control through rigorous testing, the Nintendo Seal of Quality program, and strict control over manufacturing and distribution. They limit publishers to five games per year and maintain full control over hardware production. Nintendo balances innovation with tradition, experimenting with new play styles and proven hardware features, and preserving beloved franchises like Mario and Zelda. They prioritize fun and social interaction over technical specifications, ensuring a balance between pushing boundaries and preserving core values.

Competitive Differentiation

This comprehensive strategy has allowed Nintendo to maintain its unique position in the gaming industry while building a loyal customer base across multiple generations. Their success comes not from competing directly with other console makers, but from creating their own market space through innovative products that appeal to a broader audience.

Most significantly, Nintendo has achieved something unique in the gaming industry: they don't directly compete with other console manufacturers but complement them. Many households own both a Nintendo console and a PlayStation or Xbox, viewing them as different entertainment options rather than competing products. As Nintendo expands into theme parks, movies, and mobile gaming, their focus remains steadfast: creating innovative, accessible entertainment that brings joy to people of all ages. In an industry often caught up in technological specifications, Nintendo's unwavering commitment to "gaming for everyone" stands as a testament to the power of staying true to one's principles while continuing to innovate.

Market Competition

Despite facing fierce competition from Sony's PlayStation and Microsoft's Xbox, Nintendo has carved out a unique market position that allows it to thrive alongside its rivals. A deep analysis of the company's current standing reveals both its strengths and the strategic choices that continue to set it apart.

Console Market Share

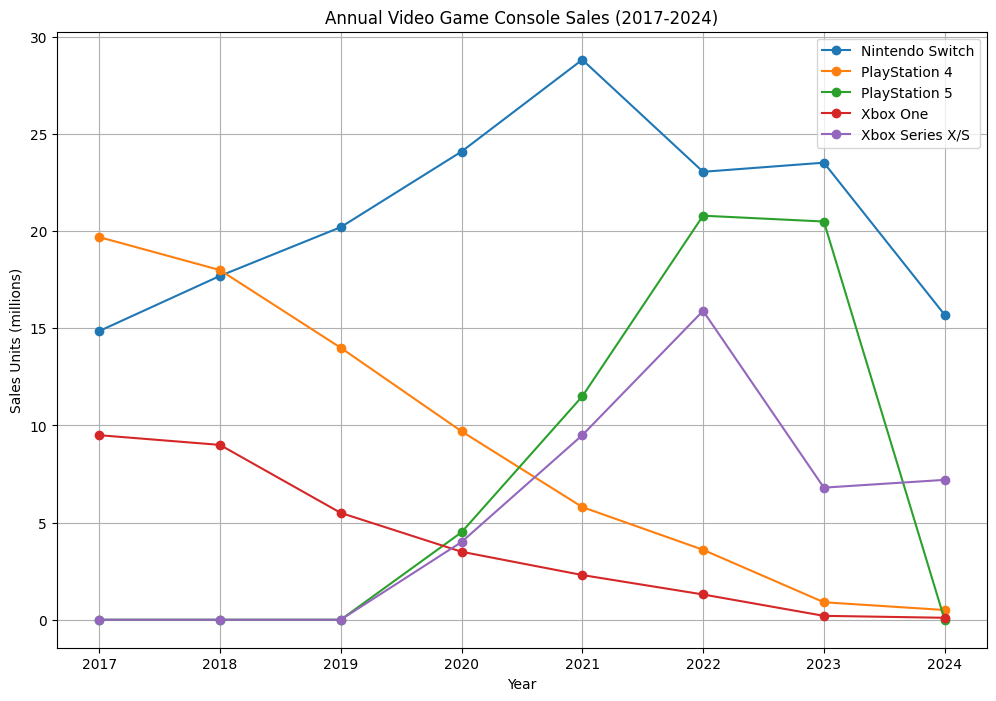

The gaming console market is primarily dominated by Sony and Nintendo, with Microsoft's Xbox having a smaller share. Nintendo has achieved cumulative sales of 143.42 million units with the Switch until as of June 30, 2024, while Sony leads with 157 million units when combining PS4 and PS5 sales (117.2m for PS4, and 61.7m for PS5). The Switch continues to perform well, though its growth is showing signs of deceleration.

Competitive Differentiation

Nintendo distinguishes itself through:

Notably more affordable price points – the Nintendo Switch's $299 price tag stands in sharp contrast to the $499 PlayStation 5 and Xbox X series.

Higher profit margins compared to competitors, demonstrating superior operational efficiency. Both Microsoft and Sony admit they lose money for each console, but profit from their fee in games sales.

Both Sony and Microsoft continue to refresh their PS5 and XBOX models with upgraded performance (aka. Pro versions), breaking the traditional “generations” philosophy that home game consoles have a lifetime of 6-8 years. Since the original release of Switch in 2017 Nintendo introduced only a minor change with the OLED model in 2021, and a standalone handheld model with a cheaper price point, but with no performance change.

Strong investment returns of 46% and equity returns of 21%, outperforming industry peers.

Balanced approach to revenue and profit growth, maintaining sustainable business practices.

Nintendo's approach differs from competitors in several key ways:

Other Game Companies

Although its direct competitors are Sony and Microsoft, Nintento’s big portion of the revenues come from games, and the numbers show that top sales are Nintendo Studio games (with their original IP of Mario, Zelda, etc.). It requires a delicate balance of having third-party titles on the eShop, but with a limited chance of getting into the top sales list, due to many reasons (brand recognition, marketing, Switch as a second game platform). The other companies are rarely going solo with a single platform as they used to, releasing many games also to PC and Switch, while in the past we could see more exclusive titles for Sony PS or Microsoft Xbox.

One interesting note is to look at what happened to other Japanese giants such as Sega and Konami, which had a strong brand recognition during the 80s and 90s, with great products, and see where they are now.

Electronic Arts (EA) - Estimated market cap of $74.3B. Most known for their focus on sports franchises under EA Sports, but have many other divisions which offer successful first person shooter and lifestyle gaming (as Sims). Strongly working under aggressive expansion and a short life cycle of sport games released on a yearly basis. Lately shifted strategy from focusing on their own EA Play store with their IP into partnership with other platforms.

Activision Blizzard - Estimated $74.5B market cap, with a strong performance in recent quarters, and a big portfolio of successful games (led by Call of Duty franchise). Recently purchased by Microsoft in 2022, which caused a long process of regulatory reviews from different authorities all over the world. Will keep its brand under Microsoft, but it is clear this acquisition will give a boost for the XBOX game services. The biggest risk is that it’s unclear if they will keep releasing titles on Switch in the long run.

Take-Two - With an estimated market cap of $16.5B, it is a very unique company. They are heavily reliant on their major franchises (GTA, NBA2K, Red Dead Redemption). They focus on a high-quality storytelling and highly polished gameplay, which brings great titles, but also follows a long project development, high costs and potential delays. On the one hand, products such as GTA V are still sold well years after their release, but the market competition and consumer spending slowdown is a risk factor.

Ubisoft - Estimated market cap of only $1.85, is a great company which made all the possible mistakes. As they struggle for some time now, they are keeping cutting jobs and other costs where possible, and looking for a buyout (Tencent was mentioned). They focus on Games-as-a-Service approach, diversifying their income than single franchises (such as Assassins Creed), but they reduced their financial targets for 2024-2025 while they restructured or acquired (or both).

Konami - This other Japanese gaming dinosaur has a surprisingly ¥341.5B market cap (~$2.2B USD). Have a strong brand recognition in Japan and in certain fields, as many of their titles represent the Japanese style and culture. They have a diversified revenue stream including gaming (Metal Gear Solid, Silent Hill and more), amusement and sports (does anyone remember PES was the competitor of FIFA games?). They projected a solid 5.4% annual growth over the next 3 years, but there is strong competition in their core segments, and I assume they will eventually get the same status as Atari and Sega has, with a glorious past, but no future, extracting income only from their IP.

Roblox - The newest kid in town, with a high estimation of $18B, yet many analysts warn it is over-priced. While its product is a single game platform and not a traditional game company, based on user generated content (UGC), it does something that Nintendo should track as it is highly popular at the same demographic (10-17 age group), and these days put their focus on revenues from advertising and commerce integration. Their main concern is user engagement and ongoing security and safety concern among young users, as many unflattering stories were published during the past few years.

Note: Sega is not mentioned at the list as it became a publisher only and focused on its Sonic IP, so it’s not a competitor anymore.

Mobile Gaming Presence: Cautious but Strategic

When Nintendo launched their handheld gaming devices, a mobile phone was very rare and expensive, and could not run even a calculator or Snake. Since then our phones have evolved dramatically, and titles like Clash of Clans, Candy Crush, and Pokémon GO have captured the attention of casual and non-traditional gamers, posing a challenge to Nintendo's handheld dominance.

Nintendo DS and 3DS tried to offer new forms of gameplay (using two screens, a 3D screen), and although they were a success, it was clear to everyone that mobile is the winner, handheld gaming needs to reinvent itself. Nintendo's solution was to combine its handheld and home console development department, and a few years later they released the Switch, a hybrid device.

Regarding pure mobile gaming, Nintendo's foray into mobile gaming has been carefully considered. Initially resistant to the idea, the company eventually embraced the platform through partnerships and the creation of its own mobile titles. Games like Super Mario Run, Fire Emblem Heroes, and the wildly successful Pokémon GO have collectively generated over $7 billion in revenue, demonstrating the company's ability to translate its iconic IP to the mobile space. However, Nintendo remains cautious, leveraging mobile as a supplementary platform rather than a primary focus.

Cloud Gaming Strategy: Selective Adoption

Ideally, imagining Nintendo streaming games as a service (in the far future), is not far-fetched.

The thing is that for many years now we’ve been told cloud gaming is the future and it will disrupt the gaming industry, but until today (end of 2024) this has not yet become any significant segment of the gaming market. While competitors are heavily investing in cloud gaming services, Nintendo has taken a different approach:

There are only a few games in Nintendo's portfolio that are offered as cloud gaming from their eShop. None of them included Nintendo’s original IP.

Nintendo currently utilizes Microsoft's Azure services for its online gaming infrastructure, suggesting a strategic partnership rather than direct competition in cloud gaming.

Microsoft and Sony are aggressively expanding their cloud gaming presence through Xbox Cloud Gaming and PlayStation Now.

The cloud gaming market is projected to grow by $1.49 billion at a 9.22% CAGR between 2023-2028.

And yet, there are few downsides for entering the cloud gaming:

Latency. Too many factors affecting the internet speed, and latency can ruin the gaming experience, as it stands in contrast to the “blue ocean” approach which requires a full control of the different aspects of the product.

The requirement for running the game from a Nintendo device is becoming questionable once it technically runs from a remote server. It can easily be tricked, and it raises the question why we need to purchase the original hardware at full price.

Multiplayer games are a large portion of Nintendo’s portfolio, and both online and offline multiplayer are not yet functioning well enough when playing from the cloud.

Notes about competitors:

Sony PlayStation: As the market leader in home consoles, Sony's PlayStation division poses the most direct challenge to Nintendo. The PS5's technical capabilities and the strength of its first and third-party software library make it a formidable competitor, particularly among hardcore gamers. It has the highest revenue growth but lower profit margins compared to Nintendo. It has an extensive game library and strong first-party titles. 123 million active users on their platform.

Microsoft Xbox: Microsoft's Xbox brand has gained significant momentum in recent years, leveraging the power of its cloud infrastructure and the popularity of its Game Pass subscription service. While the Xbox Series X/S consoles trail Nintendo in sales, the company's strategic investments in cloud gaming (also based on Microsoft’s Azure platform) and acquisition of Activision Blizzard present a growing threat as their gaming portfolio has strengthened.

Cloud Gaming: emerging cloud gaming platforms, such as Amazon Luna and NVIDIA GeForce NOW, represent the next frontier of competition. While Nintendo has been cautious in this space, the potential for cloud gaming to disrupt the traditional console model could eventually impact the company's business.

Key Challenges and Risks

Despite Nintendo's consistent success and innovative approach, the company faces a number of significant challenges and risks as it navigates the dynamic gaming landscape in 2024 and beyond. Understanding these obstacles is crucial for evaluating the company's long-term sustainability.

Past Console Failures: Lessons Learned

Nintendo's history is not without its missteps. The Virtual Boy, released in 1995, was a notorious failure, with its uncomfortable 3D headset and limited game library leading to abysmal sales and the project's quick abandonment. More recently, the Wii U console (2012) struggled to capture the same magic as its predecessor, the Wii, ultimately selling only 13.56 million units over its lifetime. These past failures serve as cautionary tales, reminding Nintendo of the importance of truly understanding consumer preferences and avoiding overly ambitious or misguided hardware concepts.

Dependency on Outside Manufacturers

As a hardware manufacturer, Nintendo remains dependent on external partners for the production of its consoles and controllers. Nintendo's reliance on external manufacturers, particularly for semiconductors and components, creates vulnerability to supply chain disruptions and pricing fluctuations. Issues with the supply chain, component shortages, or manufacturing delays can have a direct and significant impact on the company's ability to meet consumer demand. This was particularly evident during the COVID-19 pandemic, when Nintendo faced difficulties keeping the Switch in stock (as its competitors). Maintaining strong relationships with suppliers and diversifying its manufacturing base will be crucial for Nintendo to mitigate these risks.

Mobile Gaming Dilemma

While Nintendo has achieved some success in mobile gaming, it faces a delicate balancing act. The company must carefully manage its mobile presence to avoid cannibalizing its core console business while still capturing the growing mobile market opportunity. Their cautious approach reflects this complex challenge.

Online Services Development

Nintendo's venture into online services, such as the Nintendo Switch Online subscription, represents uncharted territory for the company. Developing and maintaining robust online infrastructure, managing server stability, and ensuring a positive user experience all come with significant costs and potential risks. Additionally, the company must be vigilant against cybersecurity threats and other online-related accidents that could damage its reputation and erode consumer trust.

Third-Party Developer Relations

Nintendo as a manufacturer, developer and a publisher, knows its success relies on external developers for achieving the right amount and quality of content. At the end of the day, content is the king.

You can call it a love-hate-love relationship, and it includes a fair revenue-sharing model, technical support and resources, and marketing in their eShop.

Saying that, Nintendo made a lot of mistakes in the past. Few famous examples:

Playstation Exodus - During the Nintendo64 era, Nintendo lost partnership with crucial developers who departed to the new Sony Playstation, due to the technical limitation that N64 was using cartridges while the PS used a CD-Rom which had more memory and was cheaper to produce. (they lost Final Fantasy 7 because of that)

Wii Era - Although the Wii was a huge success in hardware sales (more than 100m units sold), many developers wanted to join the party. The Wii strength was its gameplay with motion controls, encouraging local multiplayer for the whole family, but not its performance. Once developers wanted to port their games to the Wii, they rarely used the motion controls as part of the gameplay, and in many times the users got a watered-down version of games that got a better graphic performance version on other consoles.

The Wii U Crisis - Nintendo's Wii U faced criticism for its challenging development environment, lack of power, and confusing gamepad architecture, leading to a decline in third-party support. Despite initial promises from Ubisoft and Platinum Games, the system received less third-party titles. In 2013, Nintendo's president Satoru Iwata aimed to regain momentum and establish successful third-party Wii U software titles, but this plan was unsuccessful. With a dismal final sales total, Nintendo's legacy remains a source of disappointment.

Technology Adoption Strategy

Nintendo's unique approach to technology adoption often diverges from the traditional console arms race. While this strategy has produced innovative successes like the Switch, it also risks falling behind in certain technological aspects, particularly in graphics and online capabilities.

Piracy and Intellectual Property Enforcement

Nintendo faces ongoing challenges in protecting its intellectual property, especially in the digital age. Recent actions against emulators like Yuzu and Ryujinx demonstrate both the company's strong stance and the complexity of enforcement. While Nintendo has successfully shut down major emulation projects, these victories require significant resources and can generate negative public sentiment.

The company's aggressive protection of its IP through DMCA notices and legal action, while necessary for business protection, must be balanced against maintaining positive community relationships. This is particularly challenging as Nintendo itself uses emulation technology for its classic game services, creating a complex narrative around the legitimacy of emulation technology.

Funny fact - if you are a fan of generative AI (as Midjourney, Dall-E, etc.), you will notice you will get a warning that some characters are now protected by copyrights. If there’s a company that is very strict about the use of their IP it’s definitely Nintendo.

Transformation to Media Company - The Innovator Dilemma

As the strategy of diversification progresses, and everyone will agree it’s the right move for economic and brand reasons, it raises the question about the long term. Will it eventually be that mobile and cloud gaming (alongside movies, theme parks and merchandise) is another form of cannibalism that will “eat” the sales of the games and consoles? Nintendo did it once with the Switch console, by eliminating the desiccated handheld segment as a standalone sector, and it turned out to be a success, but it was a risk.

A follow up question should be, is Nintendo becoming more like Disney which is all about its IP?

I am sure Nintendo was or is doing a think tank about this issue, estimating how the game industry will look like in 5, 10 and 20 years from today, and what measures need to be made to promise Nintendo will survive (and prosper). It will raise another serious question, should it lead the change and cut their profits from other products, or should it wait for the market to change first and risk becoming a living dinosaur?

Strategy: Playing the Long Game

Historical Strategy Snapshot

Nintendo's path has been marked by bold pivots and calculated risks. From humble beginnings as a playing card manufacturer in 1889, Nintendo transformed into an electronic gaming pioneer in the 1970s and 1980s. While others raced for the most powerful graphics cards, Nintendo focused on innovative gameplay and family-friendly content. They turned plumbers into superstars (Mario), made fitness fun (Wii Fit), and convinced us all that catching imaginary monsters was a totally normal adult activity (Pokémon Go).

The Hybrid Gaming Revolution: The Switch's "play anywhere" concept wasn't just a gimmick - it was a masterstroke that solved the age-old problem of choosing between home and portable gaming. Although Nintendo was a player in both niches, having 2 dedicated departments each, it was a smart decision to merge them into one division and create one hybrid device, with all the risks of cannibalism of its own products. By ensuring games work seamlessly on both TV and handheld mode, Nintendo created a unique value proposition that competitors haven't matched. This approach forced the games to automatically adjust their performance based on how you're playing. It was found perfect for both quick commute gaming sessions and epic couch co-op marathons, and simplified the development process so the developers only needed to create one version of their game (basically saved the need to work for 2 different platforms).

IP - The Gift That Keeps on Giving: Mario isn't just jumping between platforms in games anymore - he's jumping between entire entertainment mediums. The success of the Super Mario Bros. Movie (over $1.3 billion in box office) and Super Nintendo World theme parks show Nintendo's masterful IP exploitation. Mobile games were mentioned and are still under exploration by Nintendo, and although they are profitable they still function also as a marketing tool for other Nintendo’s products. The last part is merchandise, from t-shirts, school bags, action figures, mugs, and whatever you can think of.

Digital Transformation: Nintendo is finally embracing the digital age (better late than never). The company is steadily pushing digital game sales and subscription services through Nintendo Switch Online, which brings the users access to classic games, cloud saves, and online play. The data shows the digital downloads revenue increases every year, so it definitely works well.

Monetization Strategy: Nintendo is carefully adopting modern monetization strategies while trying not to anger players. The traditional methods are still the company’s bread and butter, and they include the traditional physical full game sale (with the box and everything), the hardware sales, and licensed merchandise.

During the past few years we noticed Nintendo is pushing (very delicately) into more modern approach, starting from their eShop for digital downloads, the subscription model for their Nintendo Online that was mentioned in previous section, and also DLC (expansion packs) for their games with more content for existing titles, what increase their lifetime (it’s much cheaper to create more content vs. building a whole new game).

Market Expansion: New Players Have Entered the Game: Nintendo has been cleverly expanding its reach beyond its traditional young gamer base. It is known that gamers' average age is getting older, which is causing Nintendo to explore new game genres with their beloved characters in new ways (as Mario RPG and Super Smash Bros. titles). Also the sport titles are well known among users who are looking to do sport in their living room, without a real competition in this vertical. The theme parks might not expand their reach to new users due to their locations, but it will help them to keep the brand alive. More likely the movie (and the next one is already in production) is more likely to reach a new generation of users to Nintendo’s games.

Other potential areas for further development:

Community Building - While Nintendo has traditionally been conservative with online features, they're gradually building more community-focused elements into their games and services. Games such as Mario Maker 2 offer the user to share levels they built (similar to Fall Guys), but there are many potential safety issues while using UGC (user generated content), which extracts the control over content from Nintendo to the users. Did we mention Nintendo is cautious?

Educational Gaming - The “Edutainment” market was always a mystery, with huge potential and poor results, and it’s true for all the players. Following the moderate success of Brain Training and Labo, Nintendo continues to explore the educational gaming space, though with their usual careful approach. Although their main audience is young children, they carefully don’t want to be recognized as an educational company, as it might affect their brand.

Motion Gaming Future - The Switch's motion controls represent an interesting dilemma - while they offer unique gameplay possibilities, Nintendo seems to be taking a balanced approach, neither abandoning nor over-emphasizing this feature. It lets the games’ developers (internal or external) find the sweet spot between innovative game experience and a gimmick, and what incentives might work to make it happen.

Physical Sales of Games - Nintendo was notoriously famous with its insistence of using cartridges (from NES to Nintendo64) while the industry moved on to optical disc, and it came with a high price of losing good game developers. From Nintendo’s point of view, cartbridge was a great solution as it had fast loading time, energy efficient, durable and reliable, no installation was needed, but it has a very limited storage capacity, higher manufacturing cost, which translated to higher retail price. The bonus was it was hard to copy and sell in the pirate market. Discs on the other hand, were the opposite (happy 90s).

The switch, as a hybrid solution, brought the game card based on flash memory technology, which is a renaissance for the cartbridge era, alongside digital solutions which offers addons as game updates, DLCs, and alternative purchase directly from the eStore. The developers will push into a whole digital solution, with as few technical limitations as possible and less production costs, while consumers are split on the subject, as the numbers show.

There are some markets in which the consumers still prefer the physical media (as Japan), and the same as parents with young children, but it seems the future will keep dual channels of physical media alongside digital distributions.

Future Outlook & Recommendations

Nintendo stands at a crucial crossroads as it prepares for its next generation of gaming experiences. Here's a comprehensive analysis of key areas for future development and strategic recommendations:

Next-Generation Hardware Strategy

The upcoming Nintendo Switch successor will be announced before the end of the current fiscal year, which ends in March, 2025. The upcoming device faces the critical challenge of balancing performance with battery life. The holy grail for any portable device is the battery life limitation, which is reduced as the performance becomes more demanding.

To maintain competitive advantage, Nintendo should:

Focus on efficient power management through custom chip design optimized for handheld gaming

Implement backward compatibility to leverage the existing Switch game library. It can be done by using a similar architecture, and by emulation techniques (why not offer a job to the people you usually sue in court, just dropping it as an idea).

Utilize advanced display technology like OLED to enhance visual quality while managing power consumption (initial Switch released was using LCD screen which is proven and cheaper)

Use techniques as 4k upscaling and frame generation (as Nvidia’s DLSS and AMD’s FSR) for saving the need of a demanding and expensive hardware.

Note: The Switch is using a custom version of Nvidia TegraX1 (which was used for “Nvidia Shield” as well). The rumors about the next-gen suggest a significant upgrade with 12GB of RAM and potential NVIDIA DLSS support for 4K upscaling. A nice story was a report about a meeting between Nintendo and AMD, whose GPUs are used by both Sony and Microsoft in their consoles, as well as Steam Deck and other handheld devices (almost the whole gaming industry). It was reported AMD failed as they didn’t meet Nintendo's requirement for power efficiency, which was up to 15 watts on handheld mode, and they missed it by 5 watts (for the right context, an AMD 7600XT GPU can use a 190 Watt maximum). Lately some AMD officials said their next challenge to solve is to increase efficiency in their products (as well as mentioning AI and other buzzwords).

Market Expansion Opportunities

Saudi Arabia's increasing investment in Nintendo (The Saudi Public Investment Fund (PIF) holds 7.54% as outside investor), signals growing opportunities in the Middle East (as well as other Gulf countries). Their 2030 vision includes a massive investment in tech and entertainment, and is already becoming a big gaming hub, as there are many studios who open offices in the kingdom. Nintendo, as always, is very careful where and with whom to do business with, as their brand and IP are more important to them from a financial opportunity. For now it seems enabling the eShop and digital online services under some restrictions. Game localization might be the next step, as well as building a strong distribution and support in that region.

India is also a growing market, with the world's largest young population, and growing middle class. Their large smartphone penetration and lack of affordable hardware options might suggest using mobile games is a good penetration approach for this market.

Cloud Gaming Evolution

Nintendo's current cloud gaming presence includes several titles, but requires careful expansion.

The recommended approach is the following:

Keep Core Experience Local: Maintain traditional download and cartridge options, and ensure gameplay isn't dependent on internet connection. Make an extra effort to keep the top games as perfect as can be, as they are the face of the company (especially those who were built by Nintendo Studios and their original IP).

Focused cloud versions of graphically demanding third-party titles. There are titles that won’t look as good on Switch as they do on PS5 Pro, probably single player low paste titles.

Improve infrastructure partnerships to ensure consistent performance, and learn from their experience. As I already mentioned, Nintendo is using Microsoft Azure servers for the cloud service, which suggests it is very similar to the Xbox Cloud Gaming service, so any technological progress from one service could be brought to Nintendo cloud service without significant adaptation.

Other Future Possibilities

Instant game demos through cloud streaming

Cloud-enhanced graphics processing

Seamless device switching

Mobile Strategy Refinement

Nintendo's mobile strategy should focus on brand expansion rather than revenue generation.

Core Gaming Apps: Nintendo should develop standalone experiences that complement console titles, such as "Mario Run" and "Mario Kart." They should maintain premium pricing for flagship mobile titles to avoid diminishing the brand's value and create cross-platform benefits that link mobile and console experiences.

Companion and Support Applications: Nintendo should expand companion apps for major Switch titles, which could include features like tracking, trading, and mini-games. They should also develop new social features that connect players across platforms, enhance parental control and family management functionalities, improve the eShop and Nintendo Switch Online app functionality, and create a theme park companion app.

IP Exploration

Following the financial success of The Super Mario Bros. movie with 168.10 million viewers, and the latest openings of their Theme Park (with Universal), Nintendo should keep developing their proven partnership model.

Entertainment Partnerships: Nintendo should focus on selective movie and TV show development with established studios, emphasizing quality over quantity. They should engage in long-term partnership planning and develop transmedia storytelling strategies across multiple platforms.

Selective movie/TV show development with proven studios.

Quality over quantity approach.

Long-term partnership planning.

Develop transmedia storytelling strategies across multiple platforms.

Physical Products

Premium collaborations (Example: LEGO Mario sets).

Educational toys and tools.

Limited edition collectibles.

Location-Based Entertainment

Theme park expansions.

Pop-up experiences.

Risk Mitigation Strategy

Supply Chain Resilience:

Manufacturing Diversification - Multiple manufacturing partners across different regions

Component sourcing from various suppliers

Local assembly options for major markets

Technology Risk Management

Strengthen relationships with NVIDIA and AMD for future hardware development. The same with Microsoft for their cloud and servers.

Regular technology partner audits

Secure long-term agreements for critical components

Investment in proprietary technology development

Flexible architecture for future upgrades

Additional Risk Considerations

Cybersecurity measures for online services

IP protection in new markets

Climate change impact on manufacturing and shipping

Political risk in key markets

By implementing these recommendations while maintaining its core values of innovation and quality, Nintendo can strengthen its position in the gaming industry while expanding into new markets and entertainment sectors.

ReAssemble: Back to the Big Picture

Key Takeaways

Nintendo's journey from playing cards to gaming empire demonstrates a remarkable ability to reinvent itself while maintaining its core values. The company's success stems from its unique approach of creating "blue ocean" markets rather than competing directly with rivals. Nintendo's ability to balance tradition and innovation, as seen in franchises like The Legend of Zelda and Super Mario, has been a key driver of its long-term success. Their focus on innovative gameplay experiences over cutting-edge technology has proven successful, as evidenced by the Switch's hybrid design reaching over 143 million units sold. Despite past failures, Nintendo has demonstrated a willingness to learn from its mistakes and make bold strategic pivots to stay relevant. Lately we see their diversification strategy gain success while stepping into mobile gaming, IP licensing, and theme park ventures has helped Nintendo reduce its reliance on the console cycle and expand its reach.

Critical Success Factors

Nintendo's success is built on several distinctive elements:

Unwavering commitment to creating fun, accessible gaming experiences that appeal to a wide demographic.

A unique "Lateral Thinking with Withered Technology" approach that prioritizes innovative gameplay over technical specifications.

Careful curation and preservation of beloved franchises while continuously introducing new IPs.

Strong IP portfolio management through careful licensing and expansion into new entertainment venues, as demonstrated by the success of the Super Mario Bros. Movie generating $1.36 billion in revenue.

Balanced revenue streams across hardware, software, and digital sales, with digital content now representing 50.2% of total software sales.

Effective management of third-party relationships and developer partnerships.

Prudent financial approach, maintaining a strong balance sheet and diversified revenue streams.

Long-term Sustainability Analysis

Nintendo's future sustainability rests on several pillars:

Striking the right balance between innovative hardware and software development.

Diversified revenue streams through theme parks, movies, and mobile gaming while maintaining core gaming excellence.

Strong financial health with minimal liabilities and significant R&D investment of ¥137.7 billion, focused on next-generation development.

Global market presence with international sales accounting for 78.3% of total revenue.

Successful targeting of broad demographics with a nearly equal gender split, setting them apart from competitors.

The company appeals to the maturing gamers audience by experimenting with their IP in more adult-oriented game genres, while keeping appealing to the younger generations.

Navigating the shift to cloud gaming and online services while preserving its core identity.

Mitigating supply chain risks and dependencies on external manufacturers.

Keep good relationships with third party developers for ensuring a wide game library.

Final Thoughts

Nintendo has proven time and time again that it is more than just a gaming company - it is a cultural icon that has the ability to capture the imaginations of people worldwide. While the industry continues to evolve, Nintendo's commitment to creating unforgettable experiences, its mastery of iconic intellectual properties, and its willingness to take calculated risks position it well for long-term success.

As a lifelong Nintendo fan, I'm excited to see what the company has in store for the future. With a new generation of hardware on the horizon and continued expansion into entertainment beyond gaming, Nintendo is poised to delight and surprise us for decades to come. The company's ability to remain true to its core values while adapting to changing times is a testament to its enduring spirit and the passion of its dedicated employees and loyal fans.

Extras:

Trailer of the “Tetris” movie, and Nintendo’s gameboy is part of the plot.

Link to the TV show from 1989 - Some things are meant to be forgotten, but the internet remembers…

Written by Lior Rosenspitz, Dec 2024